Generative AI adoption in wealth management is progressing quickly. Celent surveyed executives at some of the largest wealth management firms in the world to learn about the state of generative AI in the industry. We asked them how their sentiment toward GenAI had changed over the prior year, their state of adoption by area, their view of expected impact by use case, key success factors based on experience, and their technology approach. Survey participants tended to be innovation frontrunners and hence are ahead of the GenAI adoption curve compared to most wealth management firms. We call these pioneers "GenAI-oneers."

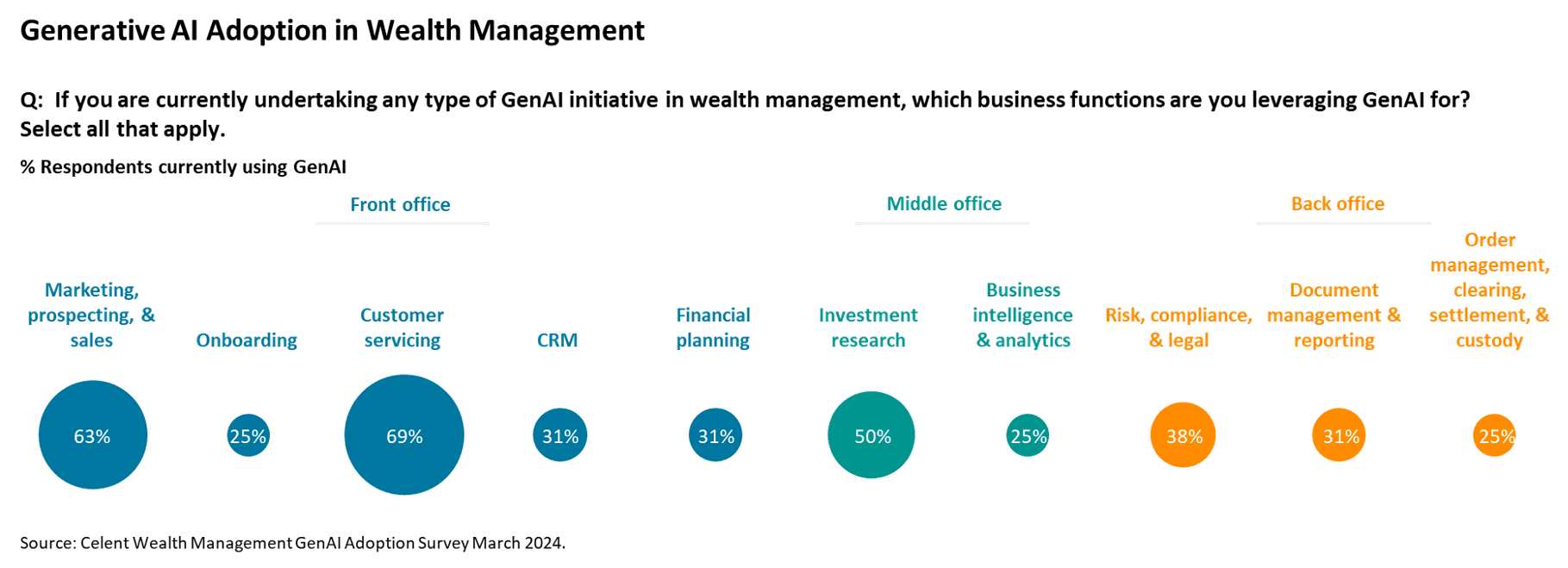

Most wealth management firms leveraging generative AI today are doing so within front-office applications, particularly in customer servicing, marketing, prospecting, and sales. These use cases are mostly for low-risk, low-level-of-difficulty employee-facing applications like generating marketing or sales content and summarizing customer service calls.

Other survey findings include:

- The average sentiment score regarding generative AI has increased over the last 14 months.

- All wealth managers surveyed expect GenAI to lead to improvements in performance metrics.

- Among firms currently live in production with GenAI use cases, all of them are focusing on employee-facing applications. A small percentage are also live with client-facing apps.

- While front-office functions have the most adoption today, the middle office is where wealth managers believe the greatest impact will come over the next two years.

- AI assistants and information analysis are considered "high impact" use cases across the wealth management value chain.