Now is the time to invest in payments data monetisation. The concept of leveraging payments data to enhance services for corporate clients is well understood, but progress for many banks has been limited by a combination of budgetary and technical challenges.

Nevertheless, the need to address both squeezed margins and growing corporate expectations is driving renewed investment in this area, supported by the expansion of real time payments and ISO 20022 message formats. There has been an explosion of activity in recent months, and no bank can afford to be left behind.

To understand the scale of the payments data monetisation opportunity, Celent has surveyed a combination of banks and corporate end users. Interviews with treasurers and CFOs at 217 large corporate entities have identified common business challenges, demand for new services, and—crucially—willingness to pay for service enhancements. In parallel, a survey of 168 senior bank executives has given us a unique understanding of how banks plan to address these growing customer needs.

There are two key findings from this research.

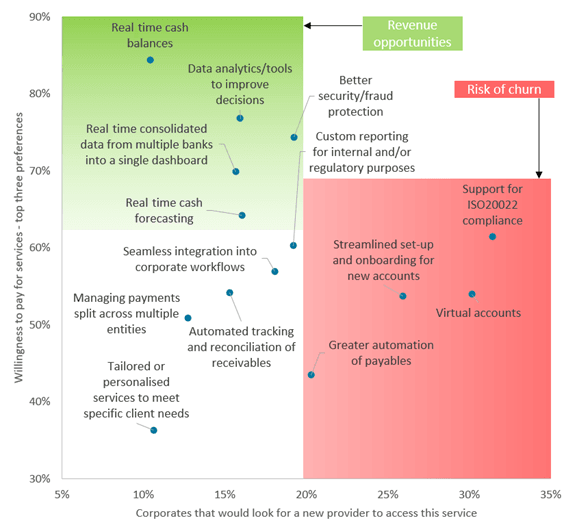

The first is that inaction on the part of banks is no longer an option. Corporate clients are prepared to pay for many value-adding service enhancements but there are several other areas that are becoming hygiene factors, such as virtual accounts and improved onboarding. A failure to deliver will see clients look to move their business to partners that can provide these services.

In other words, while there is a strong case to invest in order to support revenue growth, there is an equally strong case for banks to invest in order to protect their existing business.

The second key finding is that data monetisation is not a product. It is a product strategy and needs to be treated as such. Banks that view payments data monetisation through the lens of one-off initiatives and tactical product enhancements will struggle to deliver an ROI and will miss the much larger opportunity to be competitive in the long term. Ultimately, the objective is about more than revenue. The real opportunity is to move the relationship with corporate clients away from banking being about the consumption of products and towards acting as true partners for customers.