The pressure on insurers to become digital businesses has switched up a gear. Celent research quantifies the expected benefits and identifies practical next steps for insurers.

The pressure on insurers to become digital businesses has switched up a gear. Celent research quantifies the expected benefits and identifies practical next steps for insurers.

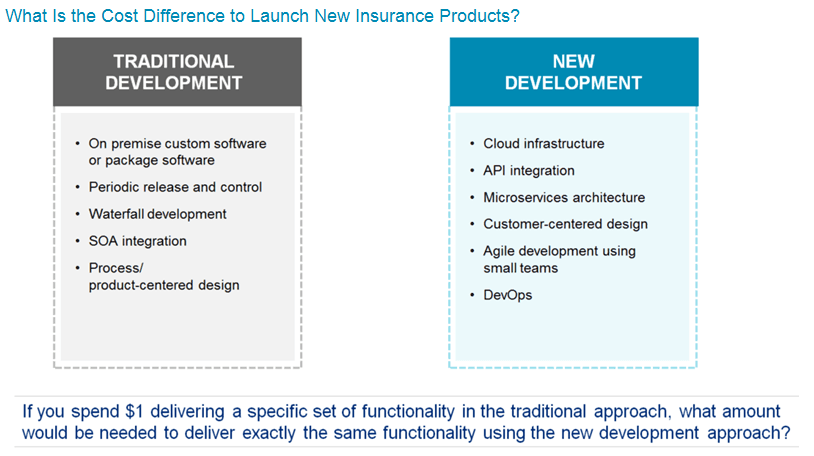

The adoption of cloud, application programming interfaces (APIs), and microservices architectures and the increasing use of customer-centered design, agile, and DevOps techniques are fundamentally changing insurance product development.

Incumbent insurers face increasing challenges and opportunities from concurrent forces. Dramatically changing customer expectations and low investment returns threaten both property and casualty and life insurers. Declining participation rates and indifference by millennial consumers restrict growth in life companies. Technologies such as driverless cars and sensors (Internet of Things) promise to shrink revenue in P&C.

Most insurers are not currently positioned to respond.

However, a new combination of technology and technique is evolving in response to insurers’ needs. Celent identifies six aspects which are fundamental to this new recipe. Three deal with technical architecture: cloud, microservices, and APIs. Three are techniques: customer-centered design, agile implementation, and DevOps management.

How do incumbent insurers catch up and overtake the innovators? They start with a better understanding of what steps they can take. This report will be a first step toward that goal.