After the COVID-19 lockdowns ended, previous Celent research showed branch channel activity largely rebounding, returning to near pre-pandemic levels among most surveyed institutions. Concurrently, more retail banking customers flocked to digital channels for transactional activity but continued to originate new financial services relationships largely in person. Not surprisingly, then, many banks aren’t rushing to shutter branches. They’re also not rushing to modernize them. The branch network at many US financial institutions shows signs of neglect.

Consistent with nearly all other retail merchant segments, retail banking institutions serving the mass market will continue to have a physical presence even as they invest in digital. But, if those branches are to deliver their mandate of sales and service excellence, they must reflect the needs of today’s customers. They must modernize. Many US banks and credit unions have plans to do so, but they don’t reflect the same sense of urgency associated with digital banking initiatives. They should.

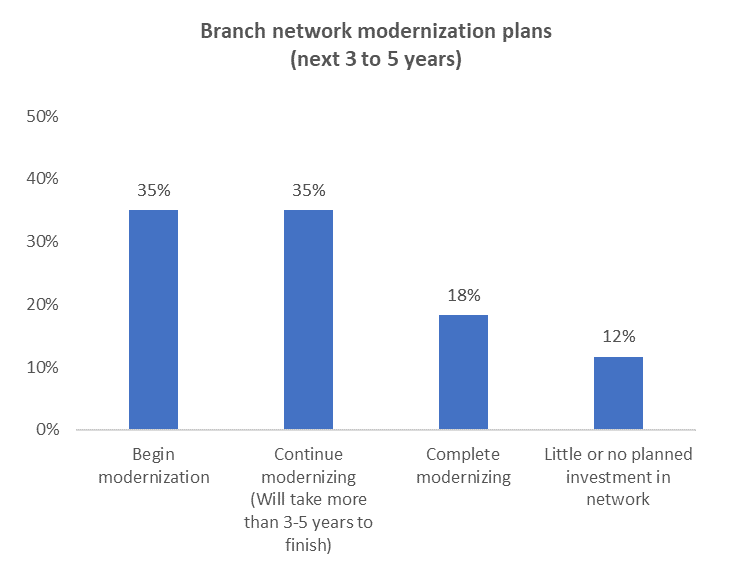

Based on a late 2022 survey of US banks and credit unions, most institutions haven’t allocated adequate capital to affect needed network modernization beyond a glacial pace. In this report, we unpack branch channel modernization plans and the challenges along the way while offering practical recommendations for project leaders.