Becoming a challenger in small business banking requires financial institutions (FIs) to move away from delivering “nouns,” that is, products to enabling “verbs,” that is, action on the part of customers. The rallying cry of challengers is “make your business run better and grow.”

Over the past decade, FIs have faced increasingly challenging competition in small business banking. “Hold your money” is a commodity. Fintechs, big tech, and accounting software firms are pursuing a platform strategy, posing an existential threat due to their warm customer base. With tech advances and bank-friendly fintech partners, FIs have the opportunity to move from being challenged to being challengers, succeeding at the challenger formula.

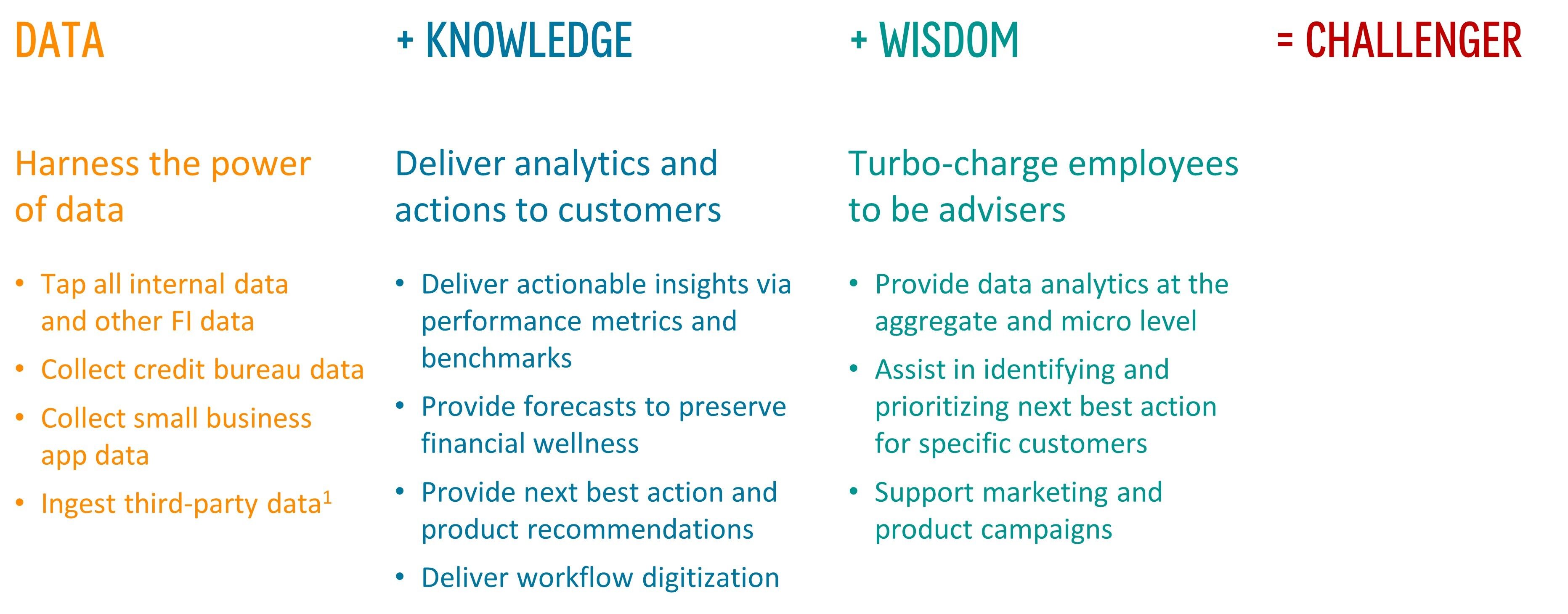

Figure: The Challenger Formula

In this report, Celent examines eight fintech partners: Autobooks, BankiFi, FIS Business Hub, Monit (including an overview of Apiture Business Insights powered by Monit), 9Spokes, Personetics, TCS Customer Intelligence & Insights, and upSWOT.