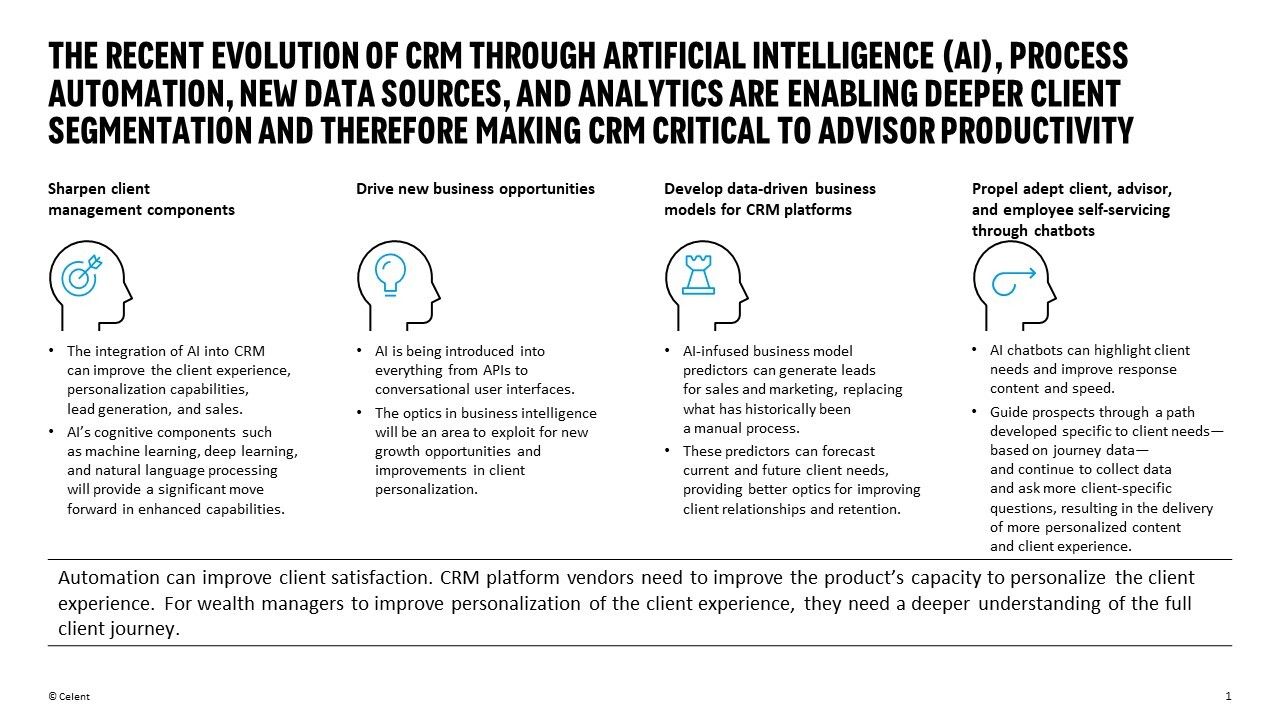

CRM solutions powered by AI have become a game-changer for the wealth management industry, empowering professional wealth managers with advanced tools and capabilities to deliver superior client experiences. AI-driven CRM systems can analyze vast amounts of client data, including financial information, investment preferences, and communication history. This enables wealth managers to gain deeper insights into client needs, behaviors, and goals, allowing for more personalized and targeted client interactions. By leveraging AI algorithms, CRM solutions can provide wealth managers with enhanced client insights, enabling them to offer tailored investment strategies and products that align with each client's unique financial objectives. This level of personalization not only strengthens client relationships but also helps wealth managers deliver more effective and relevant advice.

One of the key advantages of AI-powered CRM solutions in wealth management is their ability to automate routine tasks and workflows. Wealth managers can leverage AI algorithms to automate processes such as scheduling client meetings, sending follow-up emails, or generating reports. This automation saves valuable time for wealth managers, allowing them to focus on more strategic activities, such as building client relationships and providing personalized advice. Additionally, AI-powered chatbots and virtual assistants can provide instant support and information to clients, addressing common queries and providing basic account information. This improves client service and engagement while freeing up wealth managers' time for more complex and value-added interactions.

AI-driven CRM solutions also play a crucial role in compliance and risk management for wealth managers. By analyzing client data and transactions, AI algorithms can help identify potential compliance issues, flag suspicious activities, and ensure adherence to regulatory guidelines. This level of automated monitoring and analysis helps wealth managers stay compliant with regulatory requirements and manage risks effectively. Furthermore, AI-powered predictive analytics can analyze market data, economic indicators, and client behavior to provide valuable insights and market trends. This empowers wealth managers to make informed investment decisions, identify opportunities, and proactively address client needs. By leveraging AI capabilities, CRM solutions in the wealth management industry enable wealth managers to streamline operations, enhance client experiences, and drive better outcomes for their clients.