CROWDSTRIKEのサービス停止から得られた重要情報: デジタルチャネル障害時の顧客と銀行員のエンゲージメント

Best practices for digital bankers

Digital leaders play a key role in coordinating responses to unplanned outages in the digital channel. The recent global CrowdStrike disruption is the latest reminder that all banks should have solid disruption/response strategies and best practices ready to execute under adverse conditions. Bank leaders should refocus and perhaps improve their customer and internal communications strategies.

On June 19th, several financial institutions were disrupted for extended periods by the global Microsoft Windows issue caused by a software update from cybersecurity provider CrowdStrike. The most relevant impacts were extended outages to online and mobile banking, and to bank employee access to internal networks and resources. According to Microsoft, 1% of Windows machines worldwide were impacted.

But if your bank’s customers were disrupted all day, you’re feeling like a very unlucky 1%. The event dominated the news cycle for a day or two, and for some digital banking veterans, recalled the widespread disruptions to digital channels caused by the spate of dedicated denial-of-service (DDoS) attacks aimed at US banks in the 2010’s, when I was leading digital banking strategy and channels for a mid-sized US bank.

I provided some approaches to managing for high availability in our previous post “Time is Money: A Simple Way for Banks to Track the Value of Highly Available Digital Channels”. That piece contains four elements of managing for high availability and banks should consider each as they evaluate their current strategy.

My Celent colleague Neil Katkov shared some thoughts this week on improving platform reliability in the wake of the CrowdStrike issue, and some more thoughtful oversight approaches for technology leaders.

For me, this latest event brings to mind the role of digital banking leaders in managing the outage when it happens, specifically on the customer and internal communications front. There are several best practices I’d suggest there:

·Coordinate closely with your contact center. A flood of inbound calls caused by digital channel issues can destroy any daily productivity metrics so digital and contact center leaders should be aligned on KPM’s. Proactively building partnerships now will better prepare the organization to work together next time.

·Provide clear, flexible messaging to customers. Messaging to customers on the online and mobile channel, in front of login, in the digital channels, is critical. Login screens need content management that can deploy a pre-built incident message instantly. The goal here is call volume mitigation. Digital problems should stay in the digital channel and be mitigated there as well. It maybe goes without saying that messaging needs to reach the customer even when login or connectivity to the host is unavailable.

·Internal communications should be proactive, not reactive. For internal communications to other leaders during and after any incident, it helps to always include “expected customer impact”. These impacts can be projected from some of the techniques outlined in the blog piece above. Leadership benefits from the additional context and can help support responses based on the severity. Digital leaders are leading with knowledge rather than reacting to events or executive leadership’s requests for information.

·Meet your customers in other forums. Social media monitoring and responses from the bank can de-escalate customer frustration. I’ve seen customers go from enraged to evangelist, instantly, just because of empathetic and accurate responses from the bank in real-time on social channels.

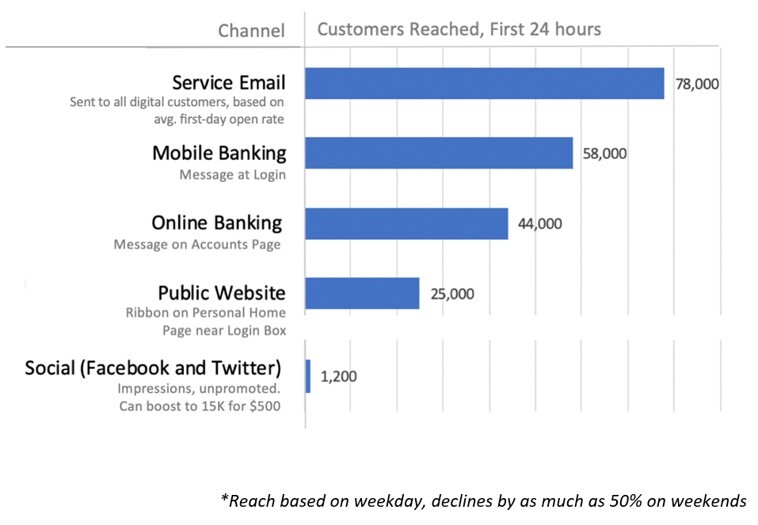

Finally, it’s handy to maintain a guide for “expected messaging reach” in each channel, based on historical interaction volumes, similar to the below (illustration only). This helps not only in incident communication planning but also in BAU marketing strategy as well. A modified version of this could be created for the “first 15 minutes” or other durations.

Source: Celent

Looking a little bit beyond customer and internal support communications, there are a few other bits to a well-rounded platform disruption strategy:

·Ensure remote teams have backup connectivity. Highly relevant in global internet issues or domain-wide outages, ensure no broken links among key teammates.

·Revisit SLAs with important platform partners. This ensures there is accountability and importantly, clear communication protocols to jointly manage recovery operations.

·Learn the names of your support contacts. Relationships matter in time-sensitive and remote support situations. Take the time to make those connection both within your organization and with your external partners (where it’s more likely to be an issue).

Related Research

The CrowdStrike “CrowdOut”: Lessons for Technology Strategists

May 2024

The Value of Digital Engagement at Large US Banks

May 2024

Time is Money: A Simple Way for Banks to Track the Value of Highly Available Digital Channels

July 2023

Deposits, Competition, & Digital: Where Big US Banks Are Focused Now

May 2023

A New Era for Retail Digital Banking Leaders: The Current Challenges and Three Pragmatic Approaches

April 2023

Become a Challenger in Small Business Banking: Embedding Fintech

May 2023