Customers expect seamless access to products and services in today's rapidly evolving digital landscape. The insurance industry is no exception, as insurers strive to provide a digital experience when purchasing insurance products. One area that has seen significant advancements in this regard is underwriting.

Automated underwriting has become a focal point for insurers aiming to meet customer demands for a frictionless buying experience. By utilising automated processes and technology, automated underwriting streamlines the underwriting process. It involves using predefined rules and decision-making algorithms to assess and evaluate the risks associated with insurance policies. Through automated underwriting, data collection, analysis, and decision-making are automated, reducing the need for manual intervention.

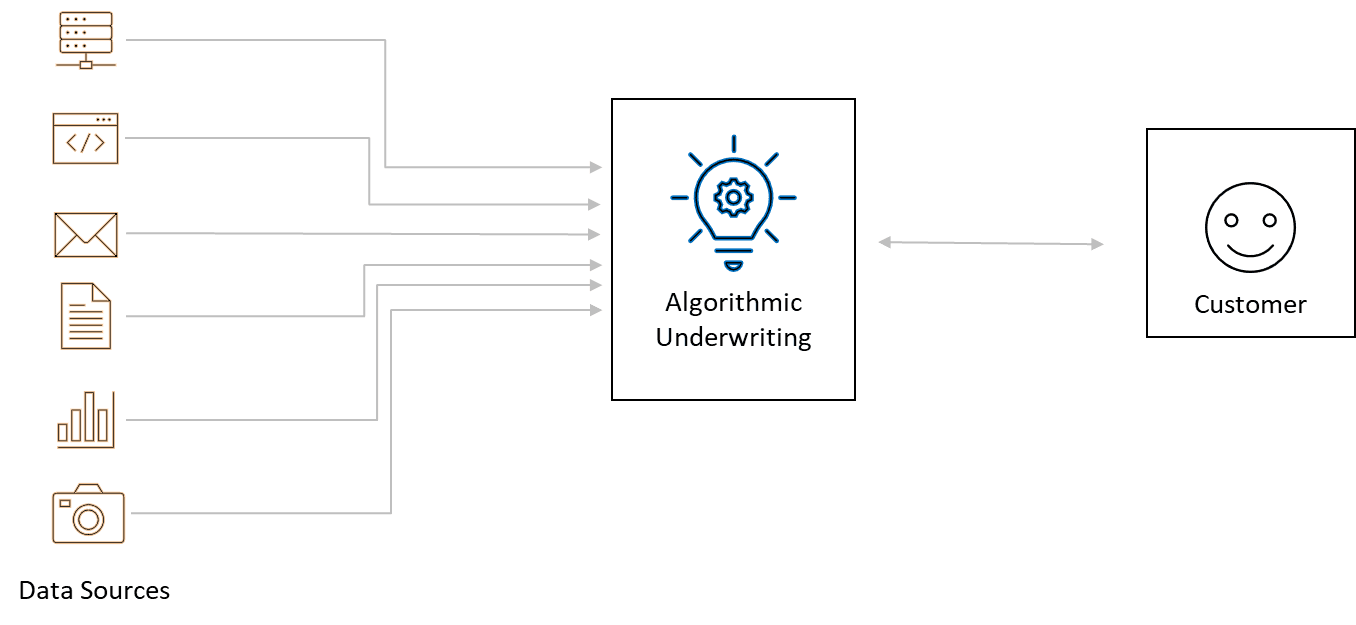

Taking it further, algorithmic underwriting leverages advanced algorithms and analytics to make more accurate risk assessments. It utilises machine learning and artificial intelligence techniques to analyse vast amounts of data and identify patterns and trends. By doing so, algorithmic underwriting can provide more precise risk assessments and offer more tailored insurance coverage.

Life insurers were among the first to embrace automated underwriting, successfully attracting new customers. Personal lines products in property and casualty (P&C) insurance companies also experienced significant success. However, the same cannot be said for commercial and speciality lines of business.

Traditionally, underwriting in commercial insurance involved manual evaluation of various factors, such as the nature of the business, financial stability, claims history, and other relevant information. This process was time-consuming and heavily relied on the expertise and judgment of underwriters. As a result, the underwriting process for commercial and speciality lines of business lagged in terms of efficiency and accuracy.

Algorithmic underwriting in commercial insurance has emerged as a game-changer. It leverages automated processes and data analysis techniques to assess and evaluate risks associated with insuring commercial properties, businesses, and other assets. Using algorithms and advanced analytics, algorithmic underwriting streamlines the process and enables more accurate risk assessments.

Benefits of Algorithmic Underwriting:

- Speed and Efficiency: Algorithmic underwriting significantly reduces the time required for underwriting commercial insurance policies. By automating data collection and analysis, insurers can process applications and provide quotes in a fraction of the time compared to traditional methods.

- Enhanced Accuracy: Algorithms and advanced analytics enable insurers to make more accurate risk assessments. By analysing vast amounts of data, including historical claims data, financial information, and industry trends, algorithmic underwriting can identify potential risks and price policies accordingly.

- Consistency and Standardisation: Algorithmic underwriting ensures consistency and standardisation in the underwriting process. By removing human bias and subjectivity, insurers can provide fair and consistent outcomes for policyholders.

- Improved Customer Experience: With algorithmic underwriting, customers can enjoy a seamless and user-friendly digital experience when purchasing commercial insurance. The streamlined process eliminates unnecessary paperwork and reduces the need for manual intervention, making it easier and more convenient for customers to obtain coverage.

- Scalability: Automated underwriting systems can handle many applications simultaneously, allowing insurers to scale their operations without increasing staffing levels. This scalability enables insurers to meet growing demands efficiently.

While algorithmic underwriting offers numerous benefits, it has challenges. Insurers must carefully consider data quality, privacy concerns, and regulatory compliance when implementing algorithmic underwriting systems. Additionally, the human element should not be eliminated, as algorithms can analyse data and identify patterns, human judgment and expertise are still crucial in complex cases or situations that require subjective evaluation.

Algorithmic underwriting has gained significant traction in the insurance industry, with several companies embracing this approach to revolutionise their operations. In the life insurance sector, companies like Ladder and Ethos Life Insurance have successfully implemented algorithmic underwriting to enhance their processes and provide more efficient services to customers.

One notable example from P&C insurance is Ki-Insurance 1, a Lloyd's of London syndicate. Ki-Insurance has developed a proprietary algorithm and leveraged machine learning technology to offer instant insurance coverage capacity through its digital platform. This innovative approach allows customers to obtain insurance coverage quickly and conveniently. Recently, Ki Insurance announced a collaboration with Travelers and Aspen, two leading insurance carriers, to offer augmented capacity from multiple syndicates. This collaboration is a significant step towards creating a fully digital follow market in the insurance industry.

Aurora is another solution focusing on the SME market by offering algorithmic underwriting capabilities. They have developed an underwriting framework that emphasises data enrichment and automates the underwriting process. Aurora aims to make insurance more affordable and accessible for SMEs, addressing the coverage gap and providing better pricing, faster innovation, and improved insurance options.

Another noteworthy collaboration in underwriting is between Hiscox2 and Google Cloud. Hiscox, a specialist global insurer, has partnered with Google Cloud to develop an AI-enhanced lead underwriting model for the London Market insurance industry. This collaboration combines Hiscox's technology platform, Hiscox AI Laboratories (Hailo), with Google Cloud's generative AI technology to automate the underwriting process from submission to quote. Their technology is anticipated to decrease the quote turnaround time for certain lines of business from three days to only three minutes for underwriting teams. The goal is to enhance the efficiency and effectiveness of underwriting processes by combining human expertise with cutting-edge AI technology.

In conclusion, algorithmic underwriting is transforming the insurance industry, especially in commercial and speciality lines of business. By utilising automated processes, advanced analytics, and algorithms, insurers can streamline the underwriting process, improve accuracy, and deliver a seamless digital experience to customers. Despite the challenges that may arise, the potential advantages of algorithmic underwriting make it a promising path for insurers seeking to maintain competitiveness in the digital era.

Related Celent Research

Life Insurers are Rewriting the Underwriting Rules

AIA: AI-Enabled Underwriting and Claims Transformation

N2G Worldwide Insurance Services, LLC: Unlocking Productivity & Insights in Commercial P&C

Reference

2. https://www.hiscoxgroup.com/news/press-releases/2023/12-12-23