WealthTech Startups to Watch: How Endowus Delivers Holistic Wealth Management Across Market Segments

WealthTech challengers have been around for over a decade. (Think digital brokerages and robo-advisors.) But today there is a new wave of WealthTechs shaking up the status quo, and incumbents are worried.

In our Wealth Management IT Priorities and Strategy in 2023 report, we found that 61% of traditional wealth management executives (wealth managers, broker dealers, private banks, and TAMPs) believe competition from fintechs and other challengers is making customer acquisition and retention more difficult.

Based on that concern, we will deliver a blog series that identifies WealthTech startups offering compelling wealth management solutions. We will also explore the broader implications of these emerging startup applications for incumbent wealth management firms. To qualify for coverage in this blog series, the WealthTech firm must have raised at least $10 million in funding in the last year and have demonstrated significant market momentum (e.g., AUM milestones, customer growth, product launches, or partnerships).

Endowus, a B2C digital wealth platform operating in Singapore and Hong Kong rose to the top of our list. Endowus calls itself a “total wealth platform,” providing wealth management solutions across the different types of savings, investment, and retirement accounts available in the country.

Here are some of Endowus’s notable achievements in 2023:

- Launched in Hong Kong in April.

- Expanded its Endowus Private Wealth offering in July.

- Raised $35 million in funding from UBS, MUFG, Citi Ventures, and other investors in August.

- Partnered with EQT to give clients access to its private equity funds in October.

- Group assets totaled over $5 billion as of October.

Considering that success, what exactly is Endowus doing that is so compelling? We found two key strategies that stand out:

- Enabling holistic wealth management across multiple market segments.

- Bringing alternatives into the HNW holistic wealth experience.

Enabling holistic wealth management across multiple market segments

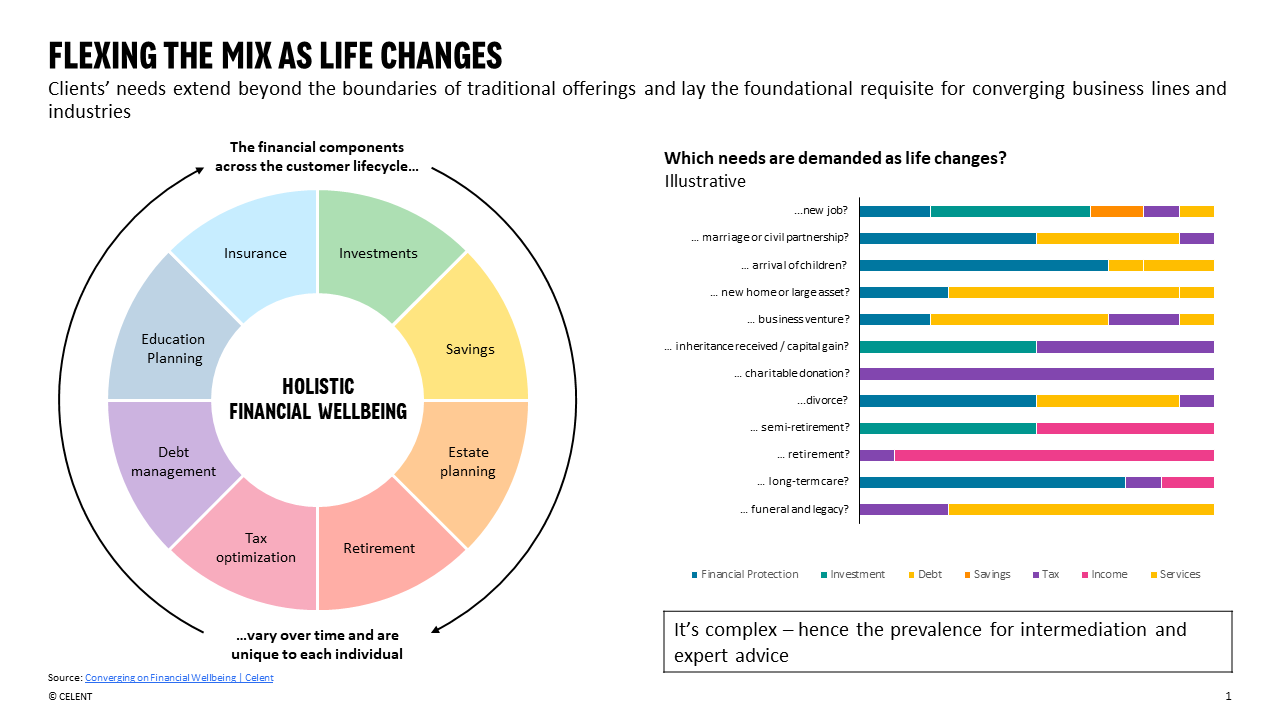

In our Wealth Management Technology Trends and Priorities Previsory: 2024 Edition, we discuss how clients’ financial needs extend beyond a single offering and stress the importance of providing more holistic solutions—e.g., savings, investments, retirement, and tax optimization.

Source: Celent, Converging on Financial Wellbeing

Endowus provides clients a holistic wealth experience by allowing them to manage and invest all their different sources of wealth in one platform: cash savings, retirement investments, and CPF (Central Provident Fund) public pension savings. Endowus touts itself as the first digital advisor in APAC to span both private wealth and public pension savings.

While the all-in-one “save and invest” concept is not new considering the retail brokerage plus high-yield savings options out there, Endowus brings a unique digital holistic wealth experience to multiple market segments:

- Mass market: CPF savings, to which all Singapore residents contribute.

- Mass affluent: Personalized advisory services.

- HNW: Specialized Private Wealth offering with access to private alternatives.

Endowus is tackling the addressable markets of each of these three segments, and at the same time it is enabling frictionless access to solutions for clients as they progress from one segment to another. For more on this topic, read our report, The Battle for Engagement: How Banks Can Compete with Digital Brokerages.

So why should traditional wealth managers care if B2C WealthTechs like Endowus succeed with holistic wealth management? It's a matter of changing customer expectations. We know that customers want an all-encompassing, straightforward personal finance ecosystem (see our Converging on Financial Wellbeing webinar). As WealthTechs help turn this want into an expectation across market segments, those with seamless holistic solutions will have an easier time acquiring and retaining customers than those without them.

Bringing alternatives into the HNW holistic wealth experience

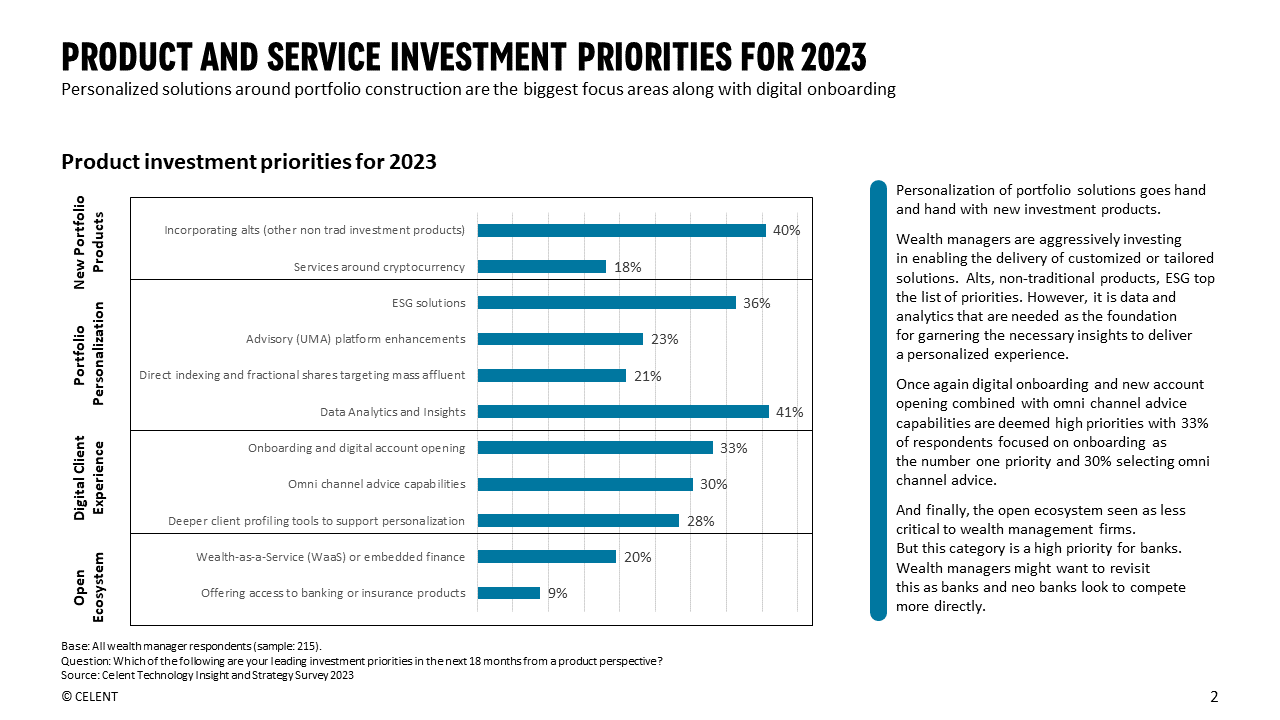

In the Celent Technology Insights and Strategy Survey 2023, 40% of traditional wealth manager respondents indicated that incorporating alternatives and other non-traditional investment products was a leading investment priority in the next 18 months.

Source: Celent, Wealth Management IT Priorities and Strategy in 2023 report

Endowus’s Private Wealth offering unlocks private markets and other alternative investments for high-net-worth (HNW) clients. The company partners with alternative asset managers like KKR, Carlyle, and BlackRock, along with alternatives marketplace iCapital to offer access to over 400 private market funds. Investment options include hedge funds, private equity, private credit, and private real estate.

Endowus is taking a unique approach to alternatives: a direct-to-customer strategy that connects back to the holistic wealth theme. Other alternatives platforms directly serving HNW clients—Yieldstreet and Moonfare, for example—don’t have any other investment offerings. Endowus Private Wealth brings alternatives into the holistic wealth management experience by combining access to public markets, private markets, and alternatives as part of one personalized plan.

Again, why should incumbent wealth managers care? They should be thinking about strategies to incorporate private markets and other alternatives to keep their HNW offerings competitive. As demand for alternatives grows, wealth managers should consider partnerships with either the alternative asset managers themselves or with alternatives marketplaces, like Endowus has.