I had the opportunity to attend and speak at Insurtech Insights 2023 in NYC this week. The event drew a lot of interest as there were an estimated five thousand attendees. As you might guess, there was a significant amount of attention focused on both the future of insurance and the impact that artificial intelligence will have on insurance operations.

I moderated a session on the how AI is personalizing underwriting. As we look forward to a new age of underwriting influenced by artificial intelligence (AI) and machine learning, these technologies will be a big driver for the transformation from one-size-fits-all to more personalized policies. AI is transforming the insurance underwriting process by increasing its efficiency and accuracy, and by utilizing predictive analytics to better understand risk and providing real-time data for quotes on demand, insurers can customize policies for each customer's needs.

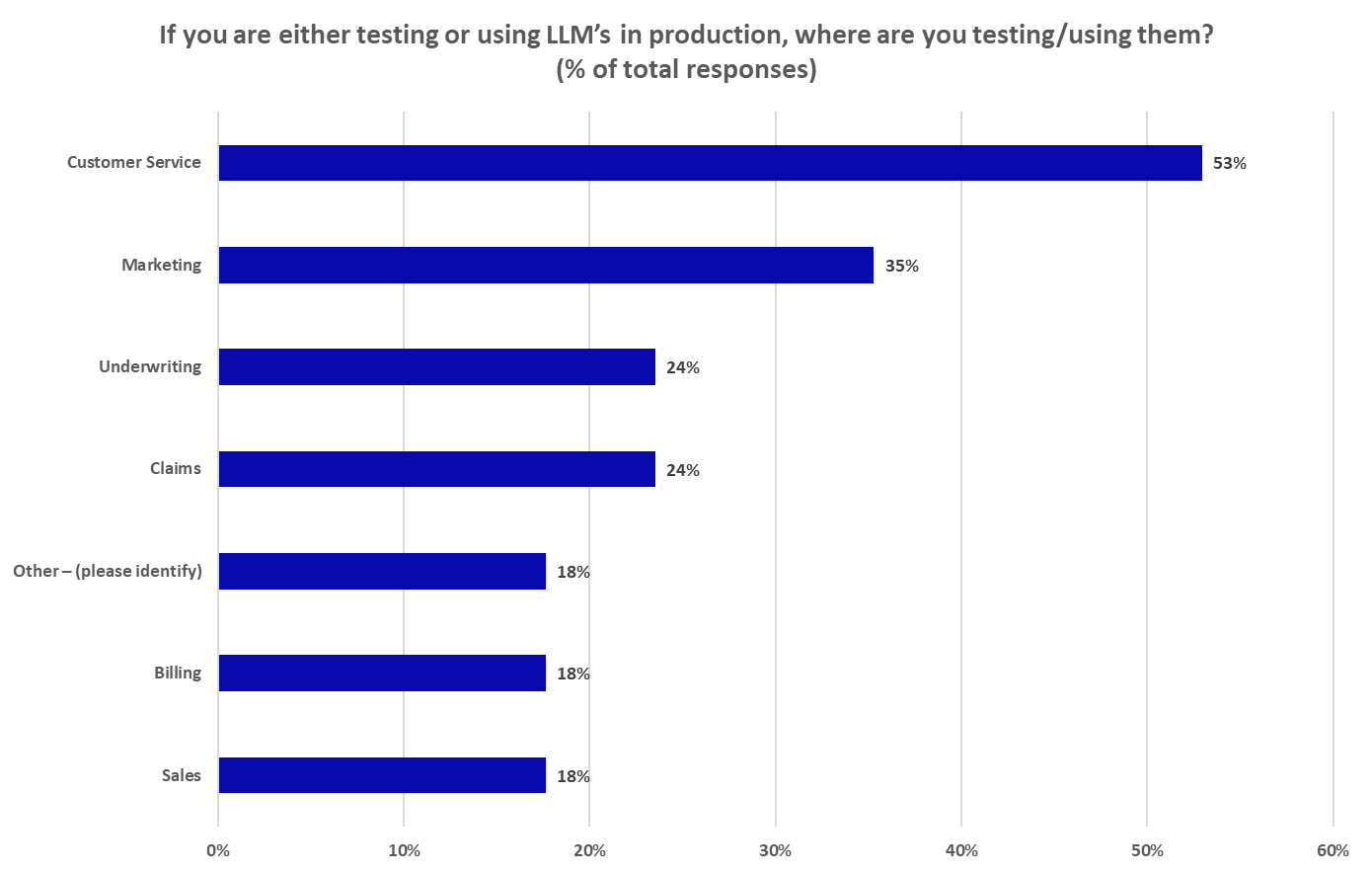

There was a lot of buzz around large language models (LLMs) like ChatGPT and everyone was in agreement they will have a significant influence on the insurance operations landscape. Based on what I have heard at the conference it seems the application of LLMs is going to have an immediate impact in a number of key operational areas. I found many of the platform and solution providers in attendance either already had or are planning to have LLMs incorporated into their solutions or services. As noted in a recent Celent poll of insurers in North America, LLMs are top-of-mind as they consider the best places to take advantage of the technology for operational improvement. Although the vast majority (over 90%) of insurers that participated in our poll don’t have an LLM solution in place today, half of the respondents indicated they will be testing or have a solution in production by year end. That is an amazing and transformative statistic. The table below highlights where the insurers plan to be focusing their LLM efforts.

Interestingly, I found that many of the platform and services providers at the conference that have or are developing LLMs in their solutions are following a similar path. Many see initial advantages in improving the customer/agent experience and in marketing. When I asked why it parallels the insurers current train of thought, they indicated that these areas of operations have a lower risk point of entry verse functions such as underwriting and claims. This makes complete sense given some of recent large profile cases of racial bias in AI, and the fact that regulators in the insurance space are playing catch up with the rapid pace of change the LLM tsunami has created.

The conference highlighted so many innovative and creative solutions using AI. It is an exciting time to be part of insurance operations as insurers look to technology to help reduce cost, and improve growth, experience and processing throughout our industry.

If you would like to learn more about how AI and LLMs will impact the insurance industry my contact is kraymond@celent.com, you can also read Celent's latest report on LLMs by clicking the following link: