Dimensions: European Retail Banking IT Pressures & Priorities in 2024

Embracing Data to Deliver for Customers

Key research questions

- What priorities are driving technology strategy for European banks in 2024?

- What are the leading product and technology investment areas?

- How much focus are banks putting on Gen AI, Open Banking, BaaS and Embedded Finance?

Abstract

The European banking sector looks set for a year of technology-driven change. IT budgets have grown by an average of 5% on average compared to 2023, and expectations are positive for spending to increase by an even greater amount in 2025. While the plans of individual banks can differ quite sharply, there are several themes that will drive activity across the region as a whole.

The first is delivering on the strategic imperatives to enhance propositions and customer experiences, which will see a renewed focus on areas such as the digital channels (including for small business customers), account opening processes and workflows, and open banking/open finance. Alongside this though, many banks are also focusing on opportunities to unlock efficiency gains and lower costs. This will create opportunities for automation and the greater use of cloud.

When it comes to the underlying technologies that will support these projects, one important theme is the emphasis on data technologies. Spending on advanced analytics and AI (including Gen AI) are expected to continue to grow, and this will see many institutions also invest in stronger data architectures to support downstream innovation and service enhancement. A further priority will continue to be around agility. While many have already seen past investments pay dividends, there is often further to go and driving real change is never a ‘once-and-done’ activity.

To shed light on the business pressures and technology priorities of the industry, Celent has completed its third global survey of senior executives at retail banks: The Celent Dimensions Survey 2024. This study captures the insights and opinions of 76 respondents at financial institutions in Europe to provide an in-depth view into attitudes across the region, as well as highlighting the leading technology priorities for the year ahead and the products and processes that will see the greatest change.

Key findings include:

- 70% believe that the competitive threat from fintechs and other challengers is increasing.

- 50% report that investing to deliver enhancements to their customer experience is one of the three most important drivers of their technology strategy.

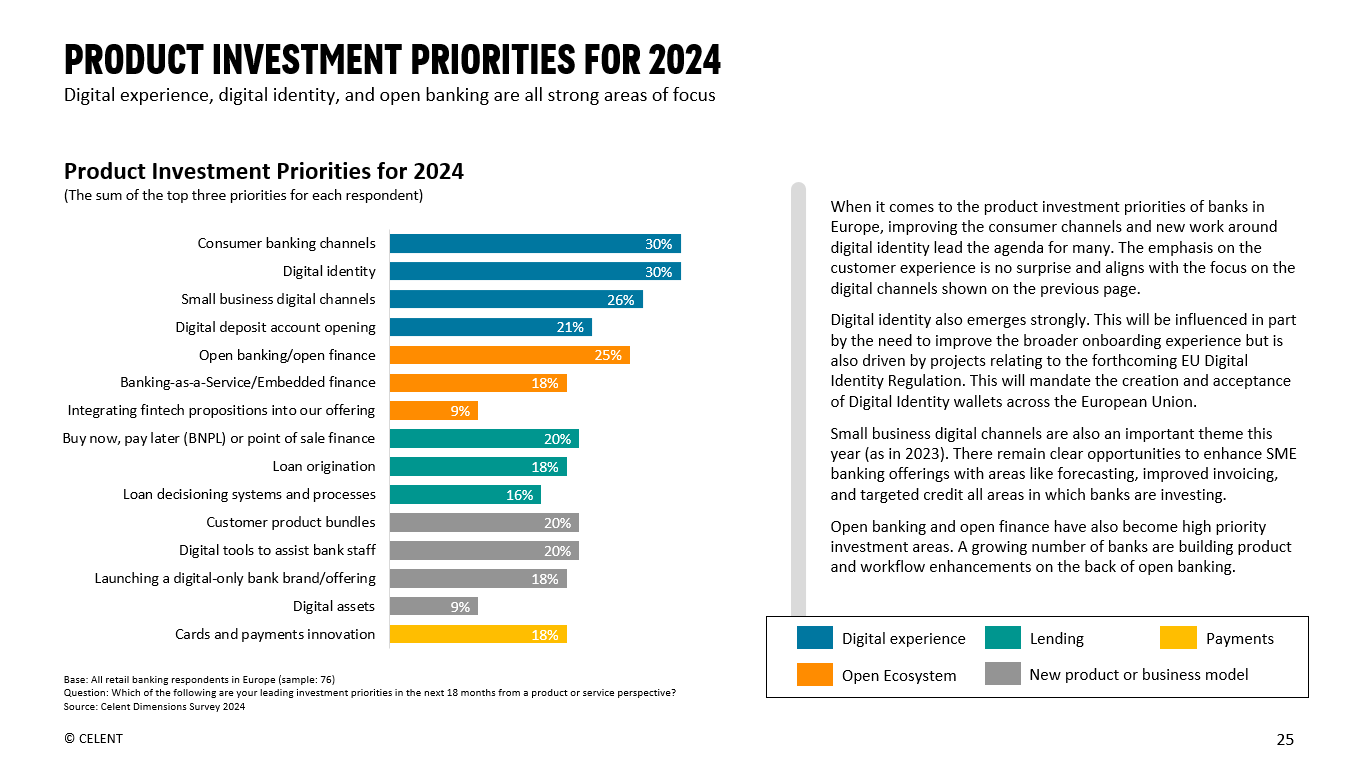

- 30% have highlighted investing in consumer banking channels as a key product-level priority, with the same proportion focusing on digital identity, and 26% focusing on small business digital channels.

- 53% are exploring new use cases related to AI technologies.

- 71% state that they expect to launch new customer-facing services using Gen AI in 2024.

The lessons for the industry are clear. Funding innovation is a major strategic driver for banks across all regions in 2024, and those that fail to keep up risk falling behind.

Related Research

Dimensions: Retail Banking IT Pressures & Priorities 2024

May 2024

Dimensions: Retail Banking IT Spending Forecasts by Technology 2024-2029

May 2024

Dimensions Webinar: Retail Banking IT Pressures & Priorities 2024 Edition

May 2024

Dimensions: North American Retail Banking IT Pressures & Priorities 2024

June 2024

Dimensions: Corporate Banking IT Pressures & Priorities 2024

May 2024