Regulatory and Ethical Considerations of GenAI and Portfolio Construction

When it comes to portfolio construction, the integration of AI technologies, including GenAI, introduces a host of ethical considerations and regulatory hurdles. One pressing question revolves around the transparency and "explainability" of AI systems employed in decision-making processes, particularly in meeting fiduciary obligations. While AI has the potential to analyze vast amounts of data, identify patterns, and make data-driven investment decisions, the need for human intervention by licensed advisors and/or traders remains paramount, and will remain as such for the foreseeable future.

Encouragingly, global AI regulation is evolving and showing alignment across key areas:

- Accountability and Oversight

- Transparency and Interpretability

- Data Privacy

- Bias and Fairness

- Security

Additionally, regulatory bodies will continue to navigate the following topics:

- Defining AI and its scope in a manner that ensures consistent governance

- Understanding various industry applications and industry needs

- Focus on areas where AI is most at risk, without dampening innovation

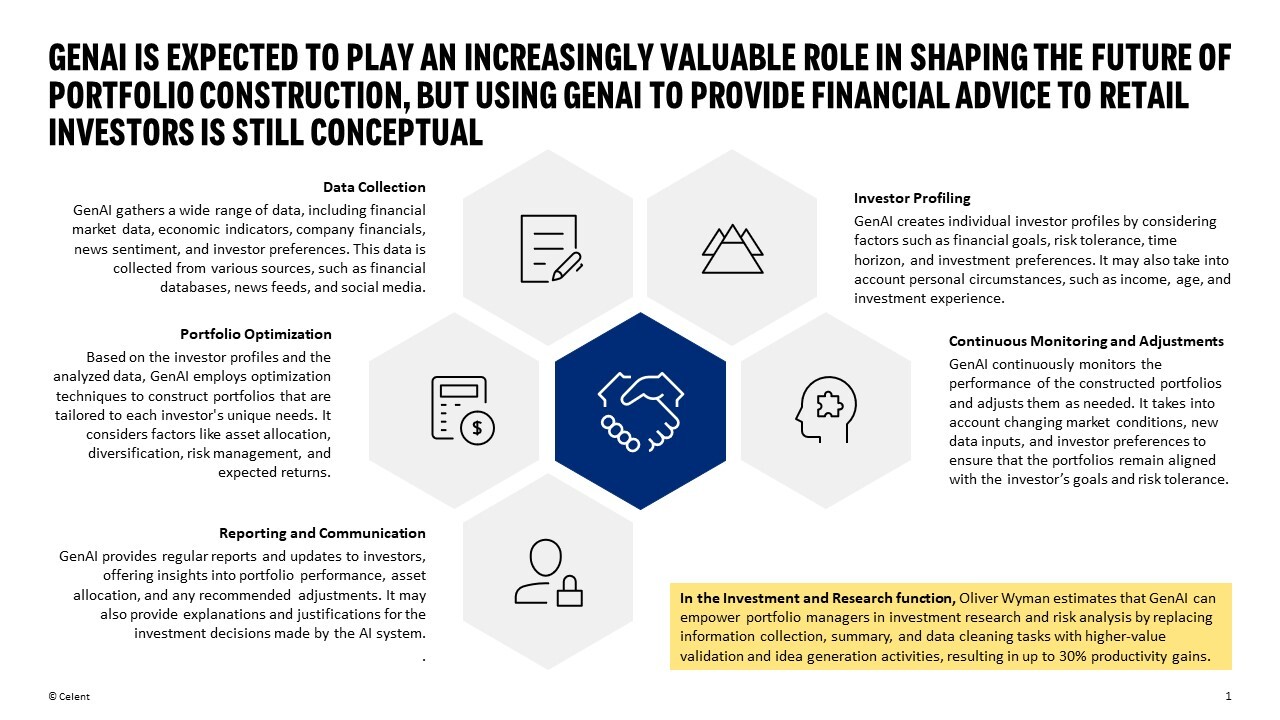

Celent's latest report, Harnessing the Power of GenAI: Accelerating Portfolio Construction | Celent explores the potential use of GenAI during the portfolio construction process, including the regulatory and ethical challenges of its application.