Fiserv Forum 2024を振り返る

Core System Consolidation is Coming As The Banking Ecosystem Opens Further

I recently had the opportunity to attend Fiserv Forum in Las Vegas, NV from September 29-October 1, 2024. Lasting over 2 ½ fast-paced days, this conference is one of the largest in financial services, with a large ecosystem of solution partners exhibiting as well. More than 3,500 industry participants attended and more than 130 sessions were held.

Many thanks to Fiserv for the invitation to present to, meet, and exchange ideas with Fiserv customers. We also spoke with Fiserv executives and technology partners. Here are two highlights from what I experienced at the event:

The Next Phase of Open Banking Launching with Section 1033 Rule Finalization This Month

There were numerous sessions addressing the CFPB’s Section 1033 rule scheduled to be finalized this month. The final rule will go into effect for financial institutions (primarily banks and credit unions) on a phased basis beginning six months after publication of the final rule.

On the panel, Boost Efficiency and Revenue With Integrated Fintech Capabilities we discussed opening banking in the context of embedded finance and banking as a service (BaaS). We discussed strategies for rapidly launching innovative embedded fintech services, what it takes to develop an agile and compliant fintech program at the banking level, and Section 1033.

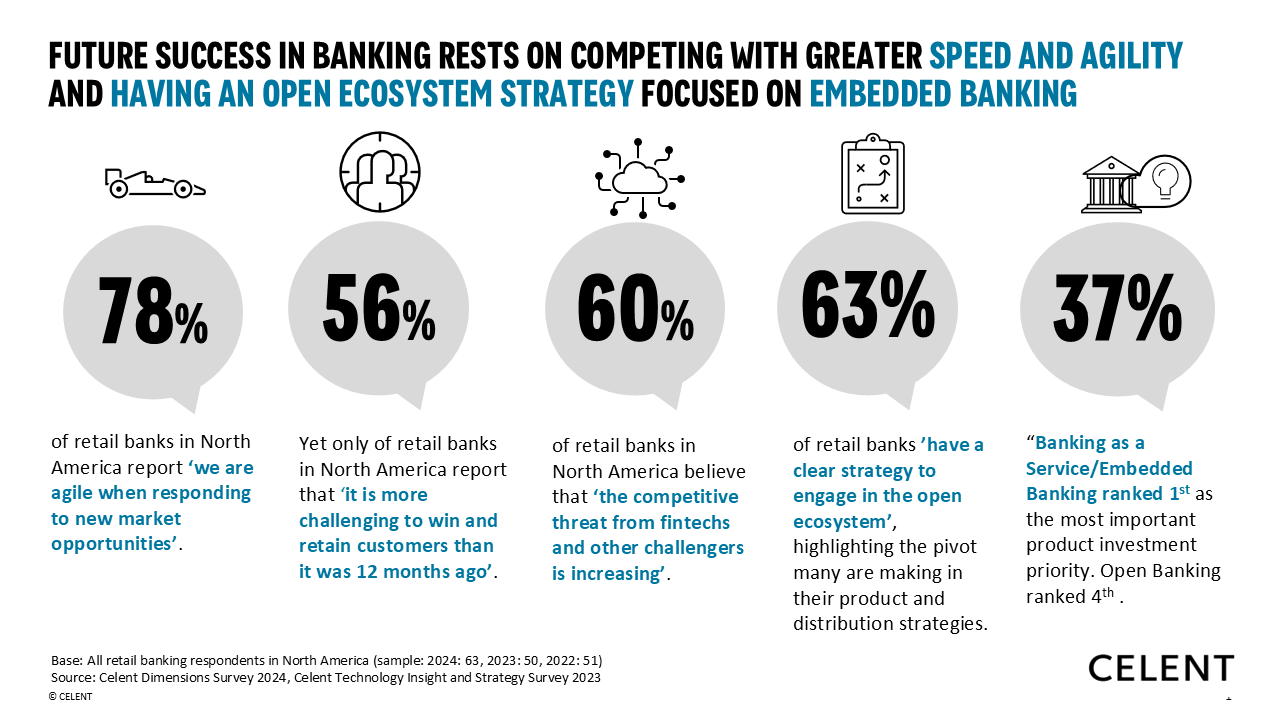

Celent banking technology survey analysis supported the panel discussion. Figure 1 below is from the survey-based Celent report: Dimensions: North American Retail Banking IT Pressures & Priorities 2024.

Figure 1

Celent recommends the following strategic approaches that have proven effective in successfully launching embedded fintech services:

·Be agile. Open Banking is a market opportunity, and agility is important to take advantage of it as well as to comply. Agility here can mean: better, faster integration, data collection and workflow.

·Improve the way you compete every year. 56% of retail banks in North America report that ‘it is more challenging to win and retain customers than it was 12 months ago. With agility, competition from incumbents and challengers is increasing. This requires new responses, such as product distribution through new channels (embedded finance) that your clients and prospects are using.

·Reassess how you compete with fintechs. 60% of retail banks in North America believe that the competitive threat from fintechs and other challengers is increasing. Digital only retail deposit and lending challengers have to excel at digital because it is their only channel, so this keeps raising the bar for omnichannel financial institutions.

·Have, and implement, an open ecosystem strategy. Sixty-three percent of retail banks ’have a clear strategy to engage in the open ecosystem’, highlighting the pivot many are making in their product and distribution strategies including BaaS and embedded finance.

·Implement embedded banking as an open ecosystem strategy. Thirty-seven percent of survey respondents ranked BaaS/embedded banking ranked first as the most important product investment priority. Open Banking ranked fourth.

My main takeaway is that financial institutions should expand their open banking capabilities now even if they are not required to do so for another one to four years.

Figure 2

Source: Fiserv (Fiserv Forum 2024).Panelists (left to right): Dudley White (Fiserv), Caro Hatley (Lincoln Savings Bank), Craig Focardi (Celent), Nathan Baumeister (ZSuite), and Niranjan Ramaswamy (Fiserv).

For more information about these topics see Celent report Section 1033 and the Next Phase of Open Banking in the US: Modernizing Consumer-Permissioned Access to Data.

Fiserv Is Consolidating Three of its US Community Bank Core Banking Systems Into One

Fiserv publicly discussed its strategy to consolidate the Premier®, Precision® and Cleartouch® core banking systems into a single platform by 2028. Premier® (which has more community banking institution clients (over 900) than any other systems) will be modified for the initiative. For example, Premier will be modified from batch/memo post to real-time posting of deposits. Only Cleartouch has this capability today.

Together these three systems have approximately 1,545 customers of 4,384 US community banks nationwide. This accounts for over 35% of the US community banking market. IBM and KPMG are partnering with Fiserv for this long-term initiative.

Main elements of the future platform:

• real-time everything (payments, transactions, file maintenance, and decisioning)

• Finxact (Fiserv’s cloud native core banking system) as optional dual core integrated with the new system

• universal user interface (UI)

For more information about these and other core banking systems, see Celent report Retail Banking Core Banking Systems: North American Community Bank Edition published in September 2024.

Looking Ahead

Contact me at info@celent.com or cfocardi@celent.com if you would like to discuss these topics, and lending systems, and related data, analytics, and decisioning systems. If you are a client email me or your relationship manager to set up a call.