Most US adults trust that their money is safe at their primary financial institution, but far fewer believe that their bank is actually helping them improve their financial lives. This sizable trust gap is a problem for banks — and closing the gap will not be easy. A number of banks are doing so, however. We’ll tell you how.

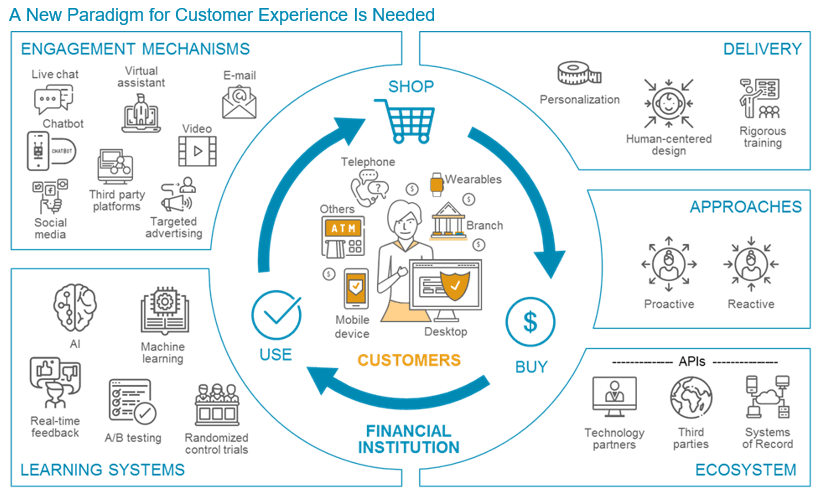

In a previous Celent report, Platform Banking in the US: Positioning to Be at the Center in Retail Banking, November 2018, Celent described the market forces that will bring a variety of platform banking business models into the US market, foundations for building a successful platform model, and the compelling first-mover advantages doing so creates. This report addresses a remaining prerequisite for successful platform banking, high levels of advisory trust. Compared to transactional trust (e.g., “My money is safe.”), advisory trust is lacking among customers of most US financial institutions. Developing high levels of advisory trust is an imperative for any successful platform, but it is also good business for retail banks with or without a platform ambition. This report explains how to develop it by embracing a new paradigm of customer experience.