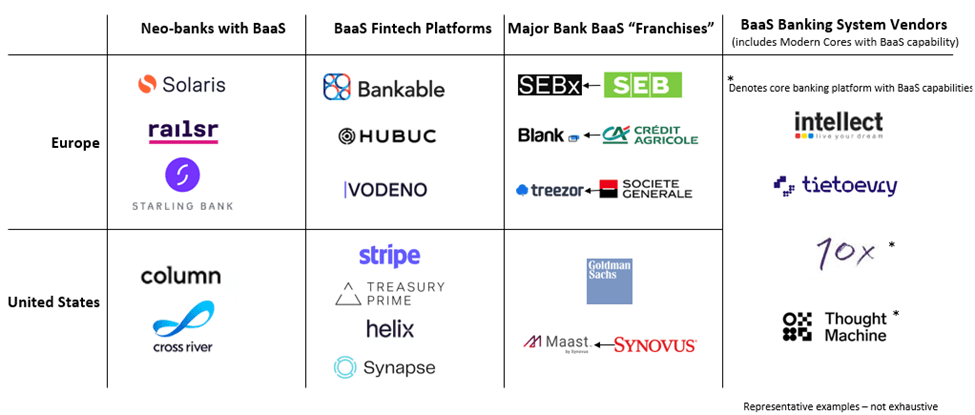

英国のオープンバンキング規制と欧州連合(EU)のPSD 2(欧州決済サービス指令第2版)は、消費者金融サービスの開放を具体的な目標としていたが、オープンデータとオープンAPIが実現した新しいグローバルエコシステムとビジネスモデルへの道も開いた。実際、現在世界的にBanking-as-a-Service(BaaS:サービスとしての銀行)と呼ばれている仕組みを生み出したのはオープンバンキング規制とPSD 2であり、その結果、エンベデッドファイナンスが可能になり、市場参加者の広範なエコシステムが育まれた。セレントの調査によれば、銀行とフィンテックの間だけでなく、BaaSフィンテックのプラットフォームやERPソリューションやコアバンキングシステムのより伝統的なアプリケーションベンダーとの間でも、ますます特異なパートナーシップが生まれている。これらの新たな発展やパートナーシップの多くは、B2B(business to business:企業間取引)バンキングだけでなく、B2B2BやB2B2B2Cの実現にも焦点を当てている。2023年は、法人顧客やビジネスバンキング顧客とより直接的に関わるうえで役立つような、影響力のあるパートナーシップを構築できる機会を模索する銀行が増えるとセレントは予想している。

銀行は、従来のベンダー管理のアプローチではなく、「パートナーシップの考え方」を取り入れる必要がある。パートナーシップは、その各要素の総和以上の価値をもたらすよう、文化的適合性、戦略的方向性、テクノロジーに沿って調整する必要がある。規制当局も銀行とフィンテックのパートナーシップを注視しており、銀行が責任を持ってパートナーのフィンテックを管理し、フィンテックに責任を持たせ、さらには成長機会を追求して過度のリスクをとることがないよう徹底したいと考えている。コーポレートバンキングのエコシステムには新たな冒険の機会に加え、新たなパートナーシップを築く機会もある。ただし、銀行とフィンテックは、その理由、恩恵、リスクを明確にしておく必要がある。