DIMENSIONS:中東およびアフリカのバンキングにおけるITの課題と優先事項:2024年版

Delivering Product Enhancement and Agility

Key research questions

- What priorities are driving technology strategy for banks in MEA for the year ahead?

- What are the leading product and technology investment areas?

- How much focus are banks putting on Open Banking, Gen AI, BaaS and Embedded Finance?

Abstract

2024 will be a year of technology-driven change for the banking industry in the Middle East and Africa. In the face of growing competitive threats and emerging market opportunities, banks across the region are increasing their IT budgets by 4.4% on average this year, and many expect growth at a higher rate in 2025. This has been underpinned by a drive to deliver product enhancements, as well as ongoing modernisation efforts and the need to keeping pace with changing compliance requirements.

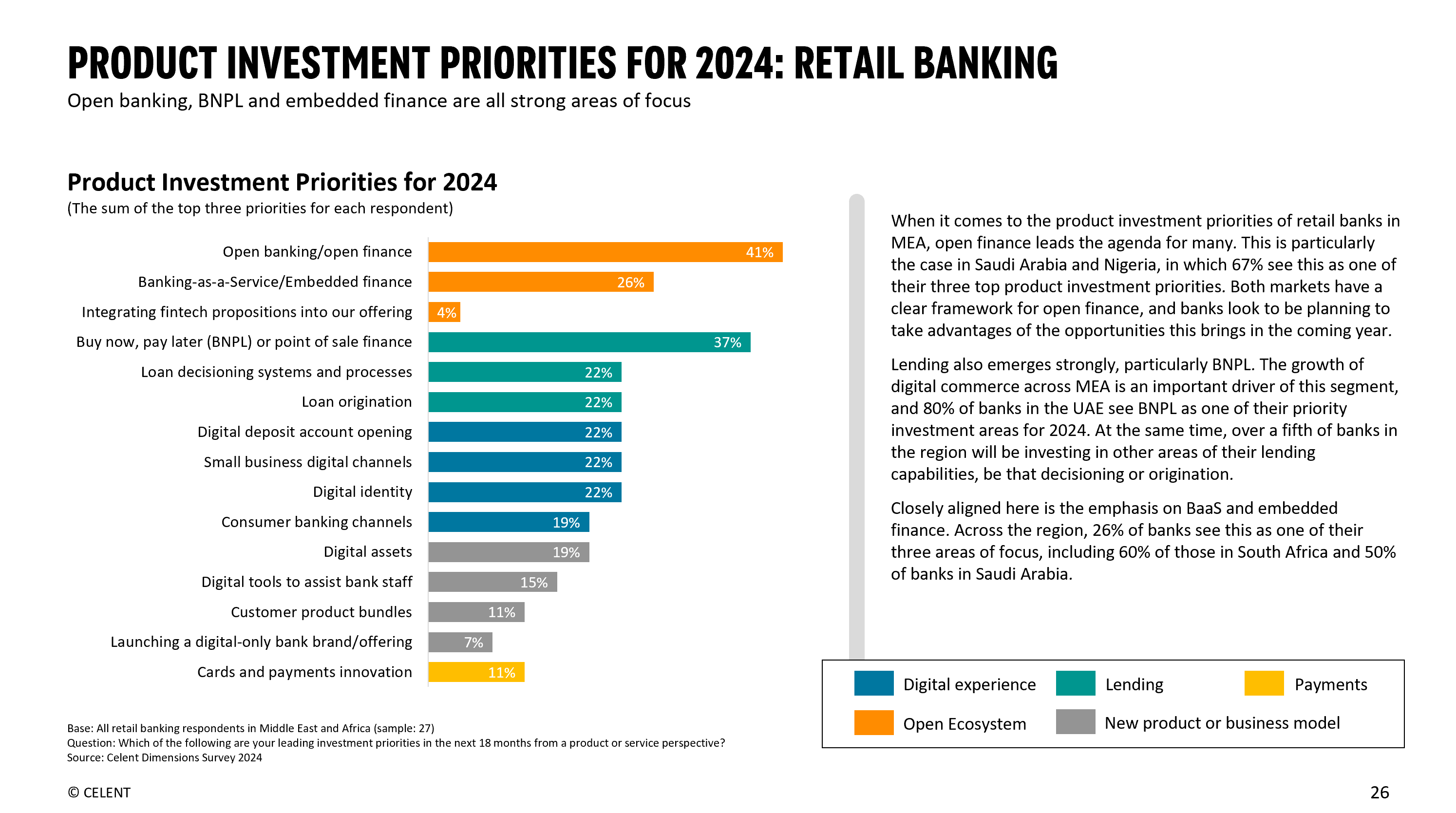

Technology investment is growing across the industry, but the projects and priorities of individual banks can vary considerably depending on the unique internal and external circumstances they each face. Nevertheless, there are several common themes across the region. The first is delivering on the strategic imperatives to enhance propositions and customer experiences, which will see a renewed focus on areas such as the digital channels, cards and payments, open banking/finance, and BNPL offerings.

Agility will continue to be a clear priority. This is not a ‘once and done’ activity, and the aspiration to remain responsive to changing circumstances will see continued investment in modernisation initiatives as well as the greater adoption of automation and cloud technologies. One other important theme is the emphasis on data technologies. The coming year will see many institutions invest in stronger data architectures to support innovation and service enhancement downstream.

To shed light on the business pressures and technology priorities of the industry, Celent has completed its third global survey of senior executives at retail banks: The Celent Dimensions Survey 2024. This study captures the insights and opinions of 51 respondents at financial institutions across the Middle East and Africa to provide an in-depth view into attitudes across the region, as well as highlighting the leading technology priorities for the year ahead and the products and processes that will see the greatest change.

Key findings include:

- 65% believe that the competitive threat from fintechs and other challengers is increasing.

- 55% report that investing to deliver enhancements to their customer experience is one of the three most important drivers of their technology strategy.

- 41% have highlighted open banking and open finance as a key product-level priority, with 37% focusing on BNPL.

- 53% are experimenting or building PoCs relating to AI technologies.

- 69% state that they expect to launch new customer-facing services using Gen AI in 2024.

Related Research

Dimensions: Asia Pacific Retail Banking IT Pressures & Priorities in 2024

July 2024

Dimensions: Retail Banking IT Pressures & Priorities 2024

May 2024

Dimensions: Retail Banking IT Spending Forecasts by Technology 2024-2029

May 2024

Dimensions Webinar: Retail Banking IT Pressures & Priorities 2024 Edition

May 2024

Dimensions: European Retail Banking IT Pressures & Priorities 2024

June 2024

Dimensions: North American Retail Banking IT Pressures & Priorities 2024

June 2024

Dimensions: Corporate Banking IT Pressures & Priorities 2024

May 2024