Top IT and AI Investment Areas in Wealth Management

Celent has completed its second annual global survey of over 200 senior wealth management executives, where we ask about drivers of IT spending, leading technology priorities, and top investment projects. Our latest report, Dimensions: Wealth Management IT Pressures & Priorities 2024, provides an in-depth view of the survey results.

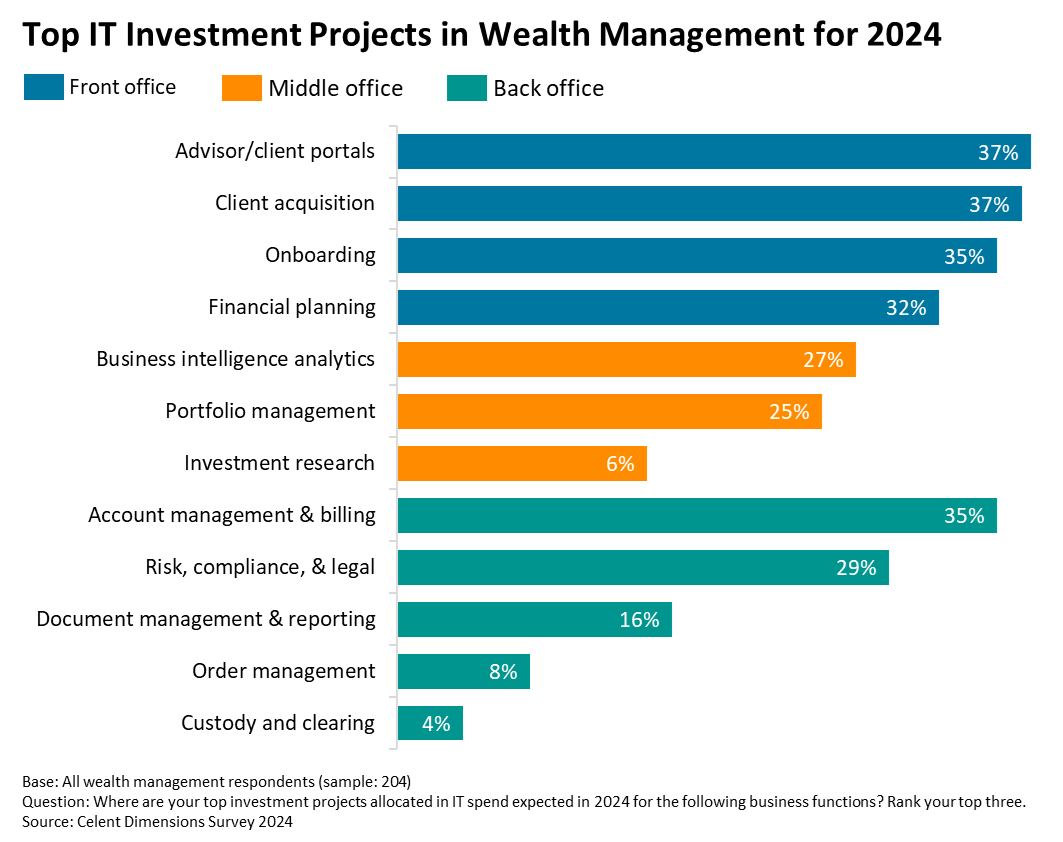

As part of the survey, we asked wealth management leaders to rank where their top three IT investment projects are for 2024. The most common answers were:

- Advisor/client portals

- Client acquisition

- Onboarding

The front office is a leading priority for IT investment

The top three areas above all fall within the front office – the advisor-driven and client-facing functions of a wealth management firm. The front office accounts for the largest share of wealth management IT budgets (see our blog Why Wealth Managers are Accelerating Their Front-Office Technology Spending).

Advisor and client portals are top priorities because they enable advisor productivity and client engagement. Most wealth managers (70%) agree that automating advisor workflows and delivering personalized client experiences are core priorities this year.

Client acquisition's ranking is consistent with last year's survey. Firms are investing more in marketing, prospecting, and sales tools to reach their AUM growth goals. Onboarding and new account opening have been priorities for years now, but aspirations to streamline the onboarding experience have not been entirely accomplished yet for most firms.

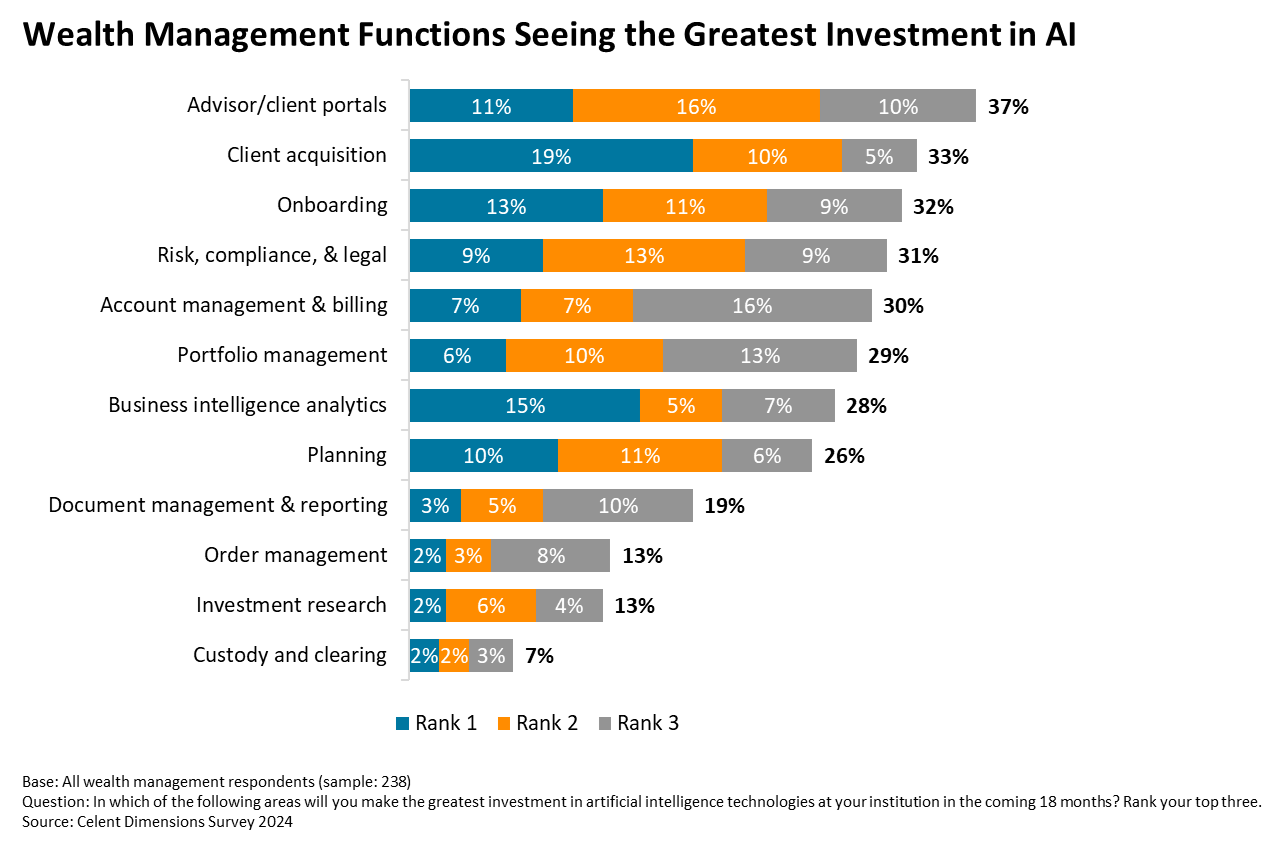

Front-office functions see the greatest investments in AI

We asked wealth managers to rank their top three AI investment areas. The most common answers were the same front-office functions as above: advisor/client portals, client acquisition, and onboarding.

AI technologies include machine learning, natural language processing, robotic process automation, computer vision, and now generative AI. Client acquisition is the most common answer (19% of respondents) for the area receiving the single greatest investment in AI. This underscores the growing importance of AI within marketing, prospecting, and sales software to make the client acquisition process more data-driven and scalable.

For generative AI specifically, the two most common GenAI use cases that wealth managers are currently live in production with are:

- AI assistants for front-office employees

- Content generation

Again, the top answers are within the front office. AI assistants for front-office employees (i.e., marketing, sales, and advisors) can generate call summaries and search/synthesize information from document repositories or knowledge bases. Content generation examples include drafting emails to clients or prospects, creating marketing content, or crafting social media posts. See our GenAI executive survey report, GenAI-oneers in Wealth Management, to learn about the current adoption and expected impact of GenAI use cases in the industry.

For more insights from our Dimensions survey, Celent clients can read the full Dimensions report here or watch our webinar recording and download the presentation.