Embracing Alternatives in Wealth Management

Abstract

An alternatives boom in wealth management may be well underway. Access to alternative investment strategies (e.g., private equity, private debt, real estate, hedge funds) that used to be reserved for institutional and ultrawealthy investors is now being unlocked for financial advisors, high-net-worth individuals, the mass affluent, and accredited investors. Retail wealth management is poised to be the next frontier for alternatives as asset managers target new sources of capital and advisors welcome alts with open arms.

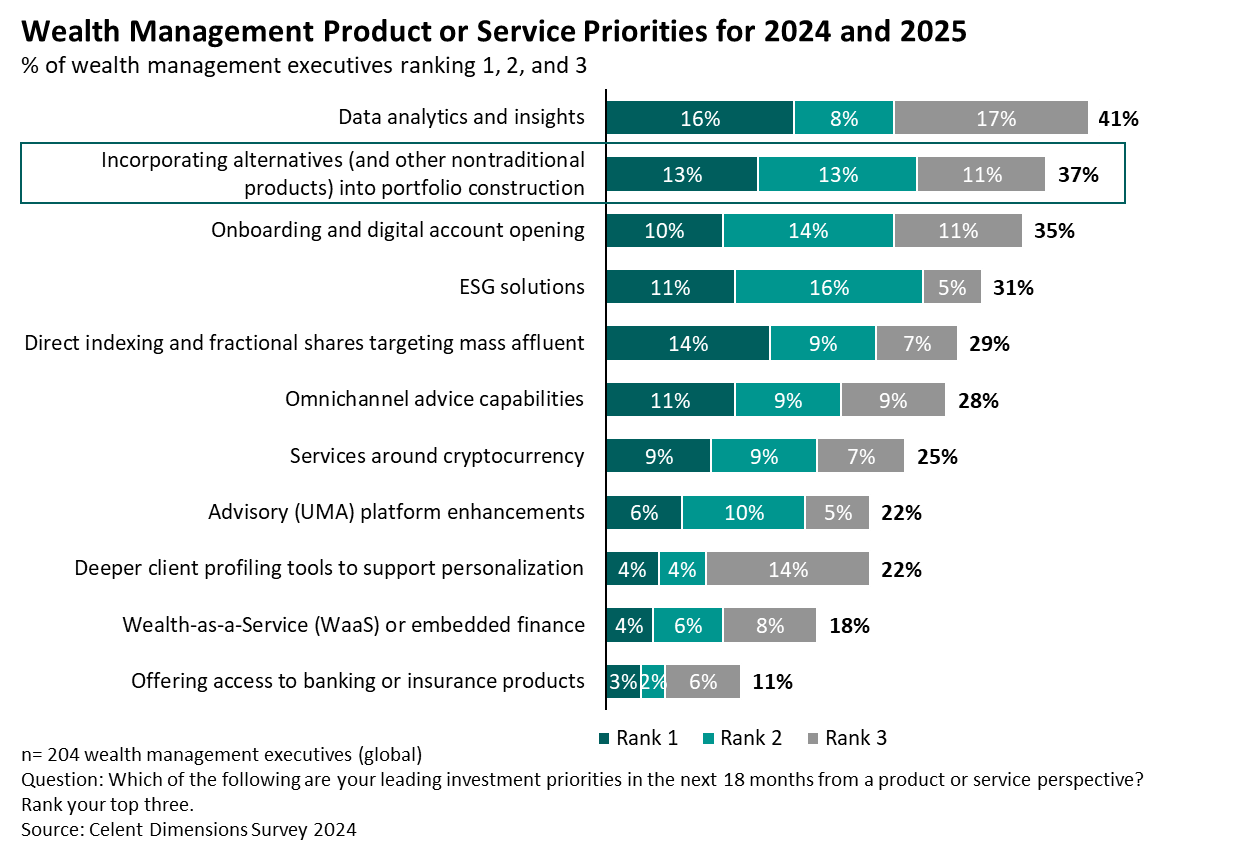

Celent research reveals that over a third of wealth management executives say incorporating alternatives into portfolio construction for their advisors and clients is among their top product/service priorities over the next 18 months (see chart below).

This report presents evidence supporting the beginnings of an alts boom in wealth management. Celent unpacks:

- How advisor adoption and allocations to alternatives are progressing.

- An overview of the technology ecosystem and leaders in the space—including a map of the alts in wealth management technology landscape.

- 5 key trends for the next 12 months.