Digital Sovereignty: The Impact on Data, AI, and Next-Gen Wealth Management Solutions

Abstract

•Digital and data sovereignty is a legal construct, but with significant physical implications on the way technology and data assets are implemented and managed. The agenda is driven in part by security, but also political ambitions for digital independence. So too does the EU have concerns about overreliance on technology services by foreign providers, as well as the extent to which they fall under the legal jurisdiction and political influence of their home governments. However, this is not a uniquely European concern, with governments across Asia-Pacific also pushing for sovereignty rules. Sovereignty is a lesser issue in the US, home to the largest software and AI companies, hyperscalers, and with less data privacy legislation.

•However, even domestic wealth managers in the US must be aware of the data they manage and the jurisdictions under which it falls. Lessons can be learned from the EU. The developments in data privacy, data residency rules, and concerns about data sovereignty combine to challenge the ability of wealth managers and payments processors to operate effectively across multiple regions. However, this also creates more challenges to deploy AI at scale across borders, and indeed the next generation of more intelligent (AI-enabled) products and services too. Data must be managed jurisdictionally and be fit for purpose for ingestion into AI models, but this raises significant questions for the business related to data center, data location, and AI strategies.

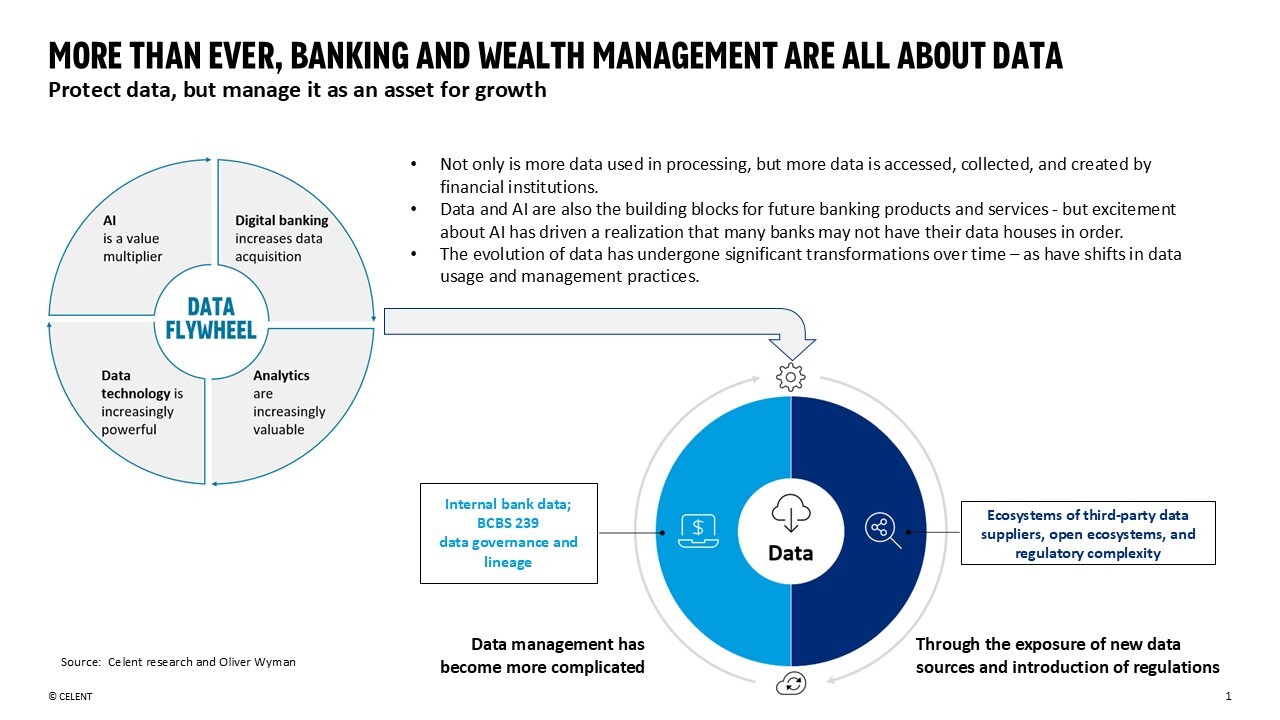

•Data is the fuel for AI, and AI ambition is fueling investment in data and cloud platforms. However, increasing the use of hyperscalers for data and AI workloads complicates how wealth managers operating in multiple countries manage their data estates in a compliant way.

•Leading cloud providers are investing heavily in regional data center footprints to support the resilience and privacy capabilities required of public sector and financial services clients worldwide. It is a logical extension to offer sovereign cloud solutions so that they, their wealth manager clients, and their mutual partners can operate compliantly in region.

The original report was published by Celent's Corporate Banking Team in September 2024.