個人向けウェルスマネジメントを手掛ける金融機関は、2022年も「顧客にカスタマイズされた総合的な金融ソリューションを幅広く提供していく」という業界の統一したビジョンに向けて邁進するとみられる。こうしたビジョンは数年前から変わっていないが、競争圧力の高まりに加え、過去に類を見ないほどのテクノロジーの進化を背景に、金融機関は行動を起こさざるを得ない状況にある。現状維持はもはや選択肢ではなくなっている。ウェルスマネジメントを手掛ける金融機関は、拡張可能な顧客中心のエコシステムへの移行を可能にするテクノロジーのトレンドに巧く乗る必要がある。さもなければ、競合相手やディスラプターからの攻勢に晒されかねない。

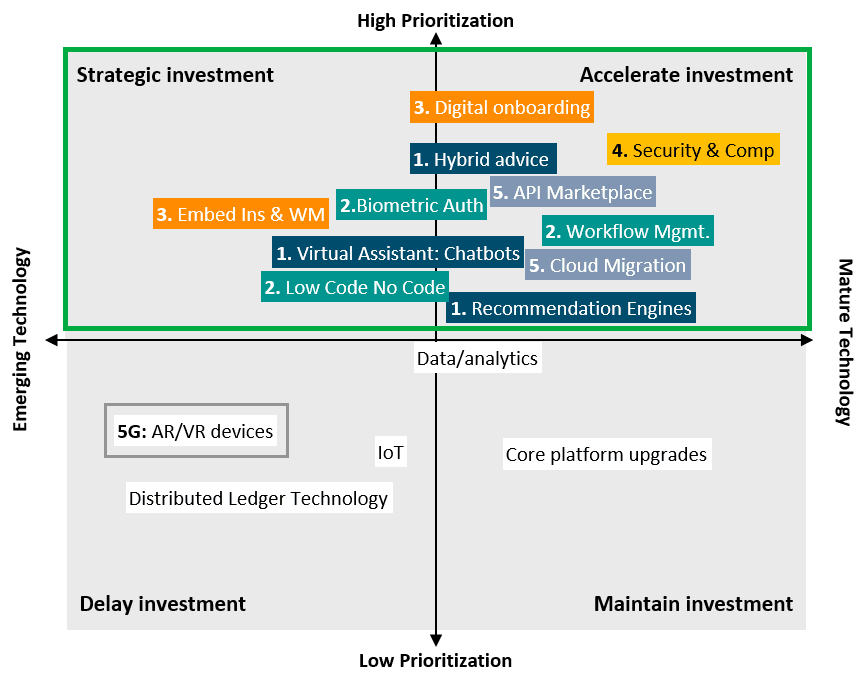

セレントは、2022年にウェルスマネジャーがテクノロジーの優先事項を選定する上で検討すべき、5つの広範で影響力の大きい分野を特定した。これらの分野は、現行のビジネスモデルを変革し、カスタム化の進んだ次世代の顧客向けソリューションを提供するために不可欠なビジネスプロジェクトを示している。本レポートは、ウェルスマネジメント向けテクノロジーの優先順位づけとベンダー動向について金融機関向けにまとめたガイダンスである。

もう1つ注目すべきは、ウェルスマネジメントを手掛ける金融機関は千差万別であるという点だ。例えば、全国展開するブローカーディーラーのテクノロジー要件は、小規模の投資助言業者(RIA)とは全く異なるはずである。セレントは業界全体を分析対象としているため、各金融機関は独自のビジネスモデル、特性、顧客の人口動態を考慮した上で我々の示す見解を自らに固有なビジョンへと転換する必要がある。