Direct indexing is an approach to investing where the individual investor owns the individual stocks that make up a basket of stocks. The constituents of that customized index, or portfolio, mirror the composition of an index with the added investor preference for certain exposures. Direct indexing is unique to the investor. And the concept is not new—the term “direct indexing” is a revamp of “SMAs” (Separately Managed Accounts), which has historically been reserved for the institutional UHNW client. However, through advancements in technology, customized portfolios are accessible to a larger swath of clients. As asset managers look to the retail channel for a new source of growth, and wealth managers seek to differentiate themselves through customized products, direct indexing has become a significant trend in the investment management industry.

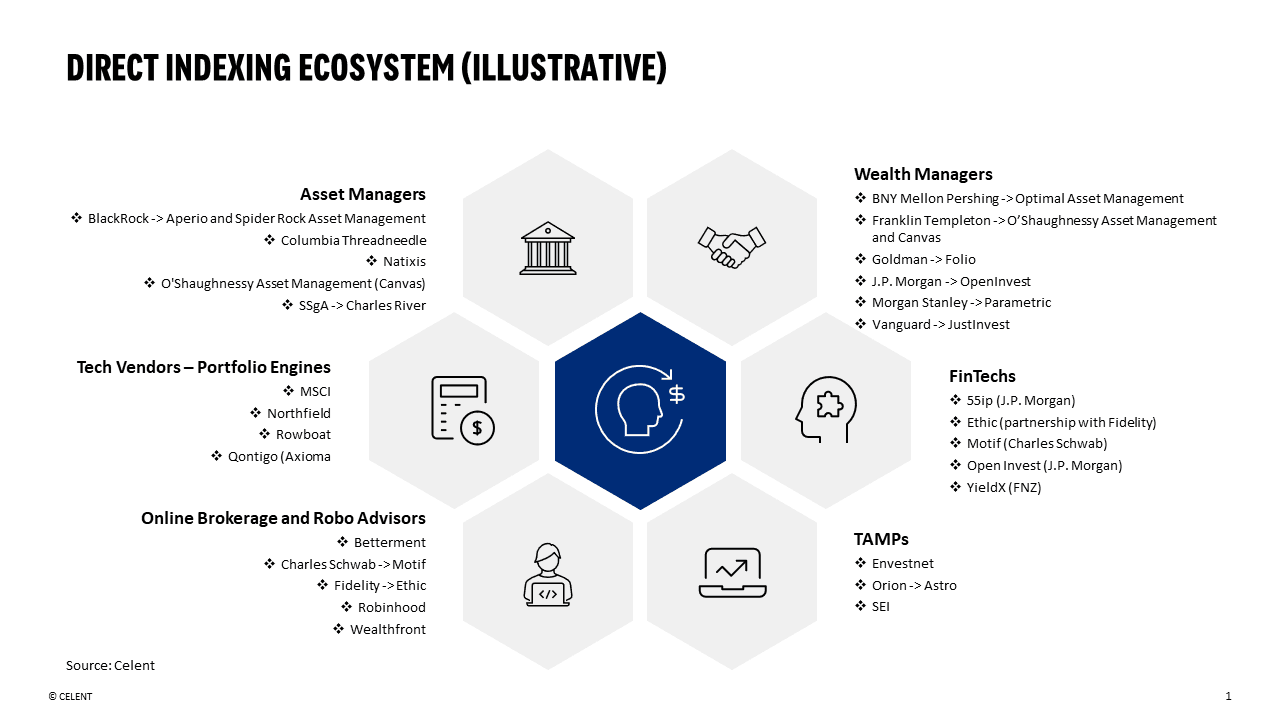

The flurry of M&A activity of direct indexing and tax optimization solutions by wealth and asset managers over the last few years is indicative of where the investment management industry is headed: utilizing improved technologies to facilitate the democratization of customized investment management across a larger client base.

The integration of direct indexing into advisory platforms is critical for the successful utilization of customized portfolios, but it is not without its challenges. As the use cases for direct indexing expand, so, too, will the need for technology capable of robust data gathering.

As the asset and wealth management industries converge over direct indexing, firms would be wise to assess their product construction and distribution capabilities to ward off imminent product commoditization.