DIMENSIONS: 中南米のコーポレートバンキングにおけるITの課題と優先事項:2024年版

2024 Edition

Abstract

Celent’s overarching theme for corporate banking in 2024 is that future success rests on faster, safer, smarter innovation. Banks must deliver technology solutions faster, within a solid risk framework, and leveraging the capabilities of AI. The question is - do bank’s investments align to the key technologies, and the product priorities that will power growth in Latin America?

Corporate banking institutions in Latin America are increasing their technology budgets, albeit more slowly than some other regions. Across Latin America, IT spending will grow strongly in 2024 as compared to 2023 and is expected to expand further in 2025. While technology investments are growing across the industry, the implications for banks in certain countries can vary considerably—and these are highlighted throughout the report.

Banks wrestle with compliance and mandate obligations as they try to modernize their application and infrastructure real estate. The key to unlocking this conundrum is through achieving greater speed and agility across the entire technology portfolio—through new architectures and technology building blocks, DevOps, and partnerships. A major theme is the emphasis on data platforms and related technologies to support the ambition around AI.

Some key findings from the research:

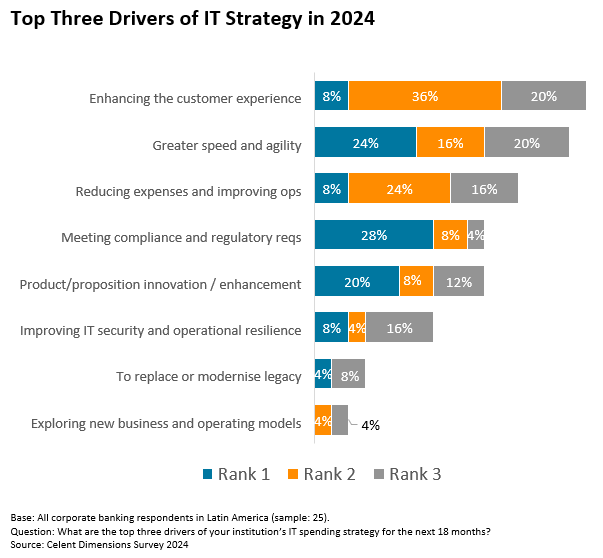

- The top three drivers for IT spend in Latin America are well aligned with global trends: enhancing the customer experience, greater speed and agility, and reducing expenses / increasing operational efficiency.

- IT budgets are increasing, but much of that is allocated to “run the bank” initiatives. Only 40% of IT budgets is allocated to “change the bank” initiatives. In a gloomy picture for innovation and growth, overall, more Latin American countries fell below the regional average than exceeded it.

- The biggest single product-level priorities this year are corporate digital channels. Indeed, digital experiences lead the way with banking platforms, and customer service tools all point to a high region-wide priority to invest in the digital banking experience as a differentiator.

Related Research

Dimensions: Corporate Banking IT Pressures & Priorities 2024

Dimensions: Corporate Banking IT Pressures & Priorities 2024: North America Edition

Dimensions Webinar: Corporate Banking IT Pressures & Priorities 2024: Asia Pacific Edition

Dimensions: Retail and Corporate Bank IT Pressures & Priorities 2024: Middle East & Africa Edition

Corporate Banking IT Spending Forecasts by Domain 2023-2028

Corporate Banking IT Spending Forecasts by Technology 2023-2028

Dimensions: Retail Banking IT Pressures & Priorities 2024

Dimensions: Retail Banking IT Pressures & Priorities 2024: Europe Edition

Dimensions: Retail Banking IT Pressures & Priorities 2024: Asia Pacific Edition

Dimensions: Retail and Corporate Bank IT Pressures & Priorities 2024: North America Edition