Corporate Banking IT Spending Forecasts by domain 2023–2028

IT Spending Trends Across the Front, Middle, and Back Office

Abstract

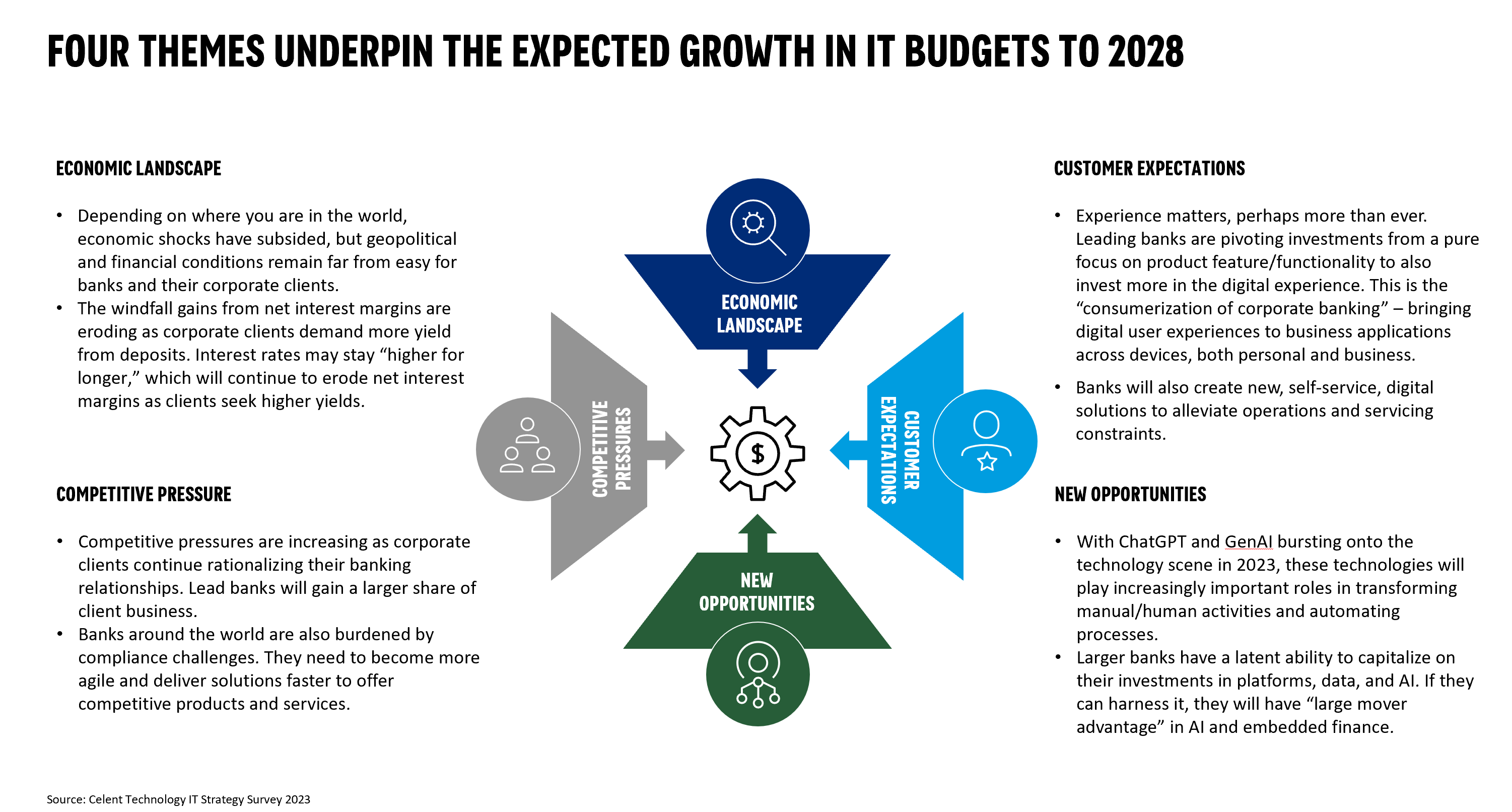

While the start of the decade was defined by the pandemic, the banking industry landscape over 2022-2023 has been driven by the growth of interest rates after prolonged ultralow levels. While this has helped improve net interest income in many markets, it caused turbulence in others (notably the US) as banks readjusted to a new asset liability environment.

Combined with inflationary pressure in many markets, banks are seeing a challenging environment to win and retain customers, driving the need to improve both customer experience and product/service propositions. This has driven IT spending growth despite continuing cost pressures.

Leveraging primary insight from Celent's IT Technology Insights Strategy Survey, this report presents the outlook for technology spending by corporate banks up to 2028, highlighting key findings from Celent's Banking IT Spending Forecast Model 2023-2028. The scope covered is IT spending by functional domains of front, mid, and back offices - and by the key categories in each group (e.g. digital channels, risk, payments). The report analyses global and regional trends.

Related Research

Corporate Banking IT Spending Forecasts by Technology, 2023-2028

Technology Trends Previsory Webinar: Corporate Banking; 2024 Edition

Technology Trends Previsory: Corporate Banking 2024 Edition

Corporate Banking Global IT Priorities and Strategy in 2023

European Corporate Banking IT Priorities and Strategy in 2023

North American Corporate Banking IT Priorities and Strategy in 2023

APAC Corporate Banking IT Priorities and Strategy in 2023

Corporate Banking Global IT Priorities and Strategy in 2023