Life is getting harder for corporate client finance teams. Companies around the world have endured the COVID-19 lockdowns, business disruptions, and staffing challenges – all of which impacted the accounts receivable (AR) process. In parallel, technology innovations marched forward, and banks and vendors dedicated greater efforts to digital and mobile innovations.

Higher interest rates have increased the cost of funding which intensifies the importance working capital management, notably the receivables process. But with a plethora of new payment types, technologies, and the impact of hybrid working models, managing receivables is more challenging than ever. In addition to the uncertainty and logistics challenges of migrating to remote and hybrid environments, a series of events were already in progress that would shift the state of receivables.

- Changes in the “payments-verse”

- The expanded role of Accounts Receivable

- Technology trends

- Acquisitions and partnerships

- Banks’ focus on operations improvement and the role of virtual accounts

Banks have new opportunities to support their clients’ transformation journey. It is important that they understand how their existing receivables solutions sit competitively to other banks, but also compared to offerings from vendors who focus exclusively on the corporate workflow.

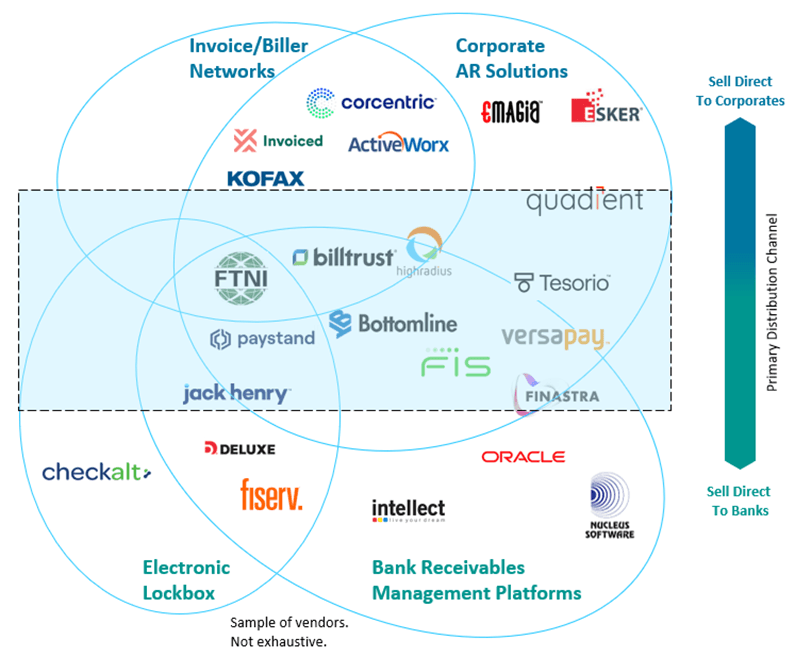

The taxonomy, or “solutionscape” maps out some major players across the very broad receivables solution marketplace. Recognizing the fluidity of the AR solution ecosystem, the Venn diagram represents a general alignment of companies to their solution segments and client focus.

As banks look to modernize their receivables management solutions, they must recognize the changes in client expectations, new technology capabilities, and different partnership options available to enable receivables management transformation. To paraphrase a well-known Bob Dylan song, times are indeed a-changing.

Banks must meet the changing needs of client financial operations – but the variable in the equation is the strategic approach. It may be partnerships to deepen corporate client experience and workflow, or enhancing back office capabilities with, for example, virtual accounts. It may be all of the above.

This is a companion report to the upcoming "Receivables Management Platforms: North America Edition" (planned for summer 2023) which will take a deep dive into a subset of vendors mapped to this taxonomy, and will only focus on solutions sold directly to banks and/or offered through partnership with banks.