I recently had the opportunity to attend FIS Emerald in Orlando, FL from May 26-29, 2024. Lasting over three fast-paced days, this conference is one of the largest in financial services, with a large ecosystem of solution partners exhibiting as well. More than 1,700 attendees and 300 unique financial institutions (FIs) were there during a busy banking conference season to learn, network, buy new technology, and renew existing IT solution contracts.

Many thanks to FIS for the invitation (also attending was Celent’s head of banking Patricia Hines) to present to, meet, and exchange ideas with FIS customers from around the globe. We also spoke with FIS executives and technology firms that partner with FIS. Here are highlights from what I experienced at the event:

Increasingly Opening Financial Services Ecosystem. From Open Banking to Open Finance

My main takeaway is that the financial services ecosystem will continue to open up at a steady pace for many years. Each institution needs to determine the opportunities and threats from this changing ecosystem where financial institutions–enabled by software vendors– can digitally distribute, originate, and onboard loans, deposit accounts, and payments services through nonbank channels. Celent defines these embedded finance, open banking, and open finance capabilities as:

·embedded finance: the discovery and acquisition (by the customer) of tailored financial services products at the point of need within the digital experience curated by a non-bank third party. This requires the financial institution to integrate a product application or workflow in the customer journey or experience of a third party.

·open banking/open finance: The use of permissioned access to customer data held by financial institutions. This can include new loan origination, deposit account onboarding, and services to initiate payments.

Customer Benefits, Opportunities and Threats

This increasingly open ecosystem is providing consumers with a more comprehensive and holistic view of their financial lives, make optimal financial product purchases, and improve their satisfaction with your financial institution. It provides FIs with the potential to participate in revenue-sharing ecosystems opening up new revenue streams. This is simultaneously a competitive threat to FIs that are weaker in embedded finance and open banking.

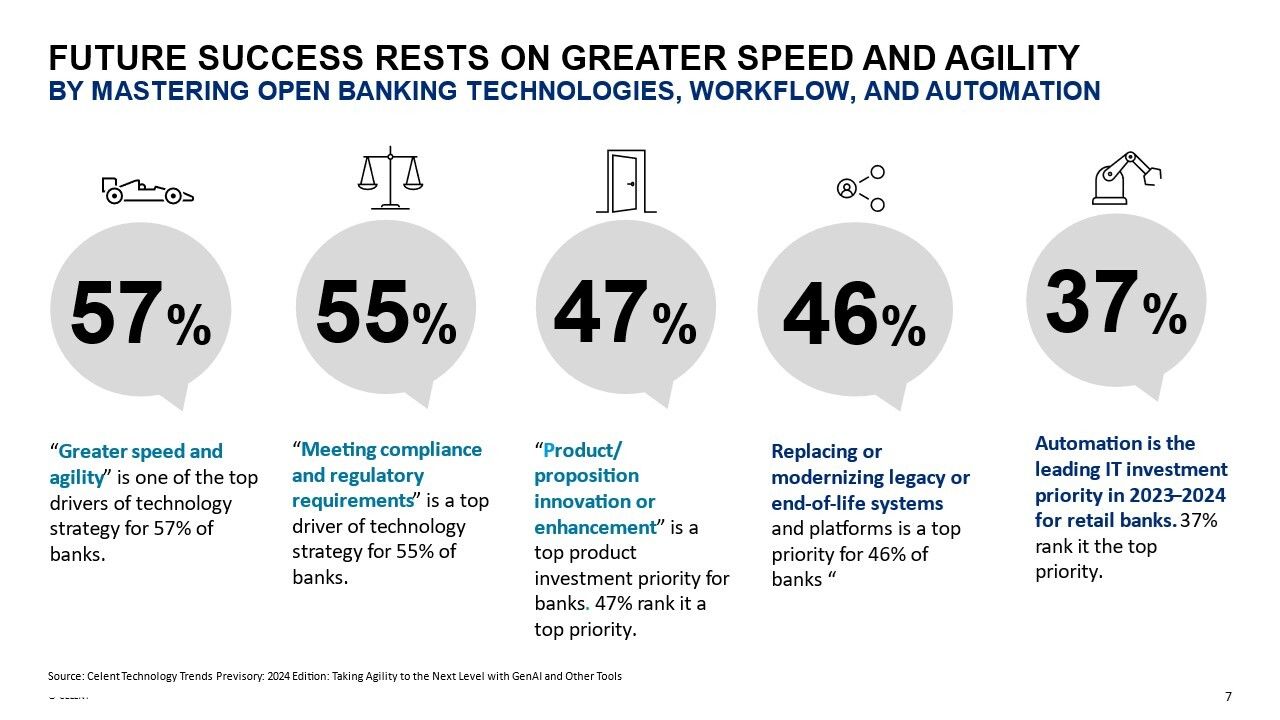

Celent banking technology surveys support this assessment. Figure 1 below is from Celent Technology Trends Previsory: 2024 Edition: Taking Agility to the Next Level with GenAI and Other Tools

Figure 1

Source: Celent

The ability to respond more quickly to emerging opportunities is high on the agenda. In total, 57% of banks cite delivering greater speed and agility as a top three priority. Greater speed and agility to change systems faster enables FIs to embed their products anywhere: customer-direct web sites, branches, and third-party retail websites. Similarly, creating and enhancing product is a top priority.

Core Banking Platforms: The Back Office Drives the Front Office

Figure 1 also shows that replacing or modernizing legacy or end-of-life systems is a top priority. This category often refers to the core banking system. As the primary back-office technology asset, core banking systems are the foundation of digital transformation and help drive front-office customer engagement. The core is needed to support open banking because it houses customer and product transaction information. For example, FIS Modern Banking Platform (MBP) exemplifies the componentized, API-first, and cloud-based approach to technology deployment for fast deployment of system changes. Celent covered MBP and other core systems in the report, Continuous Digital Transformation in the Cloud: Next Generation Core Platforms That Will Future-Proof Banking. My colleague Daniel Mayo and I are in the processing of updating this report.

I had the opportunity to present to over 100 of FIS’s financial institution executives (attending in person and remotely) during a session entitled, Core Banking System Market Outlook: Core Modernization Trends, IT Spending, and Paths to Modernization. We also conducted live polling questions and compared audience responses with Celent’s global banking and lending survey responses for five global regions.

Figure 2

Source: FIS (FIS Emerald 2024)

One of the live polling questions was similar to the Celent survey question in Figure 1 above:

What are your highest priorities for core banking system IT spending? (this question was focused just on core systems and only allowed one top priority, whereas the Celent survey asked for three top priorities).

Thirty-six percent of 64 respondents said that realizing greater speed and agility was their top priority. The top vote-getter was improving efficiency and reducing costs with 48% of voters. To me this indicates that while speed and agility is a top priority for core systems IT investment, FIs view the core as a large IT investment, so reducing its cost and improving its efficiency to enable front office technologies are a slightly higher priority than speed and agility.

I left the session feeling that this audience was proactively involved in leading their firms to continuously enhance, maintain, and if needed replace their core systems to help their firms continue thriving.

Looking Ahead

Contact me at info@celent.com or cfocardi@celent.com if you would like to discuss core banking systems (also Daniel Mayo at dmayo@celent.com), lending systems, and related data, analytics, and decisioning systems. If you are a client email me or your relationship manager to set up a call.

Related Research

Retail Banking Core Banking Systems: North American Mid-Large Bank Edition

Recalling Learnings From TSB’s Core Banking Migration Challenges