スピードの必要性!コーポレートバンキングにおけるプロダクト・アジリティの加速

Abstract

It is expensive to run a bank, and even more expensive to enhance banking products and services. Although, on average, corporate banking technology investments will increase in 2025, the slices of the budget pie are becoming slimmer for product managers. No wonder there’s a feeling of pinched wallets for product enhancements!

From lack of technology resources to project funding to technology limitations, corporate and transaction banking product managers around the world will surely identify with the challenges – they live with them every day. For corporate banking units, achieving greater technological speed and agility is required to accelerate product innovation and enhancements.

However, increasing speed and agility does not mean simply adopting agile development methodologies. Banks can also adopt technology accelerators such as next-generation banking platforms, low/no-code platforms, and GenAI to support developer productivity—all of which can help accelerate product development. Banks should also consider the importance of aligning to a modern architecture stack, designing for “cloud-first,” and embracing fintech partnership options to accelerate product development.

Product managers and their technology counterparts should consider the role of some emerging technologies and approaches that can mitigate product delivery challenges and help banks achieve their “need for speed.”

Related Research

Dimensions: IT Pressures and Priorities: Corporate Banking, 2024 Edition

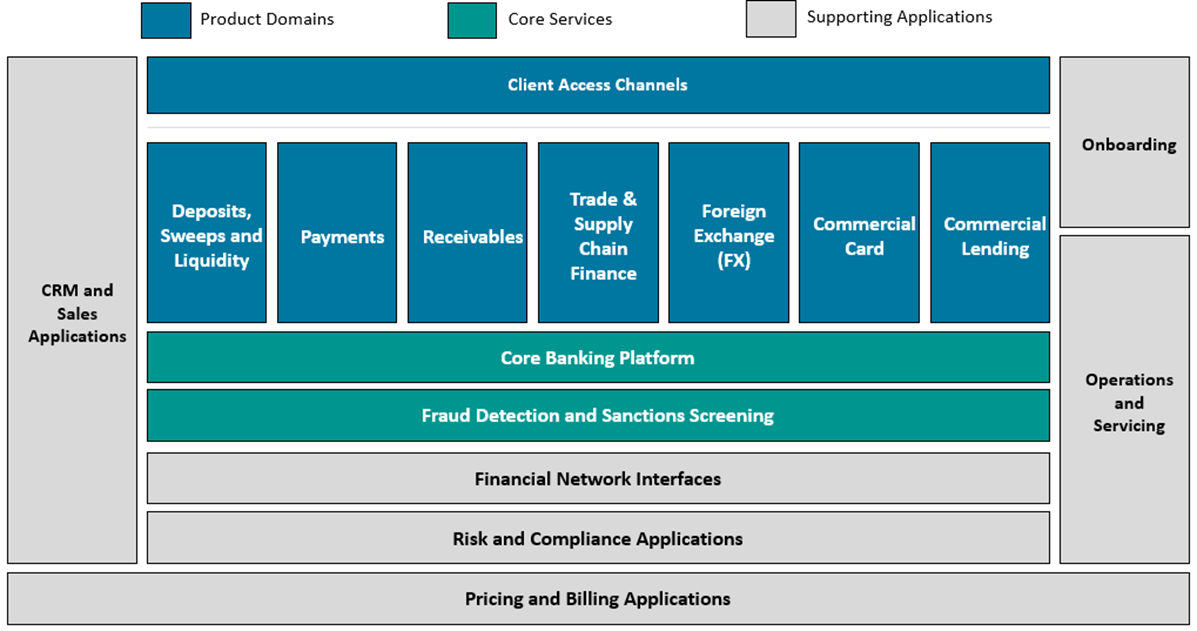

Build for Today, but Design for Tomorrow: Modern Architecture for Corporate Banking

Silicon Valley Bank: Digital Leading the Way Back with SVB Go

How DBS Is Becoming an “AI-fueled” Bank

Silicon Valley Bank: Reimagining Onboarding for Startups

Corporate Banking IT Spending Forecasts by Technology, 2023–2028

Improving Operational Excellence While Migrating to a Hybrid Cloud, Multi-Cloud World

Technology Trends Previsory: Corporate Banking 2024 Edition

Times Are A-Changing: The New Landscape for Accounts Receivable

Using Low Code to Accelerate Payments Innovation: Unlocking Greater Agility and Flexibility

Corporate Client Data Renaissance: New Tricks for an Old Dog

Unlocking Treasury Insights: Road Map to Intelligent Solutions