実践により学ぶ:メタバースへようこそ

Celent’s Wealth Management IT Priorities and Strategy in 2023 survey found that wealth managers are focused on becoming more agile, recognizing that they need to adapt their approach. The pace of cloud adoption, surge in activity around AI, and focus on investment product and platform innovation projects demonstrate this shift in attitudes.

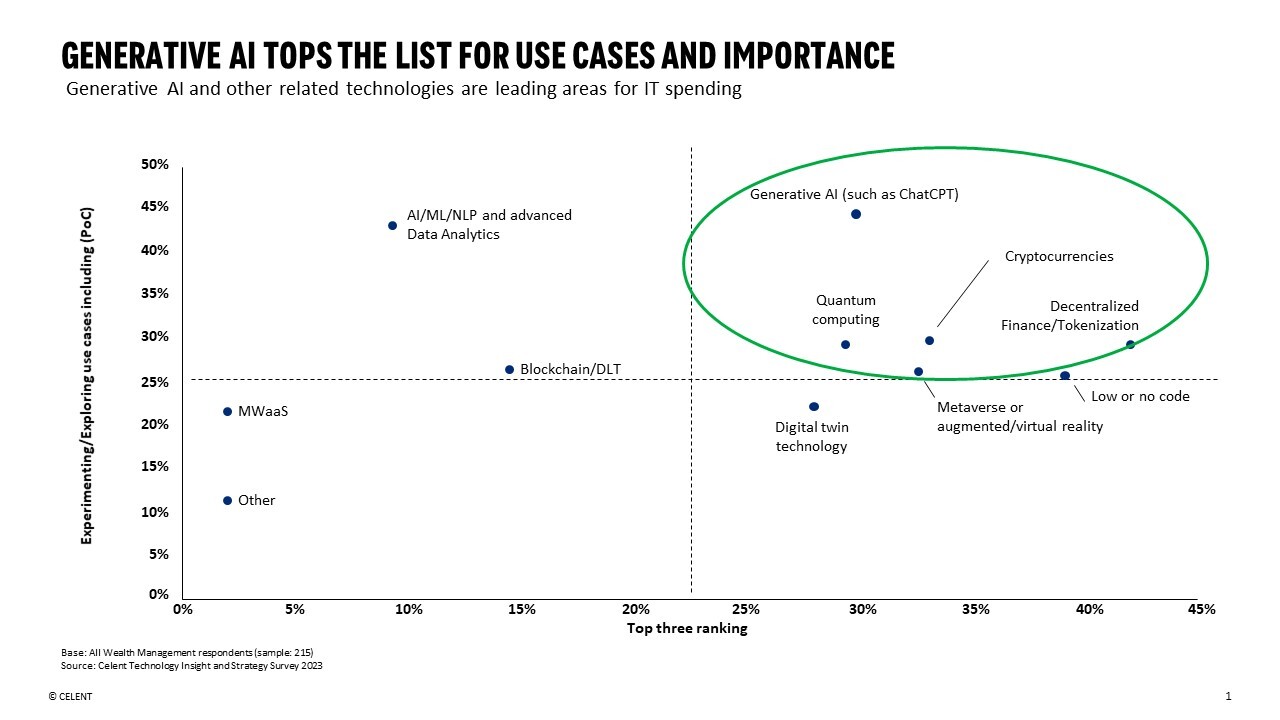

Further, the survey revealed that that “Generative AI, quantum computing, and metaverse top the list of emerging technologies with which wealth managers are experimenting. At a global level, 45% of wealth managers are currently exploring use cases for Generative AI, and a full 50% have deemed it to be an investment priority.”

When looking specifically at the metaverse, 35% of wealth managers included “experimenting and exploring use cases with the metaverse or augmented/virtual reality on their 2023/2024 roadmap”. Wealth managers’ interest in the metaverse is not insignificant. But what are these wealth management use cases for the metaverse? And, what is the metaverse, really?

The metaverse is a virtual space where humans can participate in a shared virtual universe. Simply, imagine yourself fully immersed in a video game, for example. “Meta” means “beyond”, and “verse” is shortened from “universe”, and there we have “Metaverse”; the term originated from the novel “Snow Crash” by Neal Stephenson, where humans interact with each other as avatars in 3D space. “The metaverse provides new ways to connect and share experiences[1]”- it is intended to be one single virtual reality consisting of several unique worlds (e.g., places to hang out, play games, spend virtual currency, surf the web, etc.), and is generally viewed as the next phase of the Internet that we all know and use today.

Because the metaverse is likened to a virtual reality internet where, for example, real estate can be acquired and artwork or digital tickets sold, the requirement for a “common ownership” in an otherwise decentralized (no single entity has control over it) world becomes important. Blockchain technology where digital assets ensure not only the exchange of these goods, but create ownership (that is recorded on a decentralized peer-to-peer ledger) plays a significant role. What does this mean for us mere humans left operating in the “real” world? And particularly for those within financial services and wealth management?

Of course, the use cases are explorative at this stage, especially in a highly regulated industry like wealth management. However, the metaverse is expected to have a strong linking with the real-world economy (examples are provided below), and ultimately become an extension of it. Since the metaverse is designed to be a digital world where we can collaborate, learn, shop (fun fact: metaverse property prices rose 700% in 2021), work, and play, there is ample opportunity for real companies and individuals to build, trade and invest in products, goods, and services.

Financial services and wealth management use cases today are mostly centered around investments, training, learning, and collaboration. Wealth managers are dipping a toe into the metaverse to connect with customers and partners:

-Fidelity via their Fidelity Metaverse ETF (FMET.O), which offers investors the opportunity to invest in businesses involved in the metaverse. Fidelity also opened a virtual eight-story building called the “Fidelity Stack” in blockchain-based Decentraland that offers financial education as it tries to attract nextgen investors to its platform. Users in the Fidelity Stack can explore the building's interior, dance floor and rooftop sky garden, but are encouraged to learn ETF investing basics while collecting “orbs” throughout the journey

-JPMorgan (who spends $12bn on technology a year), launched a virtual lounge/bank branch called “Onyx”; HSBC acquired a plot of land within The Sandbox’s metaverse.

-UBS has been looking at VR for training.

-HSBC has launched a fund focused on the metaverse for its private banking clients in Hong Kong and Singapore; the fund invests in key segments of the virtual ecosystem

In the retail investing world, like in the Fidelity brokerage example above, the metaverse can be viewed as next-level gamification where investors are “learning by doing” and having fun learning about investing or financial planning. In the event that retail investors can actually make investments, the metaverse paired with wealth management is an area where wealth managers should tread carefully and place guardrails (like Fidelity has successfully done in its other initiatives to attract nextgen clients); the possibility of facing a dramatic fallout of misinformed and less-wealthy-when-we-started retail investors (à la Robinhood circa 2020) could become a harsh reality.

Nextgen clients are more digitally savvy and more willing to engage with wealth managers whose tech capabilities and offerings are on a par with product and service experiences in adjacent areas; bonus points if the tech makes learning or investing fun (and safe). The metaverse is certainly an avenue to achieve a new set of clientele, but it is likely more than just that, particularly when our world has become increasingly blended between virtual and in-person interactions, and the interest in a mixed reality becomes a necessity and a real medium for social and business engagement.

But, we are not there…yet. Wide-spread adoption of and engagement in the metaverse is a challenge, as is the heavy cost of operating within the metaverse. Additionally, financial institutions are on the perimeter of DeFi but digital banks could be well-positioned to operate within this environment. Virtual economies are poised to grow and the interest in digital worlds from nextgen clients will not wane, so financial institutions would be wise to at least consider what their virtual presence might look like.

[1] Meta