GenAI in 2026: Where do Wealth Managers Expect the Greatest Impact?

Fast-forward two years from now. Many (if not most) wealth management firms will be live in production with generative AI applications. Some will be in production for a few years. So where will the greatest impact be felt?

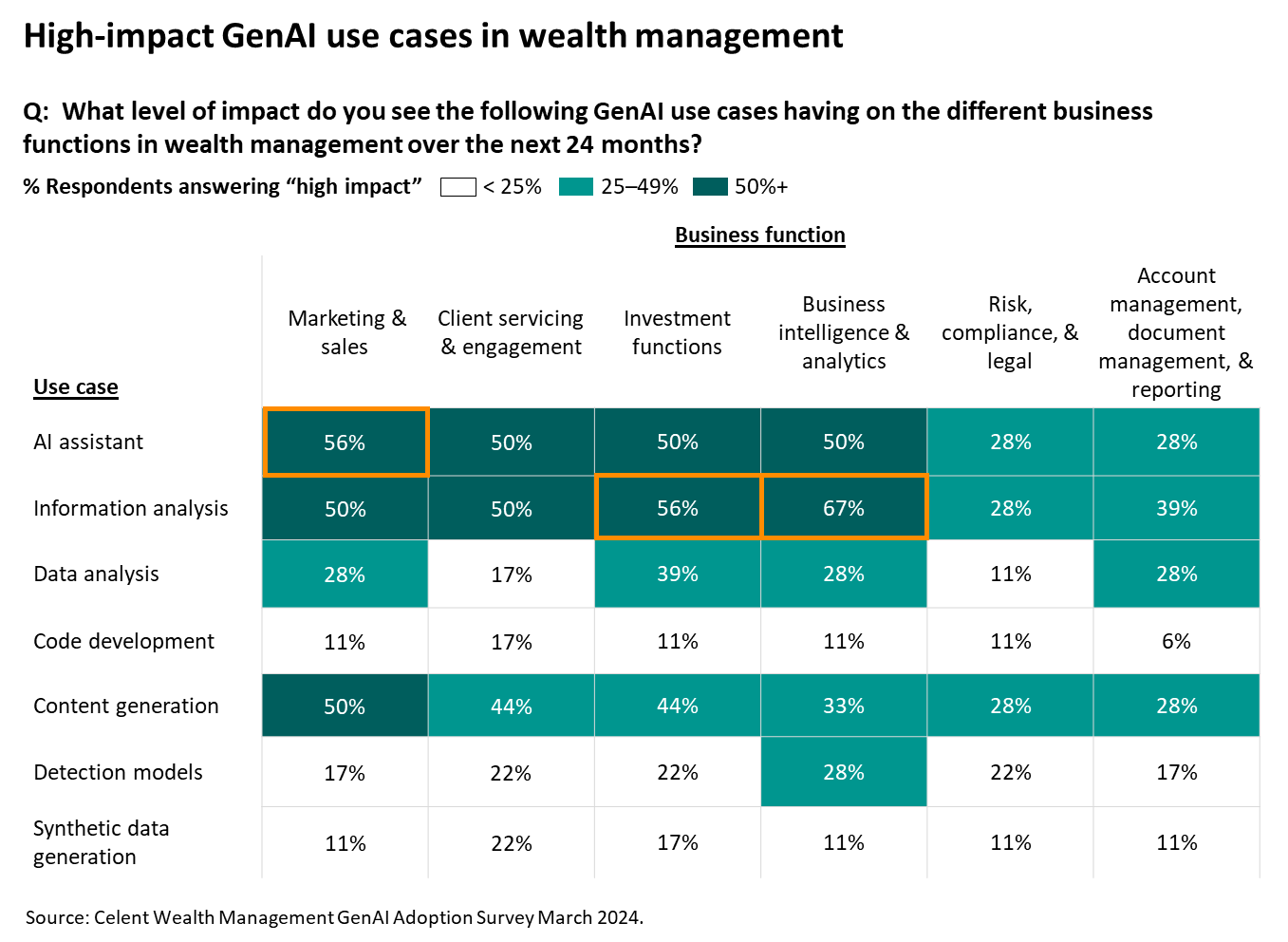

Celent surveyed wealth management executives from some of the largest wirehouses, brokerages, broker-dealers, and banks in the world for our recently published GenAI-oneers in Wealth Management report. We asked respondents what level of impact – high, moderate, low, or none – they expect GenAI use cases to have on different business functions over the next 24 months.

The chart below shows the percentage of respondents answering "high impact" for different use cases (listed in the left column) across wealth management business functions (listed in the top row). The darker the shade of green, the more respondents believe there will be a high impact by 2026.

AI assistants and information analysis

Executives see several high-impact GenAI use cases across the wealth management value chain over the next two years. Looking at the darkest green cells in the chart above, at least 50% of wealth management leaders believe AI assistants and information analysis will have a high impact across front- and middle-office business functions (e.g., marketing and sales through business intelligence and analytics). This makes sense as these use cases accelerate human decision-making, and the front and middle office are where financial advisors spend the most time.

AI assistants can be used as knowledge sources (e.g., research assistants, information retrieval) and for automation (e.g., autofill, next-best-action suggestions). Information analysis includes the summarization and synthesis of documents, call or meeting transcripts, and data files.

Business intelligence and analytics

The combinations of use cases and business functions with the most respondents expecting a high impact are:

- Information analysis for business intelligence and analytics (67% of respondents)

- AI assistants for marketing and sales (56%)

- Information analysis for investment functions (56%)

GenAI within business intelligence and analytics has the potential to streamline decision-making for both the firm and the financial advisor. Information analysis examples include automating practice management, revenue forecasting, and summarizing operational or performance reporting at the firm, advisor, product, or client segment level.

GenAI in business intelligence is still at an early stage. AWS’s GenAI assistant Amazon Q was only recently made generally available within its business intelligence platform Amazon QuickSight. Microsoft recently announced its GenAI assistant Copilot will be enabled by default in its Power BI business intelligence platform.

Marketing and sales

Marketing and sales are high-adoption, high-impact areas for GenAI in wealth management. In marketing, AI assistants can generate email templates, marketing copy, and social posts. AI assistants can support sales professionals by transcribing, summarizing, and extracting key information from sales calls.

To give an example, Franklin Templeton is partnering with Microsoft to build an AI platform utilizing Microsoft’s Azure OpenAI Service. The platform’s first use case is to assist sales and marketing teams to personalize support for prospects and clients.

Investment functions

Investment functions include financial planning, investment research, and portfolio management. Half of respondents are already leveraging GenAI for investment research. Examples of informational analysis within investment functions include summarizing earnings call transcripts, equity research reports, news, sentiment, and other market analysis.

JP Morgan Chase is leveraging OpenAI’s GPT-4 model to develop IndexGPT, a GenAI tool that analyzes company information and news to create thematic investment baskets.

Stay up to date on all of Celent's latest research on GenAI in wealth management:

- GenAI-oneers in Wealth Management

- Dimensions: Wealth Management IT Pressures & Priorities 2024 (including a spotlight on GenAI)

- The New Wealth Management Paradigm - From Apps to Agents, Part 1 - Setting the Stage

- The New Wealth Management Paradigm - From Apps to Agents, Part 2 - The AI Agent as Doer

- Three Gen AI Use Cases in Wealth and Asset Management Today: Lessons from AWS

- Morgan Stanley Wealth Management: AI @ Morgan Stanley Assistant