Dimensions: European Wealth Management IT Pressures & Priorities 2024

Key research questions

- What priorities are driving technology spending in Europe?

- How do wealth management technology strategies differ by country?

- Which functional areas are wealth managers investing in SaaS, cloud, and AI?

Abstract

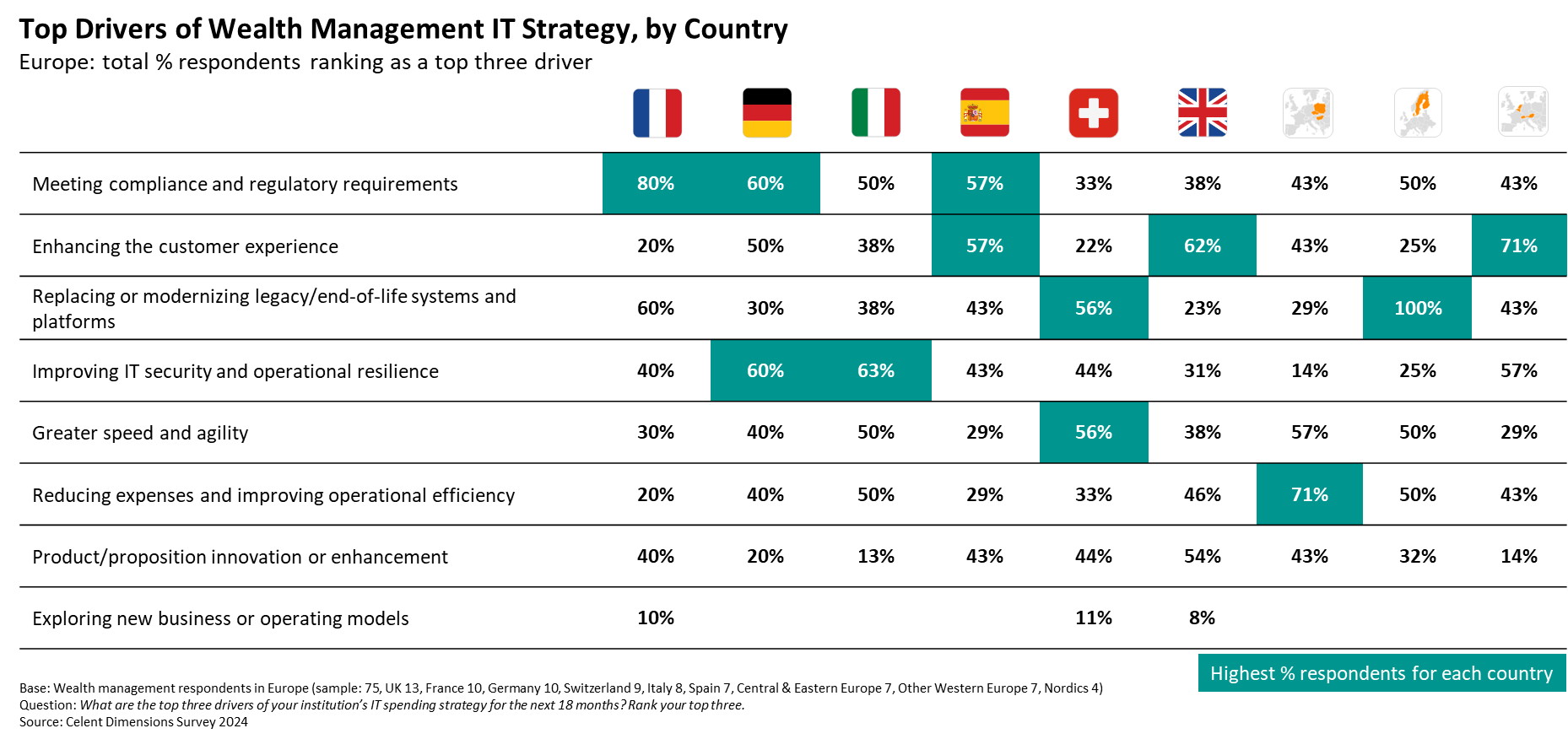

Wealth management executives across Europe report accelerating IT budgets in 2024 and 2025. Competitive threats from fintechs and other challengers, keeping up with compliance and regulatory requirements, modernizing legacy tech, and improving operational speed and agility are just a few of the most common drivers of IT spending strategy in the region.

To shed light on the business pressures and technology priorities of the wealth management industry, Celent has completed its second annual global survey of senior wealth management executives: The Celent Dimensions Survey 2024. This European edition captures the insights and opinions of 75 respondents from 17 countries in Europe to provide an in-depth view into the drivers of IT spending across the industry, as well as the leading technology and investment priorities.

Key findings include:

- 70% of wealth management firms in Europe report that streamlining and automating advisor workflows is a core priority in 2024.

- 60% of firms are either live, piloting, or experimenting with generative AI.

- 51% of executives report that meeting compliance and regulatory requirements is among their top drivers of IT spending strategy. This is the most common answer for respondents in France, Germany, and Spain (see table below).

- 36% of wealth managers' IT budgets go to the front office—the largest allocation area.

- 5.7% year-over-year growth in IT budgets is projected for the region in 2025, on average, which will be the third consecutive year of elevated spending growth.

Related Research

Dimensions: Wealth Management IT Pressures & Priorities 2024

Dimensions: North American Wealth Management IT Pressures & Priorities 2024

Dimensions Webinar: Wealth Management IT Pressures and Priorities 2024 Edition

Wealth Management IT Spending Forecasts by Domain, 2023–2028

Wealth Management IT Spending Forecasts by Technology, 2023–2028