FXテクノロジーの未来をナビゲートする: トレンドと洞察

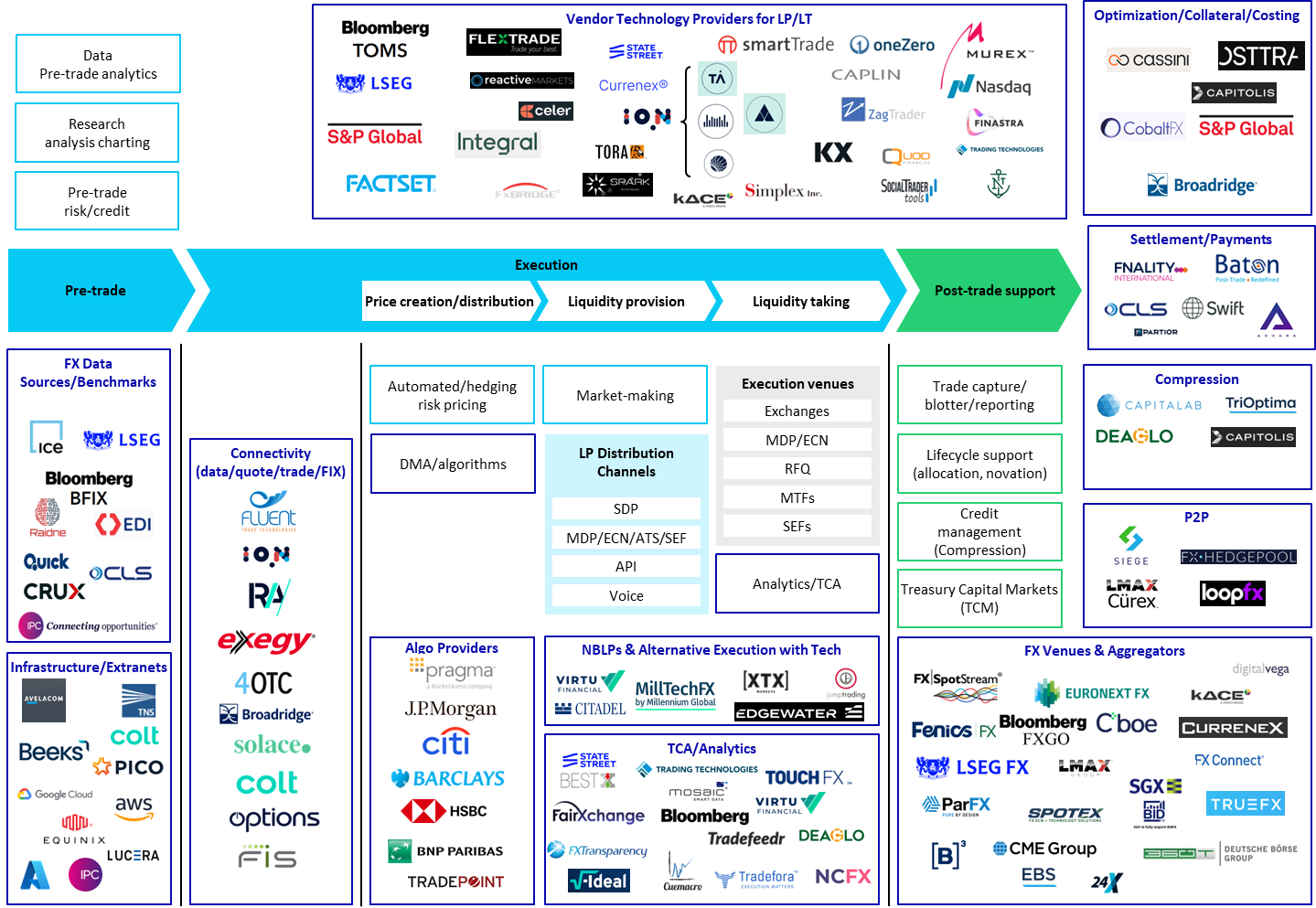

FX Vendor Solution Scape

Abstract

The foreign exchange (FX) and trading technologies industry is experiencing significant transformation driven by increased electronification and automation. This evolution is necessitated by the growth in exchange-traded volumes and the expansion of alternative trading venues. The demand for advanced execution tools, price distribution mechanisms, and trading algorithms is on the rise. Additionally, the industry is seeing a growing need for quality data and analytics capabilities, including machine learning (ML) and artificial intelligence (AI) technologies. Efficiency in workflows, end-to-end trade lifecycle automation, and post-trade streamlining remain critical demands from market participants.

The FX trading industry faced significant challenges during the pandemic period, revealing structural and technical issues. The increased trading volume, volatility, and profits experienced by participants exposed weaknesses in various offerings and internal workflows. As a result, there has been a growing demand for trade lifecycle automation across all market participants.

The market is now looking for broader data to support advanced analytics as more market players are looking to offer advanced algo execution services to institutional and corporate clients.

This report provides a concise overview of significant developments in the FX market, with a particular emphasis on trading and execution and their impact on technology decisions. It examines the current state of the FX market and highlights emerging technology trends, offering insights into the future direction of the market.

The FX technology solution and venue ecosystem is a mixture of financial technology firms and trading venues with multiple models of FX execution, venue, and aggregators, and specialty fintech

Related Research

Dimensions: Global Capital Markets/Sell Side IT Pressures & Priorities 2024

June 2024

Dimensions: Global Capital Markets/Buy Side IT Pressures & Priorities 2024

June 2024

Generative AI Making Waves: Adoption Waves in Banking and Capital Markets

May 2024

GenAI-oneers in Capital Markets

May 2024

FMIs and Cloud: Building the Business Case

April 2024

ING: FX Trading Digital Transformation

March 2024

GenAI in Capital Markets: Sell Side Roundtable Summary

March 2024

EMS—The System that Never Sleeps

February 2024

Settling for Success in Implementing T+1

January 2024

Technology Trends Previsory: Capital Markets Buy Side 2024 Edition

November 2023

Sphere: From Information Streams to a Liquidity Lake

October 2023

Société Générale: Treating Data Like an Asset

March 2023

Future of Trading Technology: The Cloud Cometh

December 2022

June 2021