Dimensions: Retail Banking IT Pressures & Priorities 2024

Delivering for Customers

Key research questions

- What priorities are driving technology spending this year?

- What are the leading product and technology investment areas?

- How much focus are banks putting on Gen AI, Open Banking, BaaS and Embedded Finance?

Abstract

2024 will be a busy year for technology-enabled change in the retail banking industry. IT budgets have grown by an average of 4.4% compared on 2023 and, while the plans and budgets of individual banks can vary considerably, there are several common themes across the market.

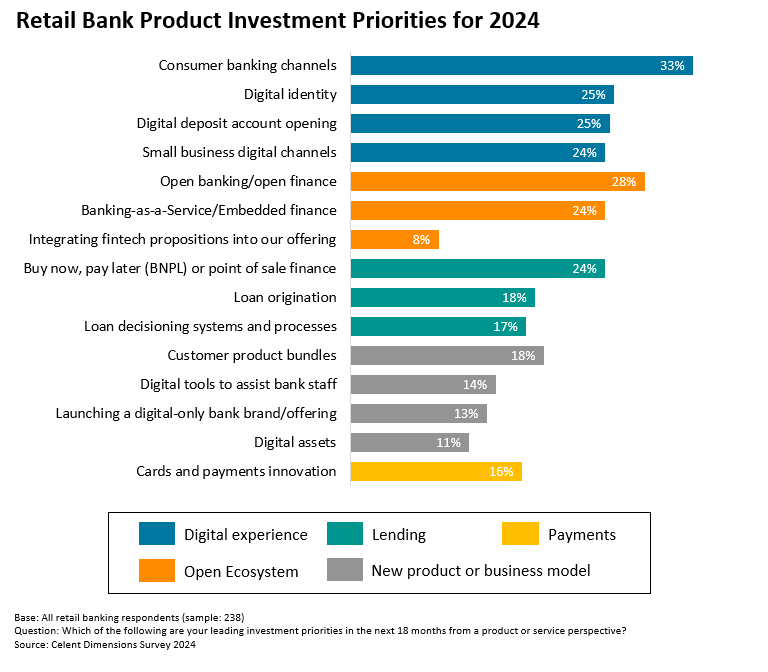

The first is a renewed emphasis on enhance products, services, and customer experiences. After many spent 2023 focused on becoming more agile, the emphasis in the industry is shifting back towards more directly delivering for customers. While this is the priority for most banks, these enhancement projects will continue to compete for resources with projects relating to areas such as compliance and initiatives to increase operational effectiveness. Digital channels, account opening processes and workflows, and open banking/open finance are all prominent areas in which banks are increasing their resource allocations.

Looking at the impact of this from a technology perspective, banks will continue to expand their investments into areas including data management, advanced analytics, AI technologies (including Gen AI), automation, and cloud. Investments in these areas will support a range of outcomes, but all underscore the broader cultural change that has taken place in the industry as financial institutions seek to become increasingly agile in the face of competitive challenges and in response to new market opportunities.

To shed light on the business pressures and technology priorities of the industry, Celent has completed its third global survey of senior executives at retail banks: The Celent Dimensions Survey 2024. This study captures the insights and opinions of 238 respondents to provide an in-depth view into attitudes across the industry, as well as highlighting the leading technology priorities for the year ahead and the products and processes that will see the greatest change.

Key findings include:

- 62% believe that the competitive threat from fintechs and other challengers is increasing.

- 44% report that investing to deliver enhanced products or propositions is one of the three most important drivers of their technology strategy.

- 33% have highlighted investing in consumer banking channels as a key product-level priority, ahead of open banking/open finance (28%).

- 59% are exploring new use cases related to AI technologies.

- 68% state that they expect to launch new customer-facing services using Gen AI in 2024.

The lessons for the industry are clear. Funding innovation is a major strategic driver for banks across all regions in 2024, and those that fail to keep up risk falling behind.

We recorded a corresponding webinar for this research on May 15. You can watch it on-demand today.