Scaling the UK and European Embedded Finance Frontiers: Lessons from Pacesetters

Abstract

The global embedded finance market has experienced some growing pains but is emerging stronger and is here to stay. It’s too early to call the sector 'mature', but the attitudes and approaches are already changing. As the sector is leaving its toddler-like overexuberance behind to experience its 'teenage years', we take a closer look at the European embedded finance market.

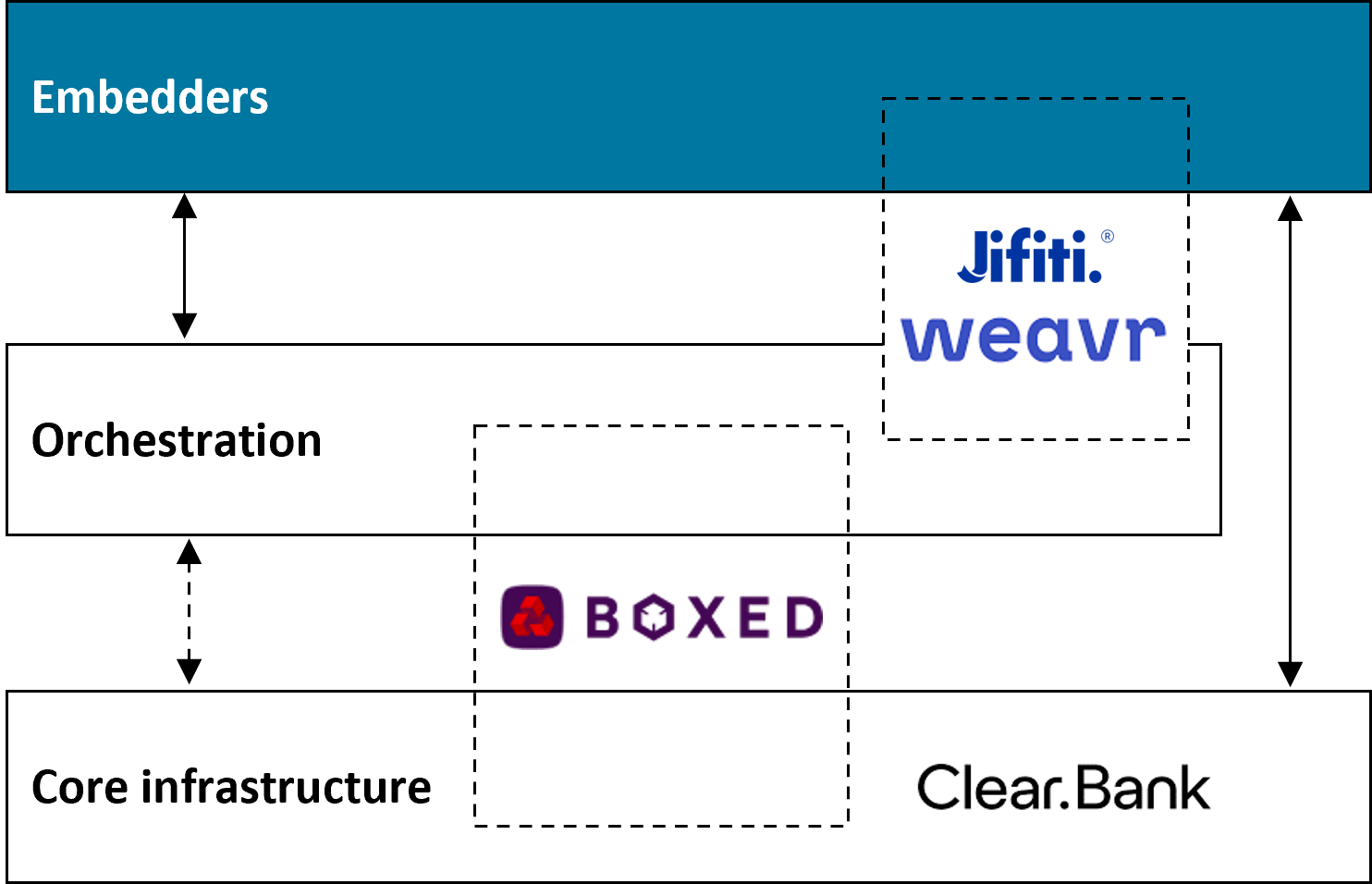

We set out to profile a small number of pacesetters, companies that we thought were doing something interesting in embedded finance. Many Banking-as-a-Service (BaaS) companies assemble the full stack needed to embed financial services into third party digital experiences. However, we are also beginning to observe the separation of at least two layers – the core banking infrastructure and an orchestration layer – with players specialising in one or the other. The firms we selected to profile reflect this increasing specialisation.

The report includes in-depth profiles of four diverse firms, in alphabetical order:

- ClearBank, an embedded banking infrastructure provider with a banking licence.

- Jifiti, an embedded finance enabler with a white-labelled embedded lending platform for banks and lenders to embed their loans at any point of sale.

- NatWest Boxed, a joint venture between NatWest, one of the largest UK banks, and Vodeno, a leading European BaaS player.

- Weavr, a technology company offering 'embeddable by design' financial solutions to B2B SaaS companies, connecting them with a complex partner ecosystem of technology and financial services providers.

The profiles vary slightly, depending on the emphasis for a particular company, but the readers of the report will learn the following about each provider:

- Basic facts about the company.

- Value proposition and market presence.

- Go-to-market strategy, target segments, competitive positioning.

- Key capabilities, including regulatory licenses and technology platform.

- Commercial and operating model.

- Future direction.

The report also includes:

- An overview of the competitive landscape for embedded finance in Europe.

- Discussion of the European banks’ attitudes towards embedded finance, based on the latest Dimensions survey.

- Lessons learned and key takeaways for other financial institutions and firms wanting to engage in embedded finance.

Pacesetters profiled in this report offer many insights and lessons for financial institutions and other players seeking to capture the embedded finance opportunity. Download the report to find out our key takeaways and recommendations.

Related Research

Dimensions: Retail Banking IT Pressures & Priorities 2024

May 2024

UK and European Banks and EMIs: Friends or Foes? Capturing the Embedded Finance Opportunity

January 2024

Demystifying Virtual Accounts: New Opportunities to Drive Adoption

September 2023

BaaS, PaaS, CBDCs, and PSD3: Decoding the Banking Buzzwords from EBAday 2023

July 2023

Practical Advice on Maximizing Value in an Increasingly Complex Technology Ecosystem

April 2023

A Primer on Variable Recurring Payments: The Next Big Thing in Open Banking?

December 2022

The Payments Processing Opportunity for Banks: Moving Account-Based Payments from Cost Centre to Revenue Stream

December 2022

Demystifying Embedded Finance: Promise and Peril for Banks

April 2021