Innovative Solutions for Global Payments. The Rise of Stablecoins and Blockchain

Collaborating for Efficiency. How 'Project Pax' is Transforming Cross-Border Payments

It hasn't been long since Celent published the report "Crossing Borders, Breaking Barriers: The Future of Global Payments," an industry primer on cross-border payments. In this report, we described how digital assets and emerging technologies, such as stablecoins and blockchain, have the potential to enhance cross-border payments. These technologies offer benefits such as near-real-time processing, 24/7 availability, reduced complexity of intermediaries, intraday liquidity optimization, and real-time on-chain information exchange.

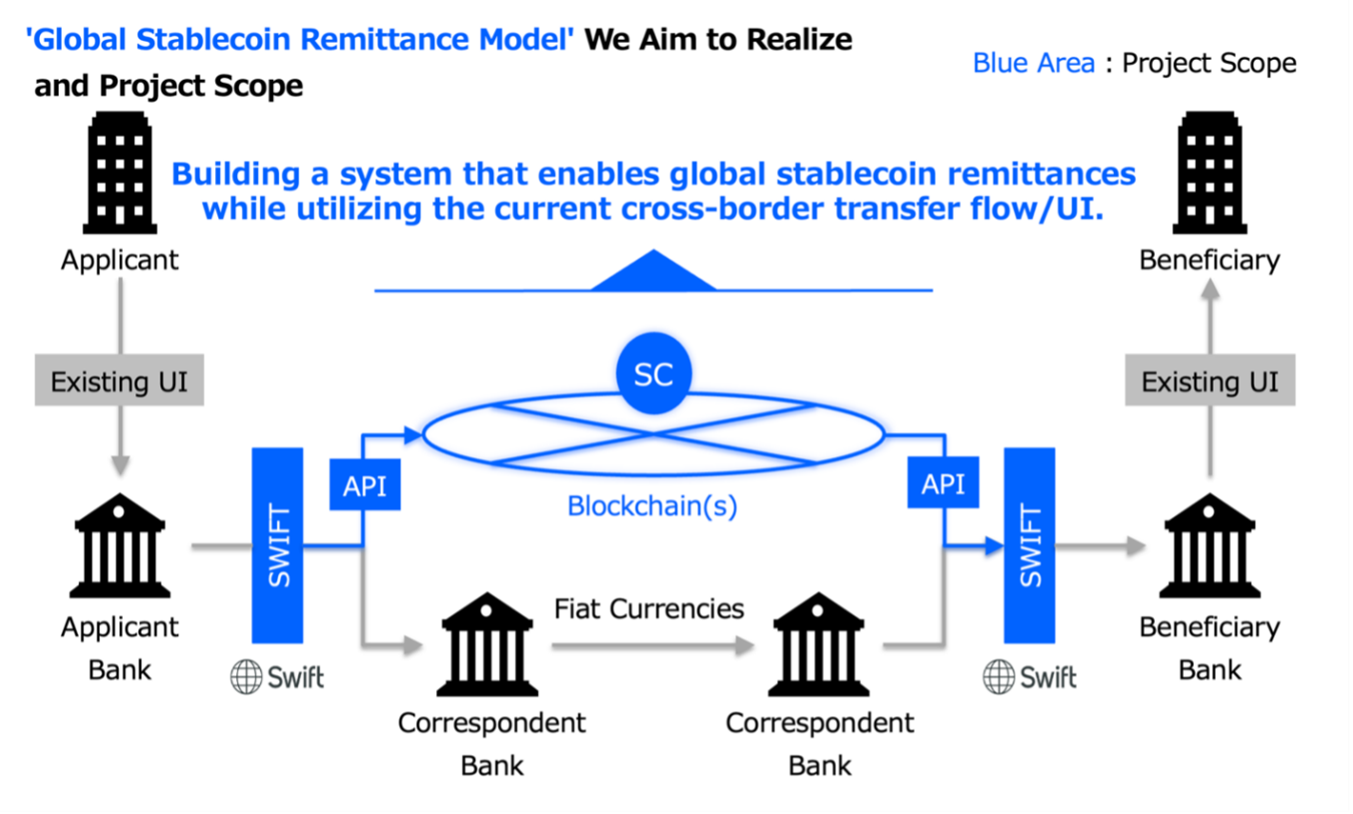

There are several examples of banks and financial technology firms attempting to leverage these technologies in global payments. This month, a new initiative has emerged from Japan called "Project Pax." The goal of this project is to enhance cross-border payments by integrating stablecoins and blockchain technology with the existing SWIFT infrastructure. The project involves local firms Progmat and Datachain, as well as Japan's three largest banks (Mizuho, Sumitomo Mitsui, Mitsubishi UFJ), and reportedly other financial institutions globally. The initiative aims to leverage blockchain's ability to eliminate intermediaries, thereby reducing costs, transaction times, and lack of transparency. However, it is important to note that this project does not seek to replace SWIFT in international payments. Collaboration with SWIFT is central to the project. In fact, "Project Pax" is closely collaborating with SWIFT, and banks will continue to use existing systems and the SWIFT network for interbank payment communication. However, stablecoins will be used to replace intermediary banks and lower funding requirements, which should bring efficiencies to the payment process in terms of settlement time and direct costs associated with maintaining intermediary accounts.

Source: Progmat, Finextra

The approach taken by this project is truly unique and innovative. Unlike other initiatives that require building everything from scratch, this project allows participating banks to continue using Swift and their existing front-end channels. This not only ensures a seamless transition for the banks but also maintains transparency for their clients. The fact that Swift is involved in this project is a significant advantage, as it may attract more banks to participate. This increased participation can lead to higher adoption rates and the much-needed scale for the project to succeed. Looking ahead, the project aims to expand collaboration with more countries, territories, and financial institutions, with a target of commercialization in 2025. While these ambitious plans and the utilization of existing rails are commendable, the true test lies in the wider adoption of the platform and its future interoperability with other networks and clearing systems. Only time will tell if this initiative can truly break new ground and deliver the scalability it promises.