Generative artificial intelligence (Al) is making headlines on a daily basis. Economists are estimating that it could add up to $20 trillion to global GDP by 2030. Leaders in the industry are excited about the potential and frontrunners in banking and capital markets are announcing pilots and moving into production with generative AI-powered tools. Given all this potential, you are likely thinking about developing a generative Al blueprint to remain competitive.

To help banks and capital markets participants to continue to plan their journey, AWS commissioned Celent to develop this report, which defines three distinct generative Al adoption waves in banking and capital markets and identifies strategies for navigating each.

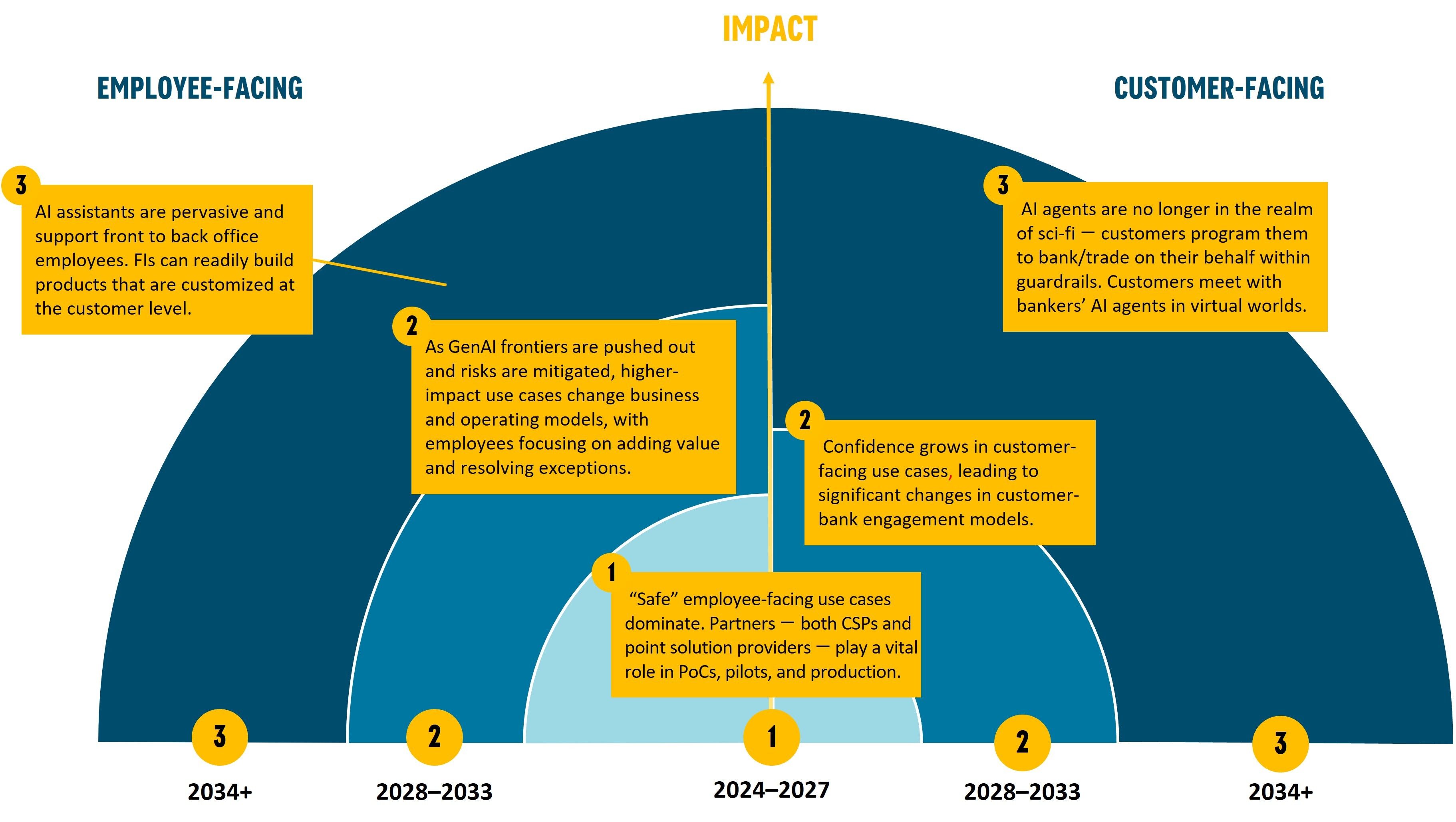

Celent WaveGram:

Celent identified the accelerators and impediments that affect the outcomes of each wave. Over time, new use cases will become technologically possible and economical, allowing Generative AI to enter workflows across the banking and capital markets value chain.

Although many use cases will be common across banking and capital markets the impact will vary both across and within the verticals. Celent analysis identifies these differences and details the overall impact of use cases on the industry.

Read this report to:

- Be informed about factors influencing generative AI development and adoption

- Develop a strategic plan to harness generative AI at the use case level along your value chains

- Make sound prioritization decisions

As generative Al's potential for financial services crystallizes, this framework aims to distinguish hype from reality and help guide your successful implementation.