コーポレート・バンキングの優先事項:日本からの考察

Tokyo is one of my favorite cities. I’ve enjoyed many visits earlier in my career and so I was excited to return for the first time since COVID-19 to meet with Celent corporate banking clients. Things didn’t start well when a cancelled flight resulted in my delayed arrival in Tokyo at 5am Monday morning – just in time for a quick nap followed swiftly by five client meetings! That tiredness was quickly dispelled by the warm welcome I received from old colleagues and new acquaintances during a hectic week of back-to-back meetings all over the city.

Throughout the week I had conversations with business leaders at all the major Japanese banks, several US “big tech” firms, and the large Japanese technology companies which provide services to banks across the country and Asia-Pacific region. We talked about trends and priorities in corporate banking business and technology, including our newly published Celent Technology Insight and Strategy Survey, 2023. A few clear themes dominated conversations as the week went on.

The first was a keen interest in what Celent calls the “open ecosystem” – whether open banking, embedded finance, or Banking as a Service (Baas). There was huge interest in the Adventures in the Open Banking Ecosystem report as banks in Japan build their strategies and capabilities. Examples of embedded finance partnerships from Europe and North America were eagerly discussed by banks and technology vendors alike.

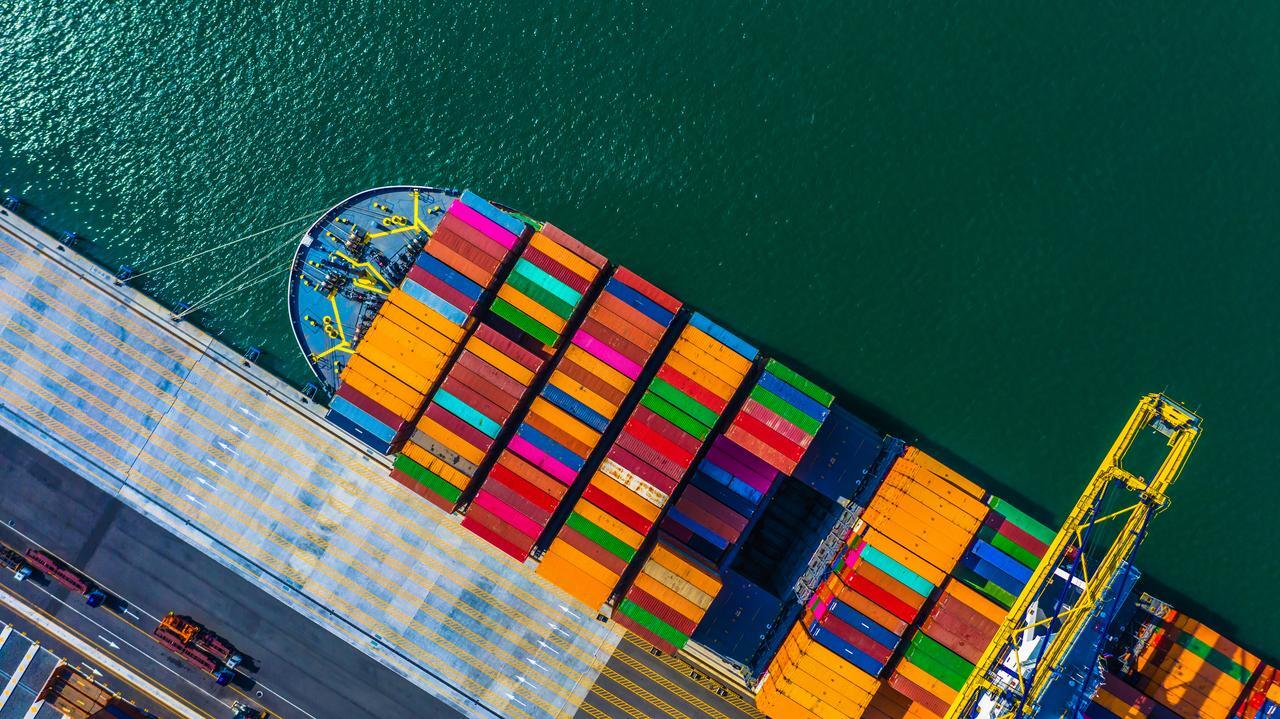

The second topic was more broadly around product management strategic priorities. Two high priority product trends consistently resonated with the banks: focus on client experiences through digital channels (online, mobile, API, file etc.) and the strategic importance of trade services and supply chain finance. Perhaps this is no surprise as banks worldwide seek to transform their digital capabilities and experiences. But pipping digital channels in Asia-Pacific is the strategic focus on trade services. International responses to the COVID-19 pandemic wreaked havoc on global supply chains and highlighted inefficiencies (or deficiencies) in trade solutions. This area has been often neglected and now looks set to benefit from renewed focus (and investment).

Finally, the banks and the technology vendors I met seek new ways to manage and monetize data. The conversations and ideas exchanged were similar to those at the Celent Navigating Turbulence event held in New York last May. It isn’t an easy challenge to solve, but stronger data platform and governance strategies are enabling analytics and ML capabilities more reliably at scale – but they need forward-thinking business leaders to set clear direction for success.

Despite the travel hiccups the trip was an incredibly valuable exchange of information. There’s no substitute for sitting down around a table discussing the most pressing agendas of the day. I am grateful to everyone who took the time to meet me.

Oh - and by the way - we are hiring to build our team in Japan. We are currently looking for a Financial Technology Researcher covering Asia-Pacific, based in our Tokyo office. Drop me a line if you are interested, or know someone who might be.