セレント生成AIシンポジウム: 変革への扉を開く

An overarching take-away from our recent GenAI Symposium is that GenAI is starting to drive step change and differentiation at financial institutions (FIs). Banks and insurers are succeeding at achieving incremental productivity gains (e.g., in call centers) by implementing GenAI and are now moving to more challenging, revenue growth use cases (e.g., customer engagement).

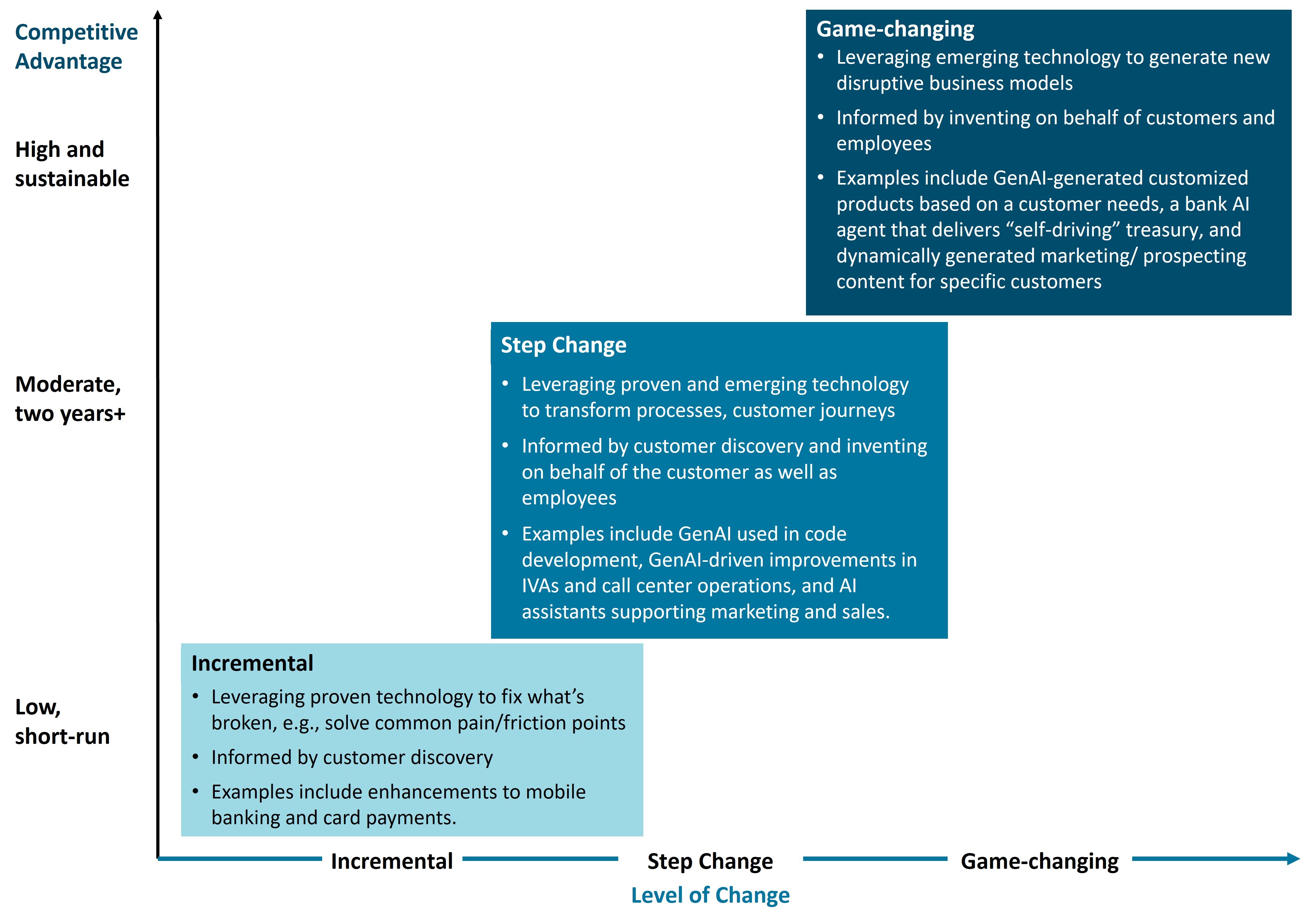

Historically, FIs have succeeded at realizing incremental change, leveraging proven technology. While cumulatively valuable for customers and employees, incremental change yields short-lived competitive advantage. GenAI is opening the door for banks to achieve step change and even game-changing differentiation.

Figure: From Incremental to Step Change to Game Changing

Panel discussions and conversations with FIs at Celent’s GenAI Symposium confirmed that they are succeeding at leveraging GenAI “behind the scenes” in employee-facing use cases. While early use cases are yielding incremental change, recent use cases are showing potential to drive step change (e.g., prospecting support for relationship managers). These are powerful use cases because they offer employees more time to focus on value-adding activities (e.g., improving a response to prospect’s RFP) and innovation (e.g., personalization). For further discussion, see Celent report, Generative AI Making Waves: Adoption Waves in Banking and Capital Markets.

During our Symposium, we also saw glimmers of game-changing use cases as described by my colleague Colin Kerr in his blog Game-Changing Customer Engagement from the Celent GenAI Symposium, 2024. We anticipate that as GenAI risks are mitigated and accuracy improved, GenAI will drive powerful customer-facing use cases (e.g., personalized AI assistant for individual customers). Furthermore, GenAI could enable FIs to develop completely new revenue sources (e.g., leasing a “CFO” AI assistant to a small to medium-sized businesses).