Dimensions: North American Wealth Management IT Pressures & Priorities 2024

28 June 2024

Key research questions

- What priorities are driving technology spending in North America?

- How do wealth management IT strategies differ in the US and Canada?

- How much focus are wealth managers putting on cloud infrastructure, AI, and generative AI?

Abstract

IT spending by wealth management firms is accelerating across the US and Canada. Executives in both countries report elevated IT budget growth year-over-year in 2024 compared to 2023, and expect another acceleration in spending in 2025.

To shed light on the business pressures and technology priorities of the wealth management industry, Celent has completed its second annual global survey of senior wealth management executives: The Celent Dimensions Survey 2024. This North America study captures the insights and opinions of 57 respondents from the US and Canada to provide an in-depth view into the drivers of IT spending across the industry, as well as the leading technology and investment priorities for the year ahead.

Key findings include:

- 63% of wealth management firms in North America are either live, piloting, or experimenting with generative AI.

- 38% of wealth managers' IT budgets go to the front office—the largest allocation area.

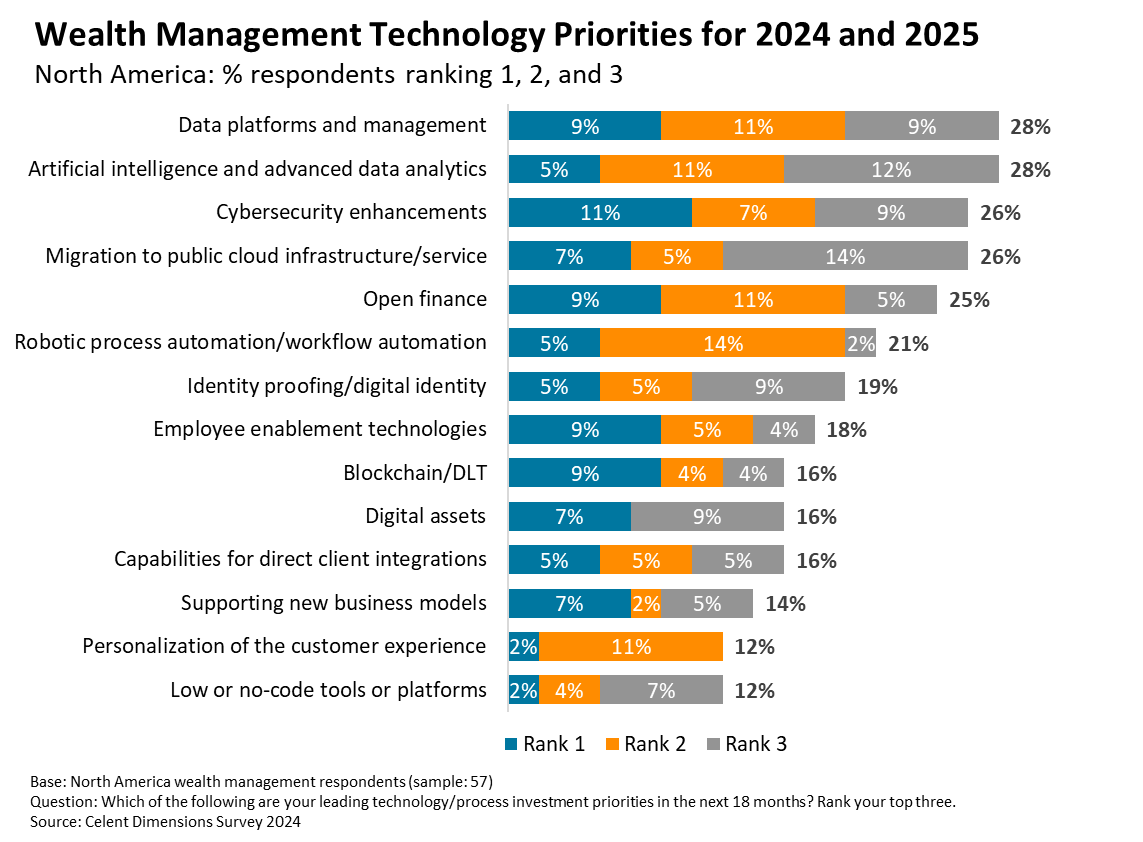

- 28% of respondents report that data platforms & management and AI & advanced data analytics are among their top technology priorities in 2024 (see the chart below).

- 23% of executives report that meeting compliance and regulatory requirements is their number one driver of IT spending strategy—the most common answer among respondents.

- 4.7% year-over-year growth in IT budgets is expected for the region in 2025, on average, which will be the third consecutive year of elevated spending growth.