Top Technology Trends Previsory 2025: キャピタルマーケッツ / バイサイド編

構造変化と世界的激変の時代におけるバイサイドの2025年テクノロジー戦略の可能性を考察する

Abstract

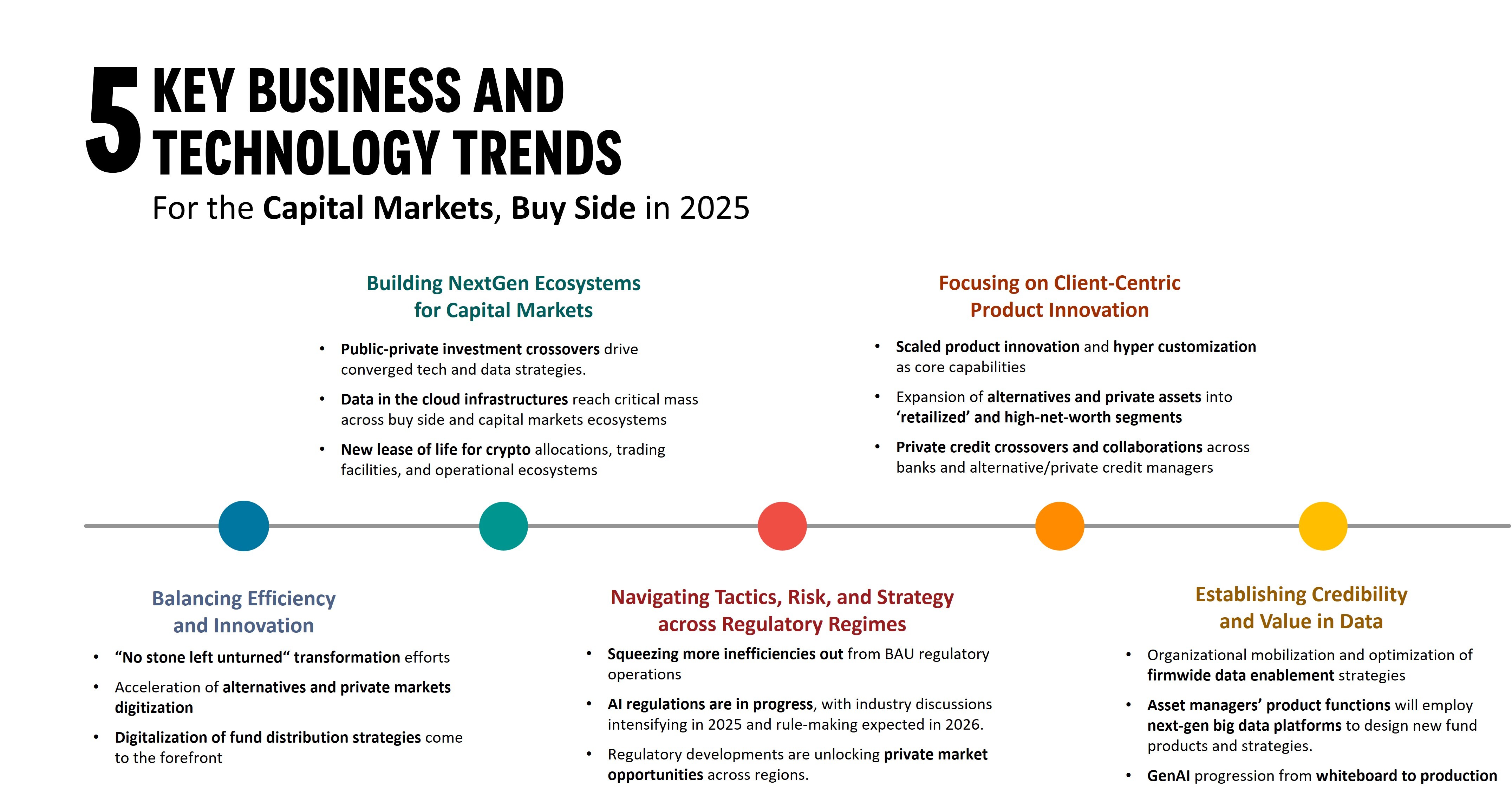

投資運用会社は今、伸び悩む収益、手数料やコストによるマージン縮小などの課題を抱え、大きな転機を迎えている。この厳しい現実を踏まえると、バイサイドにとって、ビジネスと運用モデルの強化につながる変革の実現を目指すには、応急処置的な対応だけでは十分だとは言えない。

長年にわたるセレントの取り組みや業界調査から、投資運用会社が、ポートフォリオサービシングや運用の効率化に力を入れながら、自社の商品内容や販売チャネルにおける差別化要因の基準を上げていることが分かる。テクノロジーの進歩につれ、顧客のニーズや投資戦略への対応にも変化が見られ、公的資産、オルタナティブ資産、プライベート資産のバランスも変化してきている。デジタル化とデータ中心主義によって、市場開拓戦略と顧客エンゲージメントの形も変化した。

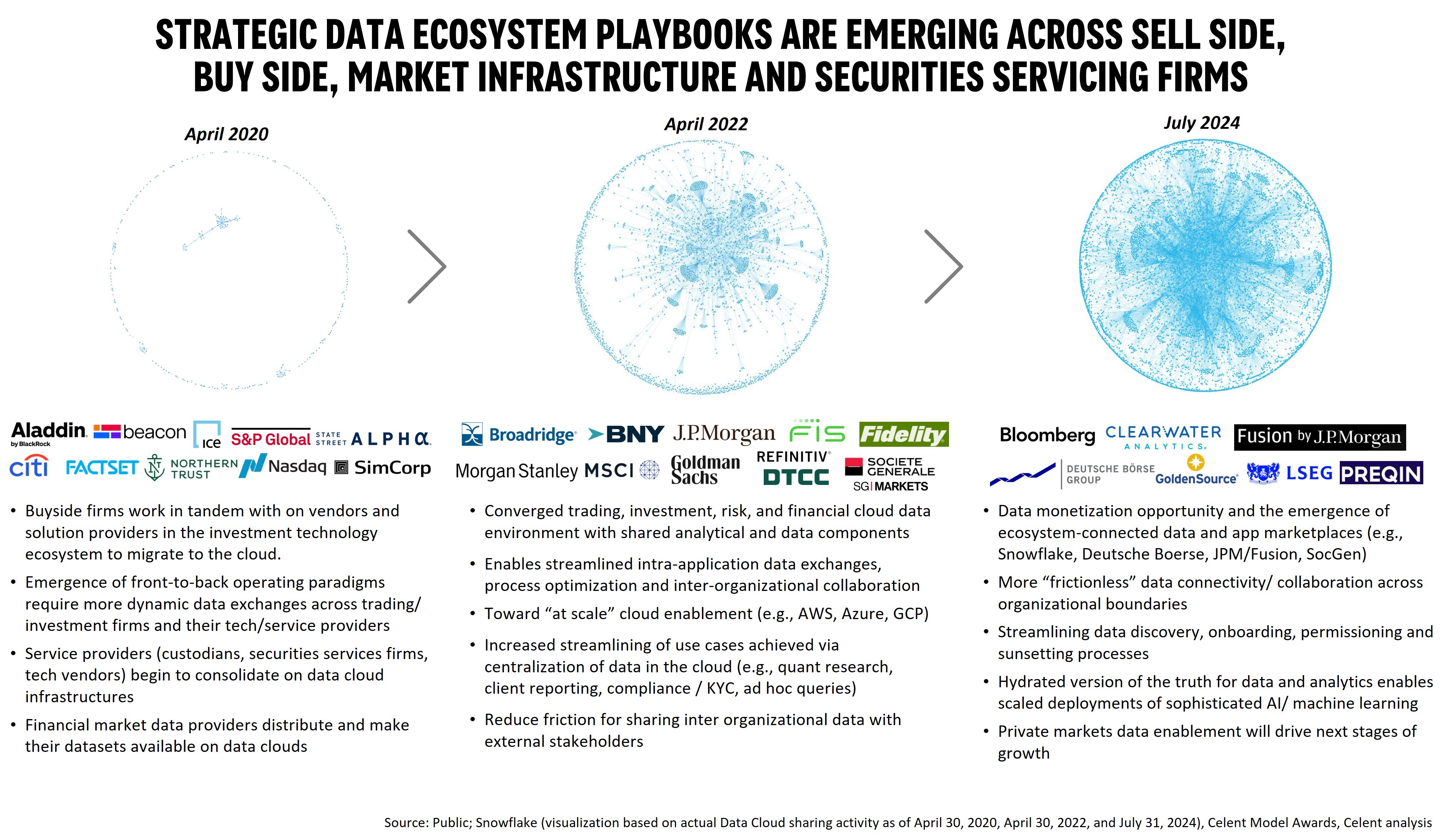

キャピタル・マーケッツにおいては、セルサイドおよびバイサイド、市場インフラ、証券会社などのさまざまなセクターで戦略的データ・エコシステムが形成されつつある。これからの接続性とコラボレーションの形を変えるであろうデータクラウドインフラの迅速な導入がこの変革の原動力となっている。導入のダイナミクスとネットワーク効果は、これらのエコシステムを中心とする飛躍的な成長を特徴としている。

このようなデータ・エコシステムが発展するにつれ、取引や投資のバリューチェーン全体における参加者間のやり取りがよりシームレスになることが期待される。適切に設計・導入されたエコシステムを活用することで、企業はアジャイルなデータ主導型の他社よりも優れた運用戦略を展開することができるようになる。企業はデータや洞察を共有できるようになり、多くの情報に基づく意思決定と市場の変動への機敏な対応が可能となる。これらの変化は、効率性の向上だけでなく、イノベーションの促進にもつながる。

本レポートでは、バイサイドの視点からビジネスとテクノロジーの関係性を細かく検証し、2025年に向けた新たなテーマとプレイブックの変化にスポットを当てる。セレントのキャピタル・マーケッツ・チームは、綿密なリサーチ、および業界エクスパートとの議論を重ね、これらのテーマを見極めた。

----------

関連レポート(サブスクリプション購入者はレポート完全版の閲覧可能):

- DIMENSIONS:グローバルなキャピタルマーケッツ/ バイサイドのITの課題と優先事項:2024年版

- 次世代の投資会計ソリューションについてのガイド: 成功のためのプレイブック

- オルタナティブ投資とプライベートマーケット:次世代のオペレーショナルエコシステムのための新たなテクノロジーのフロンティアとデジタルパスウェイを描く

- 最前線への戦略転換:アルファを求める競争が激化する中、さらなる差別化を求めて

- バイサイドオペレーションのアルファ創出: 未来のハイブリッドプロバイダー・ソリューションとエコシステムのイノベーションを予測する

- 厳しい視線が注がれるESGの達成:「約束を実行」し、信頼性ギャップを解消

- 次世代の投資/ リスクテクノロジー: 2030年に向けての予測

- エンドツーエンドのソリューションが投資テクノロジーに革命をもたらす

- 2025年 エンタープライズ・データ・マネジメントの展望 : パート1 and パート2

当社ウェブサイトのキャピタル・マーケッツページに、バイサイド、セルサイド、市場インフラのトレンド、テクノロジーの知見などについてのより詳しい情報が満載。