Dimensions: Asia-Pacific Wealth Management IT Pressures & Priorities 2024

Key research questions

- What priorities are driving wealth management technology spending in Asia-Pacific?

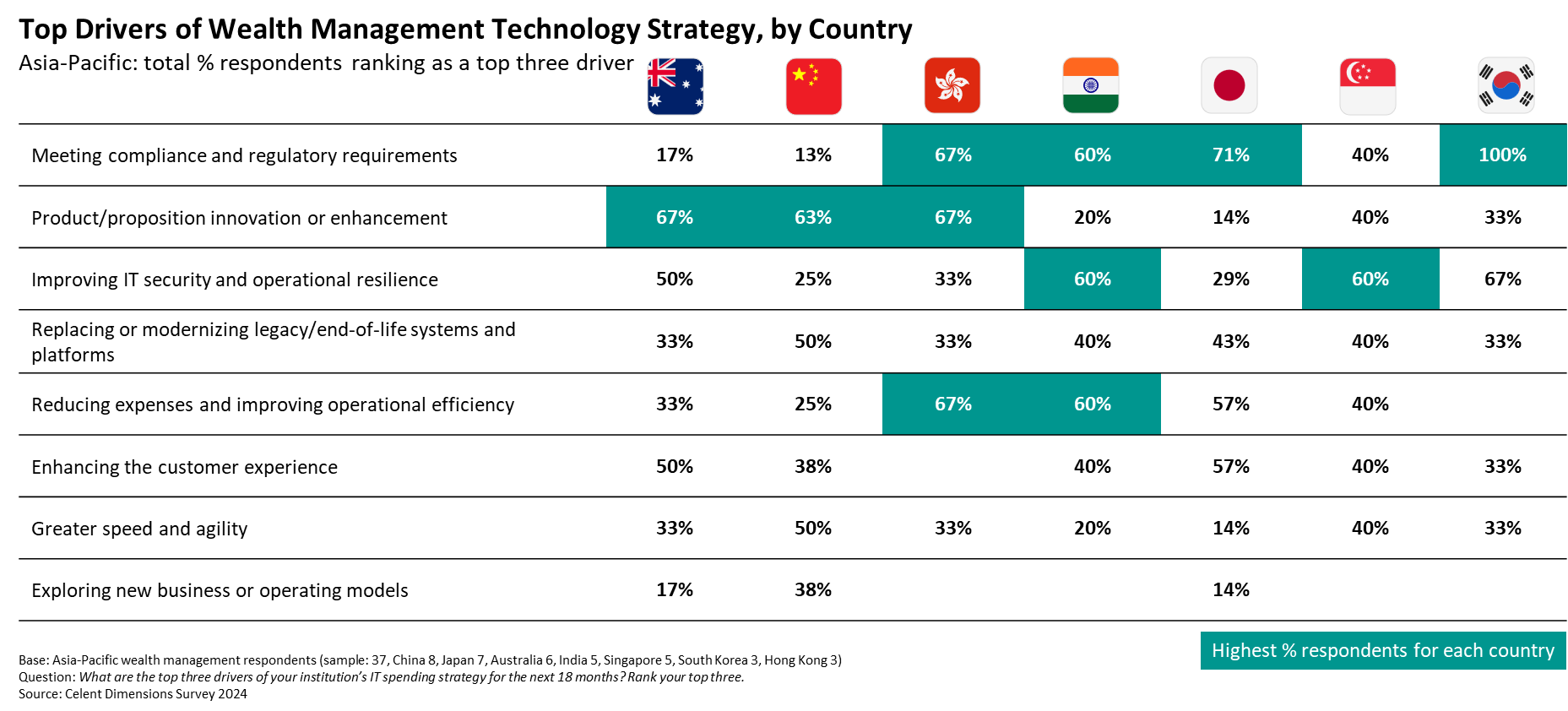

- How do technology spending strategies differ by country?

- What investment projects and emerging technology trends are wealth managers prioritizing?

Abstract

Wealth management executives in Asia-Pacific report the highest expected growth in IT budgets in 2025 of any region in the world, at 5.9% year-over-year. Wealth managers in the region are prioritizing agility, product innovation, and personalization. As a result, technology budgets are not only growing, they have accelerated every year for the past three years.

To shed light on the budget drivers and technology priorities of the wealth management industry, Celent has completed its second annual global survey of senior wealth management executives: The Celent Dimensions Survey 2024. This Asia-Pacific edition captures the insights and opinions of 37 respondents from 7 countries to provide an in-depth view into the drivers of IT spending across the industry, as well as the leading technology and investment priorities.

Key findings include:

- 81% of wealth management firms in Asia-Pacific believe they are agile in responding to new market opportunities.

- 65% of firms are either live, piloting, or experimenting with generative AI.

- 51% of executives report they are prioritizing financial education and literacy for clients (especially the mass affluent).

- 43% report that product/proposition innovation and enhancement is among their top drivers of IT spending strategy. This is the most common answer for respondents in Australia, China, and Hong Kong (see table below).

- 32% of firms say that capabilities for direct client integrations are among their top technology priorities for 2024 and 2025.

Related Research

Dimensions: Wealth Management IT Pressures & Priorities 2024

Dimensions: North American Wealth Management IT Pressures & Priorities 2024

Dimensions: European Wealth Management IT Pressures & Priorities 2024

Dimensions Webinar: Wealth Management IT Pressures and Priorities 2024 Edition

Wealth Management IT Spending Forecasts by Domain, 2023–2028

Wealth Management IT Spending Forecasts by Technology, 2023–2028