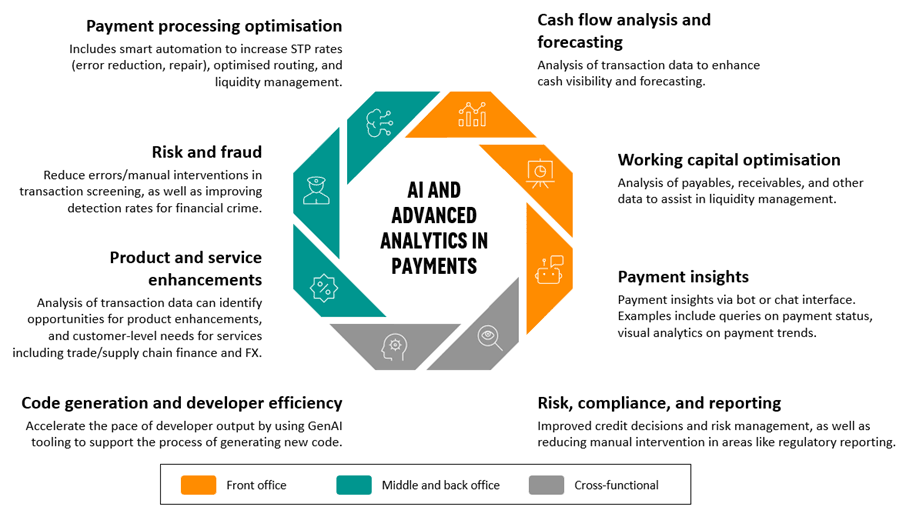

Payments are an area of particular opportunity for Artificial Intelligence (AI) technologies. The complexities involved in processing non-card payments, coupled with the inherent richness of the data involved, makes this an area ripe for harnessing the benefits of AI. The concept of using the data in payment messages to improve the customer experience or otherwise deliver enhanced services is well understood in the industry, and has been a high-profile topic for several years. To a great degree, this reflects the range of use cases it can support for corporate clients.

However, this isn’t the only way in which banks can make better use of payments data. There are many other areas in which modern data technologies can be used to drive operational improvements and efficiencies, in turn either directly supporting margin growth through lower costs, or otherwise enhancing the customer experience. A good example here is reducing the number of manual referrals when payments are processed, which brings benefits to all sides. Beyond considering the potential revenue opportunities from investments in modern data technologies such as AI, banks should ensure they take a fully rounded view of the range of business benefits that can be unlocked with the right investments.

To examine the opportunities in this space, Celent has brought together recent survey insights from both banks and corporates to give a unique perspective into not just how banks are thinking about AI in payments, but how this aligns with the needs of customers.

Key findings from this study include:

- 73% of banks report that they have delivered clear revenue opportunities from their investments in advanced data analytics

- 29% of banks are prioritising investments in artificial intelligence and NLP in 2023-2024

- 45% of Tier 1 banks view a lack of developer capacity as one of their biggest barriers to delivering product innovation in payments

- 69% of corporate clients would consider moving their banking business to providers that offer greater operational efficiencies

- 77% of corporates interested in data-led services rank analytics-driven tools as a top-three service area they would pay to access