The cross-border payments landscape is witnessing a transformative phase. With transaction flows estimated to reach nearly $300 trillion by 2030, the sector represents a lucrative opportunity for those ready to navigate its complexities. By addressing the challenges head-on and leveraging advancements in technology, participants can unlock the vast potential of this market, ensuring a prosperous future in the global financial ecosystem.

This report explains the foundations of cross-border payments, delving into the growth drivers and competitive landscape, while acknowledging the complexities and underlying challenges. It concludes with recommendations for financial institutions and technology firms to make the most of this market potential.

Selected key findings include:

Growth and its drivers: The cross-border payments market volume size is expected to reach nearly $300 trillion by 2030, fueled by global capital markets expansion, international trade, and the digital economy. The shift towards non-USD currencies and the growth of B2B e-commerce are notable factors driving this expansion.

Challenges: Both customers and providers face several challenges, including high costs, long processing times, lack of transparency, and limited accessibility. These issues stem from the inherent complexities of cross-border transactions, regulatory hurdles, and legacy infrastructure.

Industry-wide initiatives: The G20 Roadmap for Enhancing Cross-Border Payments and the adoption of ISO 20022 standards are pivotal industry-wide initiatives aimed at addressing these challenges. Efforts towards API harmonisation and interlinking domestic payment systems are critical for improving efficiency and accessibility.

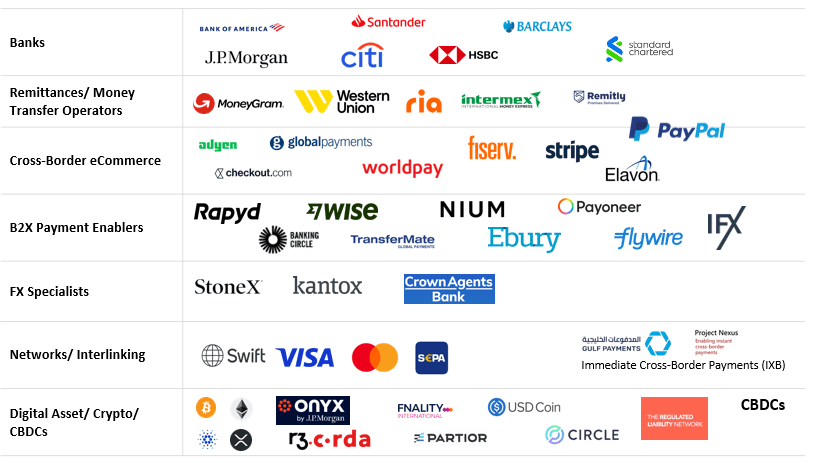

Competitive landscape: The competitive landscape is diverse and characterised by a mix of traditional banks, fintech firms, and digital asset companies, each bringing innovative solutions to tackle the challenges of cross-border payments. Strategic partnerships and leveraging emerging technologies are key strategies for staying competitive.

Recommendations for industry participants: To capitalise on the opportunities in cross-border payments, banks are advised to embrace partnerships, treat regulation and compliance as opportunities, leverage AI for efficiency, and actively engage in the industry-wide initiatives.