Top Technology Trends Previsory 2025:リテールバンキング編

Abstract

2025 will be another year of change and opportunity for retail banking. Technology budgets are expected to increase by over 5% on average, as institutions look to push ahead in unlocking efficiency improvements across their estates, while also delivering enhanced products and experiences to customers.

Building the foundations for next-generation banking is a growing priority, and the degree to which banks are successful at delivering simplification, modernisation, and resilience will influence the shape of the future competitive landscape. Indeed, the impact of making the right (or wrong) technology choices has never been greater. Public cloud, modern data platforms, cybersecurity, and AI in all forms remain some of the highest priority technology investment areas for the industry, and this will continue in 2025.

These changes will be delivered in what remains a challenging operating environment. A return to relative economic stability is welcome but will bring a further squeeze on margins as interest rates continue to fall. In addition, there remains considerable potential for further political instability, which may reduce consumer and business activity. Banks must also balance their growth plans against the need to meet a growing compliance burden. New requirements covering resilience, security, payments, data, and AI are all coming down the pipe and will consume resources.

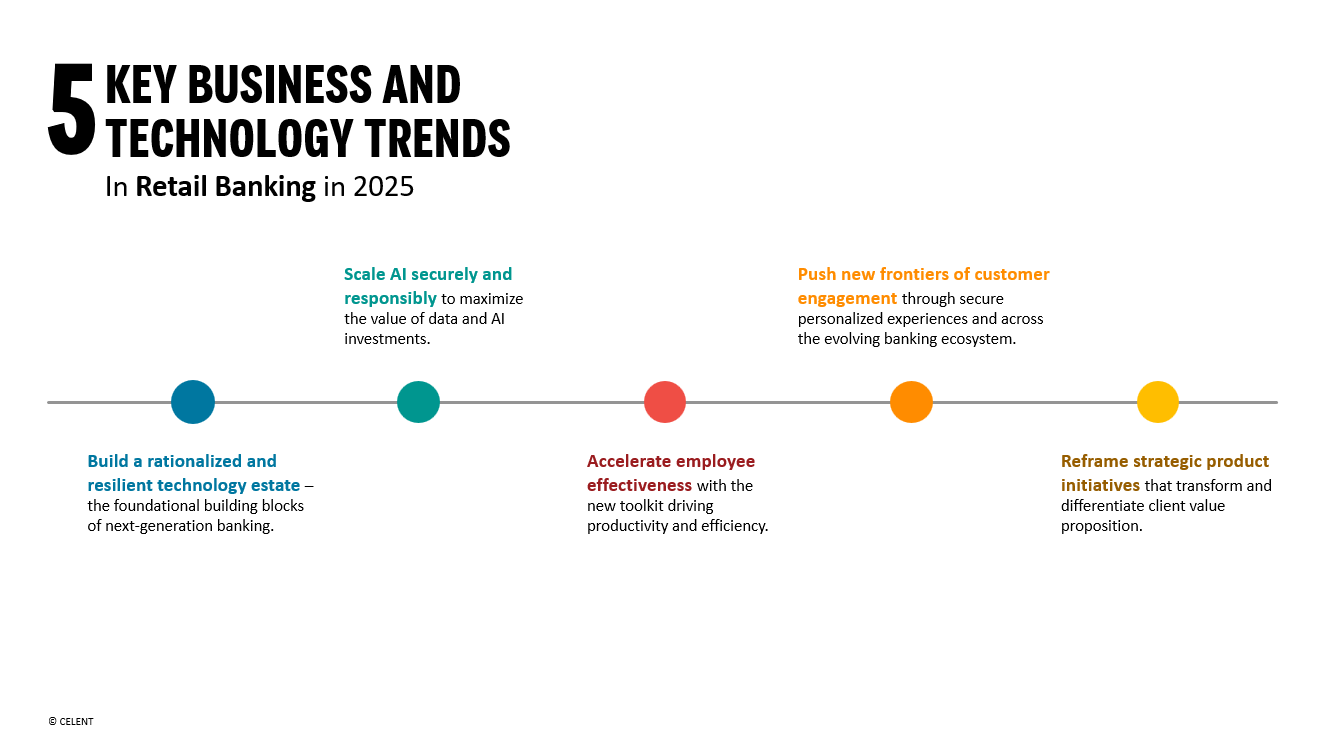

Celent has identified the five business and technology trends that will dominate the industry in 2025. Each is covered in detail and will be expanded further in Celent’s research agenda for the year ahead.

Related Research

Build a Rationalized and Resilient Technology Estate

The Need for Speed! Accelerating Product Agility in Corporate Banking.

Build for Today, but Design for Tomorrow: Modern Architecture for Corporate Banking

Dimensions: Retail Banking IT Pressures & Priorities 2024

Improving Operational Excellence While Migrating To a Hybrid Cloud, Multi-Cloud World

Scale AI Securely and Responsibly

AI and Data Governance: A New Era for Banks

GenAI-oneers in Banking: Bank Survey and Spotlights

Harnessing the Benefits of AI in Payments: Unlocking a Range of Workflow and Product Enhancements

Digital Sovereignty: The Impact on Data, AI, and Next Gen Banking Solutions

Field Guide to GenAI Hyperscalers: Banking Edition

How DBS is Becoming an "AI-fueled" Bank

Accelerate Employee Effectiveness

Intelligent Virtual Assistants Waving to the Future: Retail Banking Edition

Generative AI in Payments: Today and Tomorrow

GenAI: Beyond the Proof of Concept — Banking Edition

Gen AI – Lens on Use Cases in Retail Banking: Tech Provider Survey

First Investment Bank: Breakthrough with an LLM Virtual Assistant

Push New Frontiers of Customer Engagement

From Legacy to Innovation: Building an All-Digital Bank

Section 1033 and The Next Phase of Open Banking in the US

Scaling the UK and European Embedded Finance Frontiers: Lessons from Pacesetters

An Introduction to SPAA: A Framework for Direct Revenue from Open Banking

Personal Financial Engagement Solutions for Retail Banking

Deliver Strategic Product Initiatives

Next Generation Retail Loan Origination Systems

Payments Intelligence: A Pioneering Approach to Leveraging Payments Data

Developing Next-Generation Retail Banking Pricing Strategies