Mapping the Alternative Investments Technology Landscape for Wealth Management

Alts Tech Platforms for Advisors and Retail Investors

Retail wealth management is poised to become the next frontier for alternative investments. Celent's recent report, Embracing Alternatives in Wealth Management, makes the case for an alts boom in wealth management. Asset managers are turning to the retail segment for their next source of AUM, advisors are increasing their adoption and portfolio allocations to alts, and end investors are becoming more interested in alts for diversification, inflation hedging, and higher returns. While those trends are all moving in the right direction, the real key to alternatives becoming mainstream in wealth management is the success of the underlying technology ecosystem.

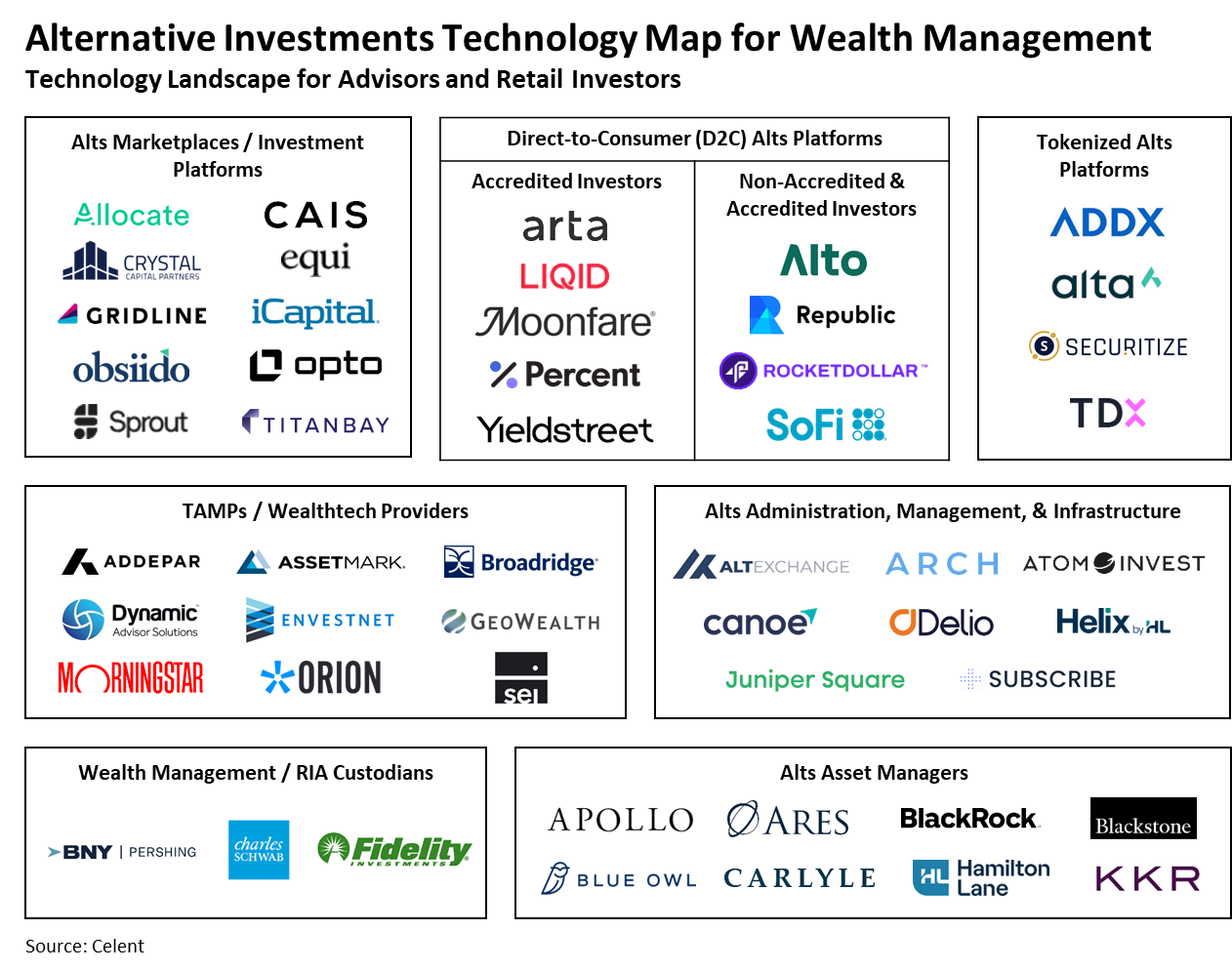

Celent research reveals that over a third of wealth management executives say incorporating alternatives into portfolio construction for their advisors and clients is among their top product or service priorities over the next 18 months. We created an Alternative Investments Technology Map for Wealth Management, below, to help wealth management firms learn about their technology options for integrating alts into portfolio management. Keep reading below the map for category definitions and 2 trends (and real-world examples) shaping the alts technology landscape for wealth management.

Technology Landscape for Advisors and Retail Investors

Alts Marketplaces / Investment Platforms distribute alternative investment products from asset managers to wealth managers/financial advisors and provide them with portfolio management, reporting, and educational tools.

D2C Alts Platforms are investment platforms that cater directly to HNW, accredited investors, and non-accredited investors (via crowdfunding).

Tokenized Alts Platforms are blockchain/DLT-based investment platforms offering tokenized alts funds for advisors and accredited investors.

TAMPs / Wealthtech Providers partner with alternative investment platforms to integrate alts products and portfolio management tools for their advisor clients.

Alts Administration, Management, & Infrastructure firms specialize in tech solutions for alts document processing, reporting, data analytics, and investment management.

Wealth / RIA Custodians partner with alts investment platforms for custody.

Alts Asset Managers partner with alternative investment platforms for retail distribution.

2 Trends Shaping the Alts Technology Landscape for Wealth Management

1) Platform developments: integrating alts into existing platforms and launching new platforms

There have been several alternative investment platform developments in the first half of 2024. In January, SoFi began offering alternative funds as part of SoFi Invest, including access to private credit, real estate, and pre-IPO companies. In March, wealthtech provider Orion announced a partnership and integration with CAIS to provide Orion’s advisor clients access to alternative funds and products.

Fidelity and Charles Schwab both made announcements this year that they are getting in the alts game. Fidelity is integrating alts investment research within its advisor platform and Schwab is launching a new alts investment platform for ultra HNW investors. In June, Mercer Advisors announced a partnership with private market investment platform Opto Investments to launch a new private markets platform for family offices and qualified investors called Aspen Partners.

2) Investment product developments: simplifying alts investing through familiar strategies

Alts players are launching new investment strategies that advisors are familiar with to simplify investing and encourage greater adoption. These include model portfolios that simplify portfolio construction through prebuilt allocations, hybrid funds combining public and private market investments, and semi-liquid funds that give investors more liquidity.

Partnerships in 2024 announcing the launch of new alts model portfolios include Yieldstreet with advisory firm Wilshire, iCapital with asset managers Blue Owl Capital and Nuveen, and BlackRock with TAMP provider GeoWealth. In May, KKR partnered with Capital Group to develop hybrid public-private fixed income investment products for individual investors. After BlackRock acquired Preqin, an alts data provider, in June, it was reported that BlackRock would explore index products for private markets, which could be attractive for retail investors. Finally, Moonfare—a private equity investing platform for accredited investors—announced its first semi-liquid secondaries fund in early July.

For more technology trends, survey data, news, and tech provider analysis on alts in wealth management, Celent subscribers can check out Embracing Alternatives in Wealth Management. Stay tuned for future Celent reports with more detailed profiles of the alts solution providers in the map above.