Exploring the Intersection of CRM and Data Privacy in Wealth Management

Key Considerations for Wealth Managers

Wealth managers are keen to understand various aspects of customer relationship management (CRM) and data privacy to ensure they can effectively manage client relationships while adhering to regulatory requirements. Key themes surrounding data privacy and CRM within wealth management include:

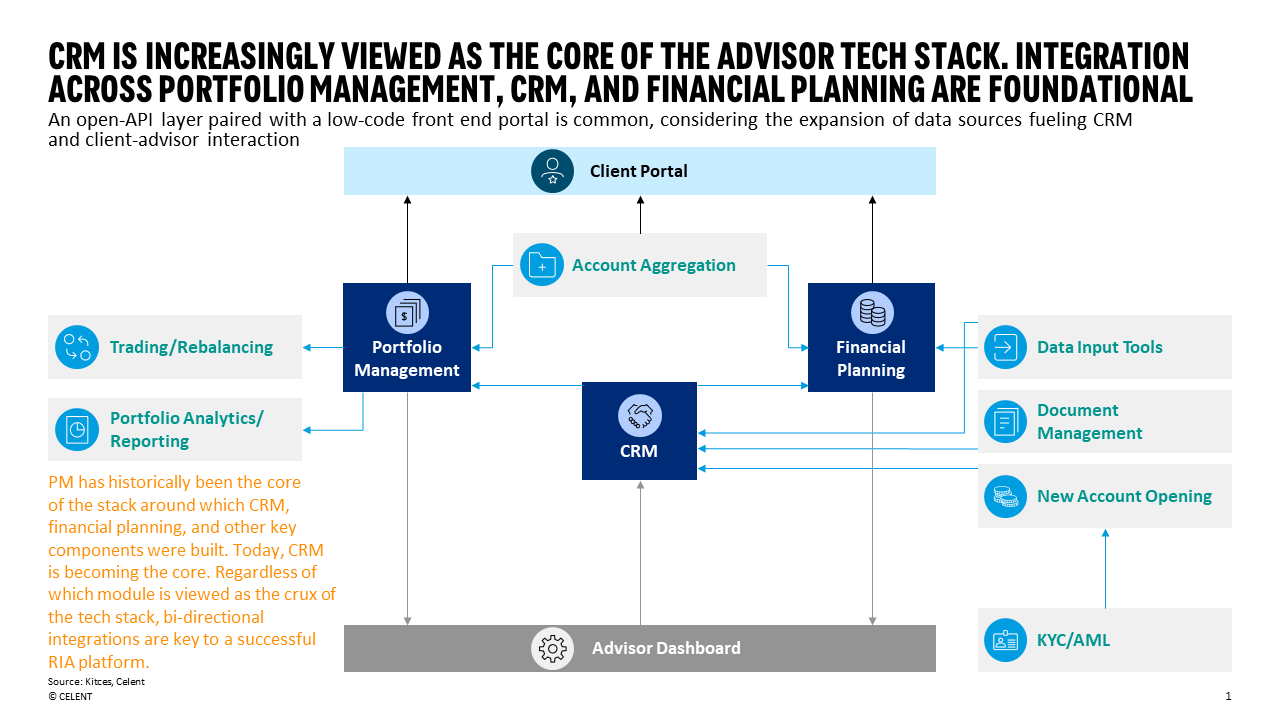

CRM Integration and Functionality: The integration of CRM with existing technology infrastructure and streamlining operations is a paramount concern for wealth managers. Wealth managers seek information on the functionality of CRM platforms, such as client onboarding, portfolio management, and reporting capabilities.

Data Security and Privacy Compliance: Wealth managers are concerned about data security and privacy compliance. Recognizing the security measures implemented by CRM providers, such as encryption, access controls, and data backup protocols, is essential for wealth managers to safeguard client data and comply with regulations like GDPR or CCPA.

Consent Management and Opt-Out Mechanisms: Wealth managers need to understand how CRM systems handle client consent and provide mechanisms for clients to opt out of data collection or marketing communications. They want to ensure that CRM platforms have robust consent management features that allow clients to control their data and preferences. This helps wealth managers maintain transparency and build trust with their clients.

Data Governance and Access Controls: Wealth managers are interested in the data governance practices of CRM systems. How is data stored, accessed, and shared within the CRM platform? Understanding the access controls and permissions available in CRM systems is crucial for wealth managers to ensure that only authorized personnel can access sensitive client information.

Reporting and Analytics Capabilities: Wealth managers seek information on the reporting and analytics capabilities of CRM systems. How can CRM platforms generate meaningful insights from client data, such as portfolio performance, client segmentation, and profitability analysis? Understanding the reporting and analytics features helps wealth managers make data-driven decisions and provide personalized services to their clients.

Read more related Celent WM research:

·Data Privacy in Wealth Management: A Primer to Navigating an Unprecedented Era of Data Production

·Securing the Future: Harnessing Data Privacy, Regulation, and AI in Wealth Management

·AI-Powered CRM Solutions for Personalized Client Experiences and Efficient Operations

·Digitizing for Impact: Putting the Wealth Management Client at the Center of Client Onboarding