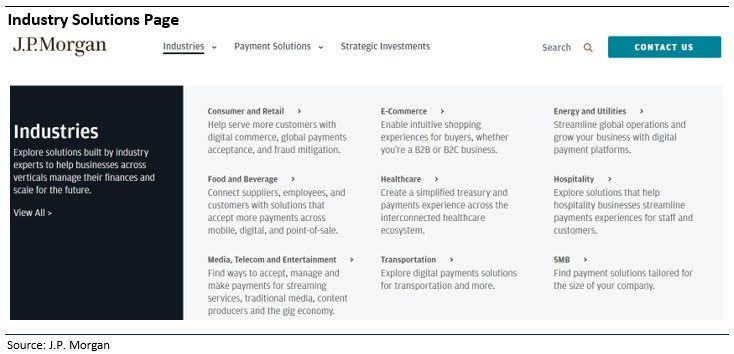

J.P. Morgan has one of the largest payments ecosystems in the world, with hundreds of third party integrations spanning virtually every industry and use case. In June 2023, the banking giant debuted its Payments Partner Network, a digital platform powered by Salesforce that lets merchants and corporate treasury clients search, learn, and discover a matrix of partner integration for their payment and working capital needs. The Payments Partner Network is J.P. Morgan’s on-demand hub for searching, learning, and discovering how the bank’s third party integrations can help solve a client’s or prospect’s business needs. Examples include ERP/TMS connectors, card acceptance, invoice finance, and healthcare payments. The portal enables business partners to search by industries, payment solutions, and strategic investments.

The Payments Partner Network is the first time a corporate payments bank has developed and launched an on-demand platform featuring third party partners using an app store approach. The platform makes it easy for clients to search, learn, and discover relevant J.P. Morgan partner product solutions, unlocking opportunities for growth and efficiency. The Payments Partner Network is just one component of J.P. Morgan’s comprehensive embedded finance approach that includes Integrated Digital Solutions, Celent’s 2024 Model Bank Award winner for Turbocharging Embedded Banking.