Harnessing the Power of GenAI: Accelerating Portfolio Construction

6 August 2024

For Advisors and Retail Investors

Abstract

- AI technologies, including Generative AI, have the potential to greatly enhance the efficiency and effectiveness of portfolio construction. However, there are important regulatory and ethical considerations that need to be addressed.

- Wealth managers believe the middle office is where GenAI will have the greatest impact in the next two years– specifically in business intelligence and analytics and investment functions. These areas have the highest average expected impact ratings for the near-term, likely because they are where advisor decision-making takes place. Top uses cases include information analysis and AI assistants for practice management and investment research. However, AI agents can act, creating an opportunity to reimagine and optimize workflows; use cases are emerging in portfolio construction.

- Customized portfolios is a core expectation for today’s investor, which aligns with their expectations in adjacent industries for personalized products. Customized portfolios are more attainable and scalable due to improved data management strategies and advancements in technology.

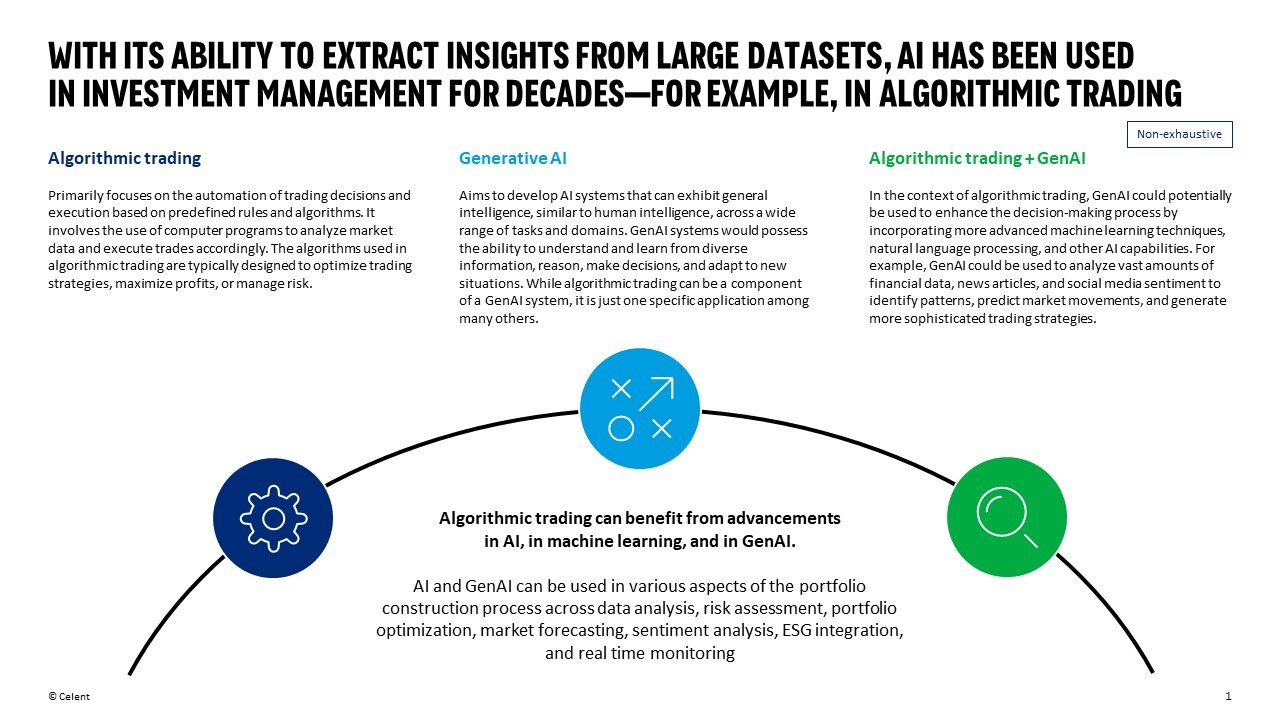

- With its ability to extract insights from large data sets, AI has been used in investment management for decades, for example, in algorithmic trading. GenAI is expected to play an increasingly valuable role in shaping the future of portfolio construction but using GenAI to provide financial advice to retail investors is still conceptual. Uses cases are emerging.

- Regulatory hurdles and ethical considerations are significant. Additionally, GenAI excels in numerous areas, but it is important to acknowledge that other well-established models, including traditional statistical models and AI models, may outperform GenAI in certain use cases.