決済における生成AI: 今後3年間に何ができるか、2028年以降にどう備えるか

Use Cases Driving Adoption

Abstract

Having exploded onto the scene less than a couple of years ago, generative AI (GenAI) technologies have evolved very rapidly, and adoption in financial services has already advanced at an extraordinary pace compared to that of other tech-related initiatives. Given its strong potential, developing a GenAI blueprint is a core requirement for payment firms to be competitive.

To help payment companies to continue plan their GenAI journey, AWS commissioned Celent to conduct a research study investigating the adoption of GenAI use cases in payments. Celent interviewed several pacesetters, including Convera, EXL Service, Featurespace, Remitly, Stripe, Visa, and AWS. The report includes mini case studies, showcasing where and how these leaders are adopting GenAI.

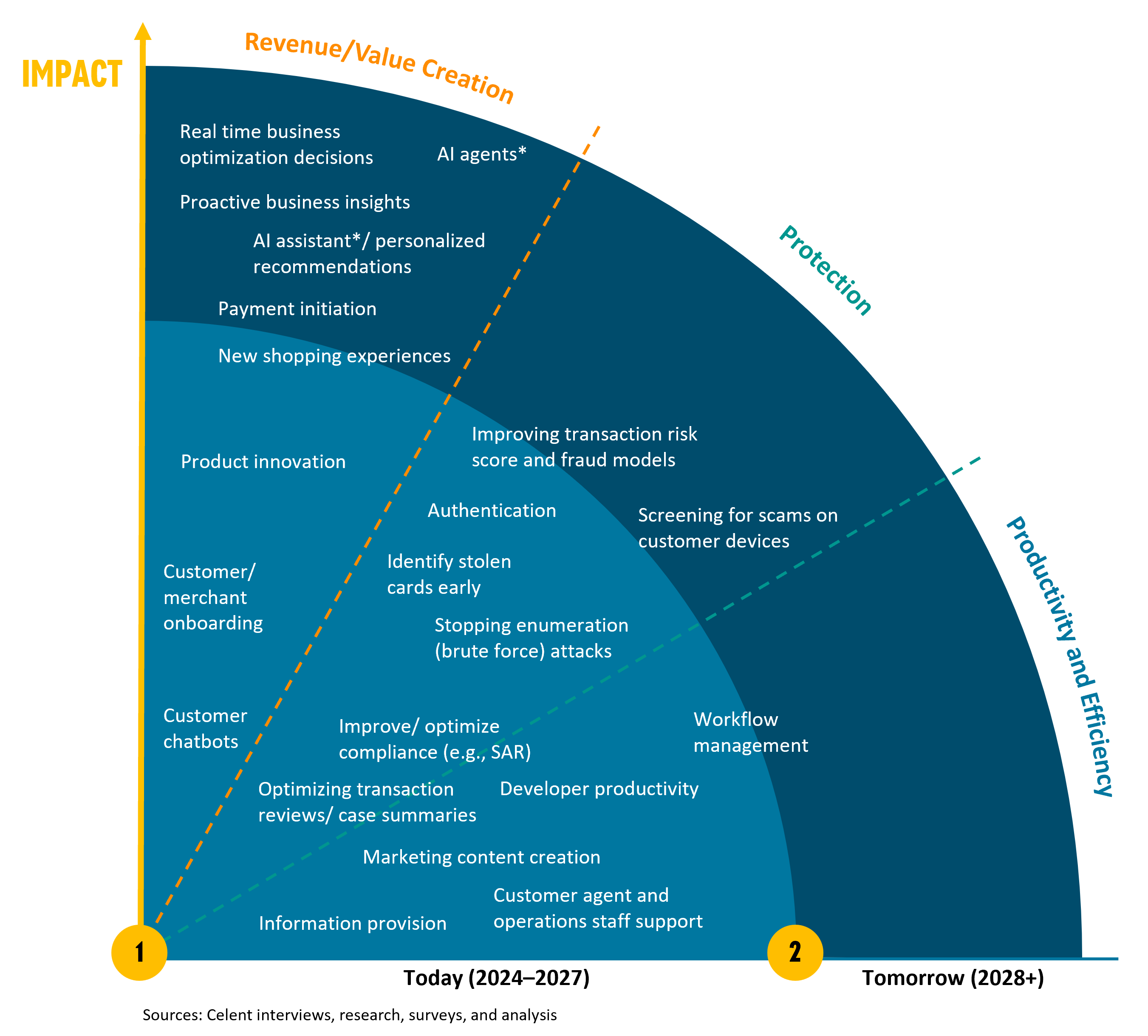

Payment companies must consider what they can do with GenAI “today” (Wave 1, the next three years) and how to prepare for “tomorrow” (Wave 2, 2028+). These adoption waves are propelled by tech advances (e.g., faster/more efficient compute), competitive pressures, and the maturation of GenAI applications through increasing comfort level of the companies and regulatory clarity. They also need to be looking across the entire payments value chain: enabling transactions, such as developing and marketing new products and bringing new customers onboard; executing transactions – orchestrating commerce, initiating payments, and managing fraud and risk management; and providing post-transaction support to customers.

Celent believes the value of GenAI-led transformation of the payments industry will be clustered around three major areas:

- Like other financial institutions, payment firms can achieve significant productivity and efficiency enhancements in areas such as product development, sales and marketing, customer onboarding, customer support, operations, and IT, and most are starting with these use cases.

- AI and traditional ML models are already widely used by payment companies for protection – to mitigate fraud and manage risk. GenAI can enhance those models further and lead to efficiencies in fraud management, as well as risk and compliance.

- GenAI will help payment companies become data-driven organizations that leverage the abundance of payments data to make faster and smarter decisions for themselves and their clients (“payments/ commerce intelligence”), generating revenue and unlocking new value creation opportunities. Furthermore, it will transform commerce and how payments are initiated and conducted.

Read this report to:

- Be informed about factors influencing generative AI development and adoption in payments

- Develop a strategic plan to harness generative AI at the use case level along your value chain

- Make sound prioritization decisions

As generative Al's potential for payment firms crystallizes, this framework aims to distinguish hype from reality and help guide your successful implementation.

Related Research

Generative AI Making Waves: Adoption Waves in Banking and Capital Markets

Payments Intelligence: A Pioneering Approach to Leveraging Payments Data

Harnessing the Benefits of AI in Payments: Unlocking a Range of Workflow and Product Enhancements

Field Guide to GenAI Hyperscalers: Banking Edition

GenAI-oneers in Banking: Bank Survey and Spotlights

GenAI—Lens on Use Cases in Corporate Banking

GenAI—Lens on Use Cases in Retail Banking