How AI and Data Are Redefining Wealth Management: A Broadridge Webinar (Part 2)

What innovations will be game-changers for wealth management in the next five years?

That was the final question asked to the panel I spoke on earlier this week for Broadridge's webinar: Mastering Disruption: How AI and Data Are Redefining Wealth Management. Click the link to watch the webinar on demand.

Reflecting on the panel discussion, the answers to that question on innovation over the next five years were the perfect summary of the key points made throughout the webinar. Here were our three game-changing innovations for wealth management:

1. AI and GenAI

The panel agreed that the wealth management industry is still only at the beginning stages of leveraging artificial intelligence. In Part 1 of this blog series about the webinar, I shared that wealth management executives in North America are making their greatest AI investments in:

- Account management

- Onboarding

- Advisor/client portals

Today, AI and generative AI are being leveraged for efficiency gains. We know that most wealth management firms' first genAI applications to go live in production are mostly employee-facing, front office business funtions like customer servicing, marketing, prospecting, and sales. The use cases for these areas include searching internal knowledge bases to find information faster, summarizing calls, generating emails, and writing content.

But over the next five years, the use of AI in wealth management will shift from focusing on internal efficiencies to becoming much more investor-centric. The shift is already happening. For example, AI and genAI are being used to personalize portfolio analytics and insights for the investor. This includes AI-powered real-time performance analytics, customizable dashboards and portfolio views, and customizable benchmarking all based on the investor's individual circumstances and goals.

In the future (and this is really the game-changing innovation), the Broadridge team believes we will see more investor-facing AI applications for end clients to use directly.

2. Wealth-as-a-Service

Wealth-as-a-Service (WaaS), similar to the more familiar term Banking-as-Service, is the unbundling of the wealth management tech stack into component products and services through open architectures and the flow of data via API integrations. This was my answer as a game-changing innovation over the next five years. Modularized or "à la carte" technology products and data integrations across the front to back office (e.g., marketing and communications, CRM, advisor dashboards, reporting, compensation) allow firms to be more agile with their digital transformation initiatives. The Broadridge Wealth Platform does just that.

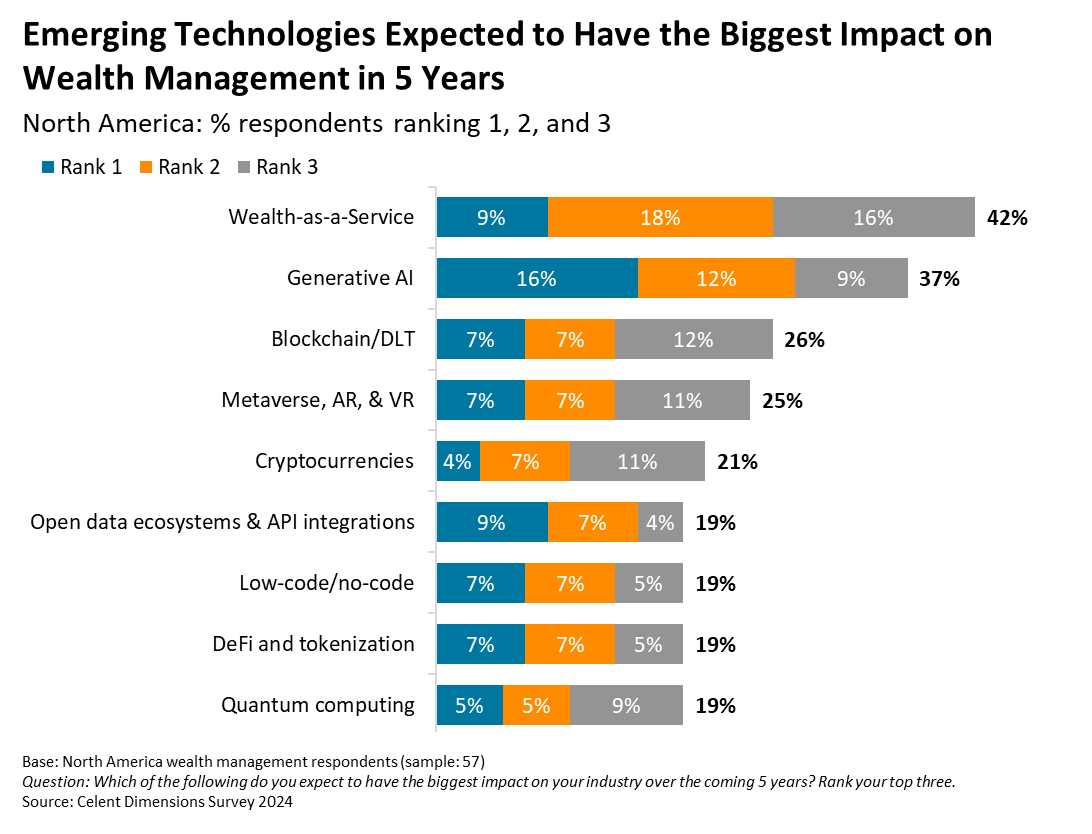

In Celent's Dimensions North America survey, we asked wealth management executives which emerging technologies they expect to have the biggest impact on the industry over the next five years (similar to the "game-changing" question from the webinar). Wealth-as-a-Service was the most common answer that respondents ranked among their top three for biggest impact. WaaS enables faster product or application launches at scale with less resources spent on internal infrastructure and data management.

Looking at the blue bars in the above chart, WaaS and open data ecosystems & API integrations—which go hand in hand—are tied as the second most common answers for having the single greatest impact on the wealth management industry. Generative AI is the most common answer.

3. Alternative Investments

Access to alternative investment strategies (e.g., private equity, private debt, real estate, hedge funds) that used to be reserved for institutional and ultrawealthy investors is now being unlocked for financial advisors, high-net-worth individuals, and mass affluent accredited investors. This creates an opportunity for trillions in retail investments to move to alternatives. Over a third (39%) of wealth management executives in North America agree that incorporating alternative investments into the portfolio construction process is among their top product or service priorities over the next 18 months.

This is really a technology trend since platforms with robust data integrations are necessary for the distribution of alternatives from the asset managers to the financial advisors and end investors at scale. These platforms are removing barriers to democratize access to alternatives, educating financial advisors and end investors, and simplifying alt investment strategies. Celent clients can read more about these trends and more in our report, Embracing Alternatives in Wealth Management.

We also mapped out the alternative investments technology landscape for wealth management as it stands today. Keep a look out for future reports from Celent on alts tech platforms.