Many statistics were presented at the JP Morgan Chase Investor Day 2024. Among them was a statement that the bank would invest (spend) some $17bn on technology - in one year. This led one financial analyst to call the institution “the Nvidia of Banking.”

Over the years there have been several articles in financial news media, and posts on JP Morgan’s web site (links below), that speak openly to steadily increasing levels of technology spend. Over time these rose from $12bn, to $15bn, and now $17bn. JP Morgan is a mammoth-sized institution, but $17bn is still a very big number. Whatever the amount, and wherever it goes, it does pose questions about what it costs to run a bank these days – and just as importantly, how to continuously modernize bank technology. By definition, this is an exercise that never ends.

From our Dimensions Survey 2024, Celent sees bank IT budgets increasing globally across both retail and corporate banking, but obviously inflation also takes its toll. It is sobering to think that, if we optimistically assume an inflation rate of 4%, some $600mn of that JP Morgan Chase technology spend is eroded by inflation before any projects start!

Is technology spend an investment, or is it a cost?

Is technology spending an investment, or a cost? Semantics? Maybe. However, one way of thinking about this is what it costs to “run the bank” versus what investment is needed to “change the bank.”

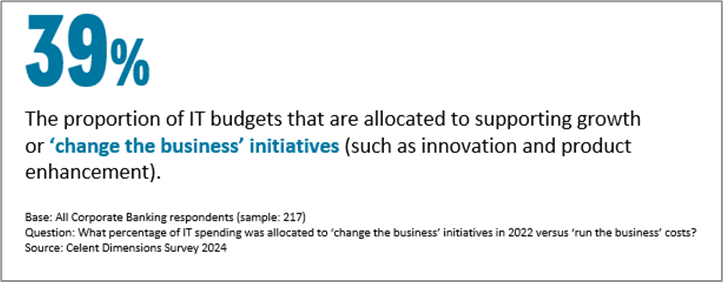

If 39% of a bank’s budget is invested in “change” initiatives, the simple math shows that, on average, 61% of technology spend is allocated to running the bank on a daily basis – the cost of keeping the lights on. Celent research shows this pretty consistently, globally, for retail and corporate banking.

Everyone drives a used car!

I once noticed a compelling slogan on a billboard for a used car dealer. “Remember, everyone drives a used car!” Brilliantly simple psychology. A new car becomes a used car the day you drive it home. So, too, for banking technology. Once deployed, it starts to depreciate and incur costs on day one (actually as soon as a project starts, but that would be pedantic). Patching, backwards compatibility, upgrades, end to end testing, regulatory compliance, technical debt remediation, and increasing security threats all consume large technology expenses on a daily basis without any improvement in banking products or services.

Almost all banks have legacy technology baggage and redundant/overlapping platforms and technologies. I’m not just talking about stereotypical mainframe legacy from the 1980s or 1990s. Essentially, anything more than 8-10 years old is legacy and prone to higher costs of operations and support. (Yes, that’s more recent than early pioneers of cloud solutions, and well after “next gen” mobile banking apps were launched).

Of concern, the percentage of budgets allocated to “change the bank” decreased by a global average of 10% compared to the Celent 2023 survey. IT budgets are going up, but inflation and an increased allocation to “run the bank” initiatives all point to an erosion of investment in growth initiatives. This reflects the ongoing urgency to deliver regulatory and mandate compliance, risk management solutions, and implement operational efficiencies.

For any bank, the ambitions expressed in product and technology innovation will be difficult to achieve if this trend does not reverse.

Related press and JP Morgan website articles

This $12 Billion Tech Investment Could Disrupt Banking, JP Morgan Chase

Investor Day 2023 Full Presentation, JP Morgan Chase

Investor Day 2024 Full Presentation, JP Morgan Chase

Top-ranked analyst declares JPMorgan ‘the Nvidia of banking’ after it spends $17 billion on tech in a single year Fortune Magazine, (subscription required)