日本のメガバンクが次にすべきこと: 良好な経済情勢を利用してリターンを最大化する

Oliver Wyman's most recent report, titled “3 Key Opportunities To Seize In Japanese Banking: How global executives can act on this unique moment,” offers valuable insights on how Japanese megabanks can capitalize on the current favorable economic climate to establish sustainable earnings power and attract global investors. Japanese megabanks find themselves in an exceptional position, benefiting from the positive economic conditions. These conditions have not only boosted their returns but also strengthened their capital buffers, providing them with a broader range of strategic possibilities. The favorable economic momentum has not only improved their returns but also fortified their capital buffers, granting them increased flexibility and the opportunity to embark on significant strategic initiatives.

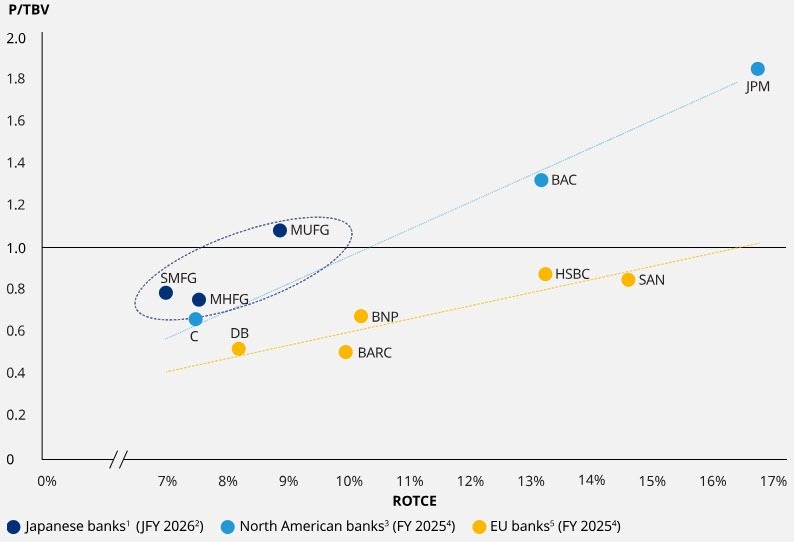

However, investors still have reservations about the "megabank miracle." On a return on tangible common shareholder equity (ROTCE) basis, Japanese megabanks have lagged North American and European peers, struggling to take advantage of their scale to generate attractive returns for shareholders. These gaps are projected to narrow over the next three years but not materially enough to change the story.

Note: Price to tangible book value (P/TBV), Return on tangible common shareholder equity (ROTCE)

Japanese banks have a generational opportunity to build a wealth management franchise that generates returns now common in other markets. Investors also see significant untapped value in a pan-Asian banking platform that can capture local growth opportunities and extract synergies from regional operations.

Oliver Wyman has identified three key areas where Japanese megabanks can take action.

- Firstly, it is imperative for Japanese megabanks to streamline their operations and eliminate inefficiencies. The intricate governance and expansive legal entity structures of these banks present a challenge for global investors seeking to understand them. While these structures are a product of Japan's legal, regulatory, and business landscape, the current economic conditions present an opportunity for megabanks to demonstrate their ability to navigate complexity and deliver stronger returns in the long run.

- Secondly, Japanese megabanks should develop credible strategies in activities that investors value. Investors tend to reward stable and profitable businesses supported by sustained economic growth, such as wealth management and transaction banking. The domestic wealth and asset management opportunity in Japan aligns with this profile, but the business model needs to evolve to fully capture its potential.

- Lastly, Japanese megabanks should leverage their domestic scale globally. Their strong domestic franchises, including loyal customer deposits and flexible capital positions, position them well to gain market share and generate attractive returns outside Japan. However, achieving success in this endeavor requires focused strategies integrating international operating models and infrastructure.

Celent wholeheartedly agrees with Oliver Wyman that technology and platform enhancements are critical to supporting future growth ambitions. These programs take several years to deliver successfully, and megabanks have tended to focus on quick fixes as incentivized by short executive tenures. Integrating and re-platforming technology could position megabanks to achieve full benefits.

Technology and platform enhancements are especially critical to support corporate and transaction banking (CTB). The APAC banking market is disproportionately oriented to corporate and transaction banking (CTB), partly driven by the region’s role in international trade and the necessity of facilitating significant cross-border flows across many jurisdictions. While the numerous geographies and associated jurisdictions present a challenge from an operational perspective, they also present an opportunity to service and take advantage of those flows.

The APAC region has consistently held a significant position as a key research focus for Celent. Recent reports include:

- Dimensions: Asia Pacific Corporate Banking IT Pressures & Priorities in 2024

- Crossing Borders, Breaking Barriers: The Future of Global Payments

- Dimensions: Corporate Banking IT Pressures and Priorities 2024

- Build for Today, but Design for Tomorrow: Modern Architecture for Corporate Banking

- How DBS is Becoming an "AI-fueled" Bank

- The Imperative for Payments Modernization: Doubling Down Before It's Too Late

Don't hesitate to contact us if you’d like to learn more about the opportunities in Japan and across the APAC region.